- Revenue Cycle Management

- COVID-19

- Reimbursement

- Diabetes Awareness Month

- Risk Management

- Patient Retention

- Staffing

- Medical Economics® 100th Anniversary

- Coding and documentation

- Business of Endocrinology

- Telehealth

- Physicians Financial News

- Cybersecurity

- Cardiovascular Clinical Consult

- Locum Tenens, brought to you by LocumLife®

- Weight Management

- Business of Women's Health

- Practice Efficiency

- Finance and Wealth

- EHRs

- Remote Patient Monitoring

- Sponsored Webinars

- Medical Technology

- Billing and collections

- Acute Pain Management

- Exclusive Content

- Value-based Care

- Business of Pediatrics

- Concierge Medicine 2.0 by Castle Connolly Private Health Partners

- Practice Growth

- Concierge Medicine

- Business of Cardiology

- Implementing the Topcon Ocular Telehealth Platform

- Malpractice

- Influenza

- Sexual Health

- Chronic Conditions

- Technology

- Legal and Policy

- Money

- Opinion

- Vaccines

- Practice Management

- Patient Relations

- Careers

Secrets to Financial Success for Young Physicians

Imagine you have just finished residency and are finally starting your medical career. You may feel relieved to finally have those years of schooling and training behind you. Then reality sets in and you wonder how you are going to deal with the medical school debt that you've accrued.

According to the American Medical School Association, 86% of medical school graduates carry educational debt and the median debt burden is $155,000 for public school graduates and nearly $185,000 for private school graduates.

How can a young physician balance the financial stresses of overwhelming medical school debt with buying their first home, saving for retirement, buying a new car, and at the same time enjoying life?

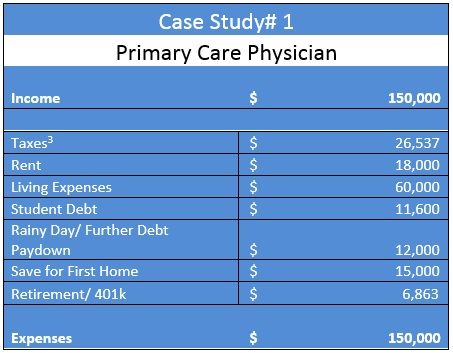

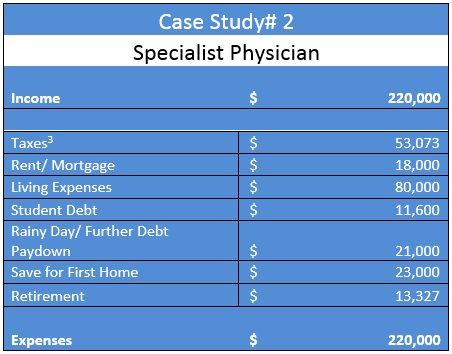

Let’s approach this with a specific plan of action with some principles that can help any young physician. I have broken down the prioritization based upon 2 different case studies — one for a primary care physician and the other for a specialty physician.

Specialist physicians, on average, have more income than a primary care physician. Due to the extra wiggle room, there are some significant differences between the 2 case studies. For example, we bump up retirement savings and the down payment for the purchase of a first home.

To develop a plan, you will need to take some time to ponder and reflect upon your situation. The best time to do that is now, early in your career. Here are some things to consider as you do that.

Strategies for Student and Consumer Debt and the “Rainy Day” Fund

In my opinion, one of the most important things you need to do is to lower and eliminate your consumer and educational debts as well as to establish your “rainy day” fund.

Now that you have your first job as a physician, make sure for the first few months to set aside money for the “stuff happens” factors in life like the car breaking down or the furnace going out. I call this the “rainy day” fund.

For any physician, I suggest a minimum savings of $6,000 within the first few months. If you make over $200,000, double that. Continue to save that amount annually to keep building up for the rainy day.

Keep these funds in a money market or checking account until you have more than $15,000. Then, consider a low-risk investment account where you can pull out ALL of your money without any penalty, if necessary.

Beyond the cash cushion, focus on reducing your debt.

First, make sure that you consolidate and lock-in the interest rates for your student and consumer debt. We are at all-time interest rate lows. Interest rates are not likely to get any lower. As a matter of fact, interest rates are likely to rise within the next 2 to 3 years.

Consider signing up for automatic payments to knock off 0.25% or more on your debts.

Secondly, while in residency or fellowship, consider either deferring your loan (where interest will compound) or forebearing through an income-sensitive repayment plan or through an earnings-based repayment plan (EBR). Note that an EBR requires a lower monthly commitment than an IBR, but extends the life of the loan.

Next, consider debt-forgiveness programs that are available through federal or state sources. Check out https://services.aamc.org/fed_loan_pub/ and http://NHSC.hrsa.gov/loanrepayment/studentstoserviceprogram/

Also, find out what it would take to pay back your student loan in 10 years or 15 years instead of 30 years. Consider that 30 years of interest on a 5%, $150,000 student loan amounts to nearly $140,000 worth of interest! If you pay back the loan over 30 years, you’ve just nearly doubled the total amount that you’ll have to pay. Whereas using only 15 years reduces the total interest to nearly $64,000. That $76,000 interest savings could buy you the cabin or RV (or 5 European vacations!) you want in retirement.

At a minimum, consider putting at least an extra $500 per month to an extra $1,000 per month or more towards your debts.

Lastly, your student loans are not likely to be tax deductible (since you will be making over $90,000). Pay them down before you pay down a mortgage. However, other consumer debt like credit cards and car loans typically have higher interest rates. Pay off consumer debt (or even better, don’t have consumer debt!) before paying down student loans.

Focus on how paying off one debt or another by balancing interest rates versus your cash flow. If you have a huge interest rate difference between debts — let’s say 4% or more – pay off the higher interest rate debt. Also, if you only have $5,000 or less left for a debt, consider focusing on that debt to have it paid off and increase your monthly cash flow.

In the next few days, we'll continue to outline this financial roadmap to success. Keep an eye out for the next part in the series!

About the AuthorDave Denniston, Chartered Financial Analyst (CFA), is an author and authority for physicians providing a voice and an advocate for all of the financial issues that doctors deal with.”

He is also the author of 5 Steps to Get out of Debt for Physicians, The Insurance Guide for Doctors, and The Tax Reduction Prescription. You can contact him at (800) 548-1820, at dave@daviddenniston.com, or visit his website at http://www.MDRetire.com to get the Top 5 Financial Tools for Doctors and a FREE video course.