- Revenue Cycle Management

- COVID-19

- Reimbursement

- Diabetes Awareness Month

- Risk Management

- Patient Retention

- Staffing

- Medical Economics® 100th Anniversary

- Coding and documentation

- Business of Endocrinology

- Telehealth

- Physicians Financial News

- Cybersecurity

- Cardiovascular Clinical Consult

- Locum Tenens, brought to you by LocumLife®

- Weight Management

- Business of Women's Health

- Practice Efficiency

- Finance and Wealth

- EHRs

- Remote Patient Monitoring

- Sponsored Webinars

- Medical Technology

- Billing and collections

- Acute Pain Management

- Exclusive Content

- Value-based Care

- Business of Pediatrics

- Concierge Medicine 2.0 by Castle Connolly Private Health Partners

- Practice Growth

- Concierge Medicine

- Business of Cardiology

- Implementing the Topcon Ocular Telehealth Platform

- Malpractice

- Influenza

- Sexual Health

- Chronic Conditions

- Technology

- Legal and Policy

- Money

- Opinion

- Vaccines

- Practice Management

- Patient Relations

- Careers

Settle Your Debt 2: Your Debt Forgiveness Game Plan

Last week, we looked at the nuts and bolts of federal loan-forgiveness programs available to physicians working for nonprofit entities. This week, we take a closer look at 2 programs: the Income Based Repayment (IBR) Plan and the Pay-As-You-Earn (PER) Plan.

Last week, we looked at the nuts and bolts of federal loan-forgiveness programs available to physicians working for nonprofit entities. This week, we take a closer look at 2 programs: the Income Based Repayment (IBR) Plan and the Pay-As-You-Earn (PER) Plan. We’re focusing on these 2 plans because they require lower premiums in residency and fellowship, which can lead to greater debt forgiveness.

Your Commitment:

What is the Difference between the Income Based Repayment (IBR) Plan and Pay-As-You-Earn Repayment (PER) Plan?

IBR and PER both accomplish the same goal, minimizing your student debt payments while in residency/fellowship and then paying back your student loans at a higher rate once you are making more dough.

The government will ask questions about your household — i.e. spouse, spousal school loans, kids, etc., as those affect the poverty guidelines. How do they determine your income? By looking at your tax return!

This is an important distinction because the government is purely looking at your “adjusted gross income.” This means that they are taking a snapshot of your income AFTER pre-tax deductions for 401(k)/403(b) contributions, AFTER pre-tax deductions for health-savings accounts, and AFTER deductions for any active business losses.

The higher you can contribute in those areas, the lower your monthly obligation will be.

What Will Happen After Residency/Fellowship?

If you ended your residency/fellowship in June and started your first contract in July, you would likely not have to start higher payments UNTIL the following year. For example, if you finished your residency in June 2013, your higher payments will not take effect until after January 2014.

Then, payments will increase even more substantially the following year. In this example, it would be after January 2015 before you have a full year of higher income under your belt.

However, the payments DO NOT take into consideration your overall student loan debt (undergraduate and medical school debt) nor your age or whether you have a car loan, mortgage, etc.

Payment Calculator

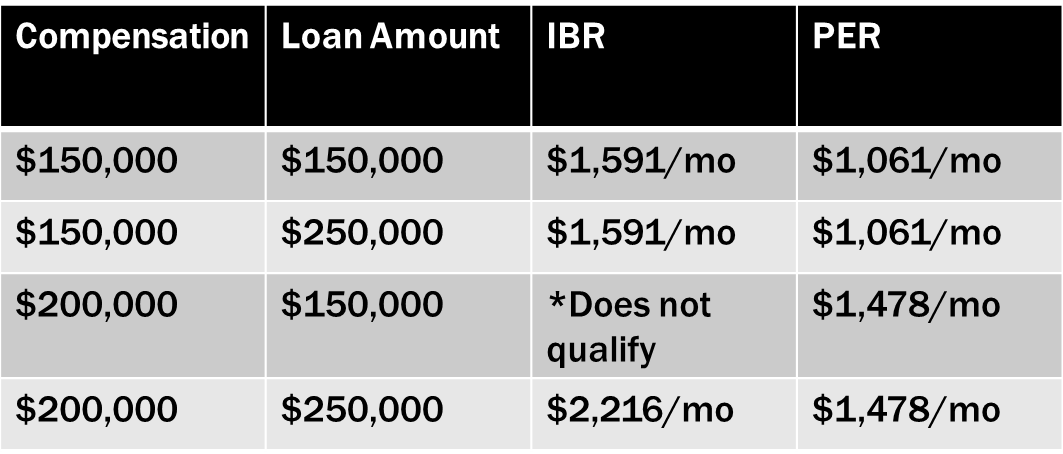

The table below was created using the calculators from the Federal Student Aid website. It assumes that the person (1) is married, (2) has no kids or spousal school loans, (3) the original loans were $20,000 to $30,000 below the current loan amount, and (4) the loans carry an interest rate of 6.8%.

While you could likely easily qualify for IBR while in residency, the calculator on the website doesn’t allow me to calculate the payment at a $200,000 income level, $150,000 loan amount for IBR.

However, we could safely assume that the payment should be $2,216/month given the example below because the monthly payment fluctuates with compensation, but not with the loan amount.

See the tremendous difference between IBR and PER?

The difference is more than $500 per month at the $150,000 compensation level and more than $700 per month at the $200,000 compensation level! Notice how the IBR or PER amount does NOT change as the loan amount goes up. This is because it is primarily dependent on income.

There is one big caveat between the 2 programs. To qualify for PER, you must have been a new borrower as of Oct. 1, 2007 or later.

Tying Forgiveness and Repayment All Together After Residency/Fellowship

How does all of this tie in with loan forgiveness programs? Let’s take a look at an example where 2 young ophthalmologists, Dr. Smith and Dr. Jones, who started Public Service Loan Forgiveness (PSLF) programs at the very start of residency. They each had an equal amount of student debt coming out of medical school.

Dr. Smith has been in residency for 3 years, has made 36 payments towards PSLF, and went right into practice. He is making $150,000 per year.

Meanwhile, Dr. Jones has also been in residency for 3 years, has made 36 payments towards PSLF, and also just entered into practice. He is now making $200,000 per year.

Let’s examine the difference of what would happen if each of them enrolled in IBR or PER at the start of residency.

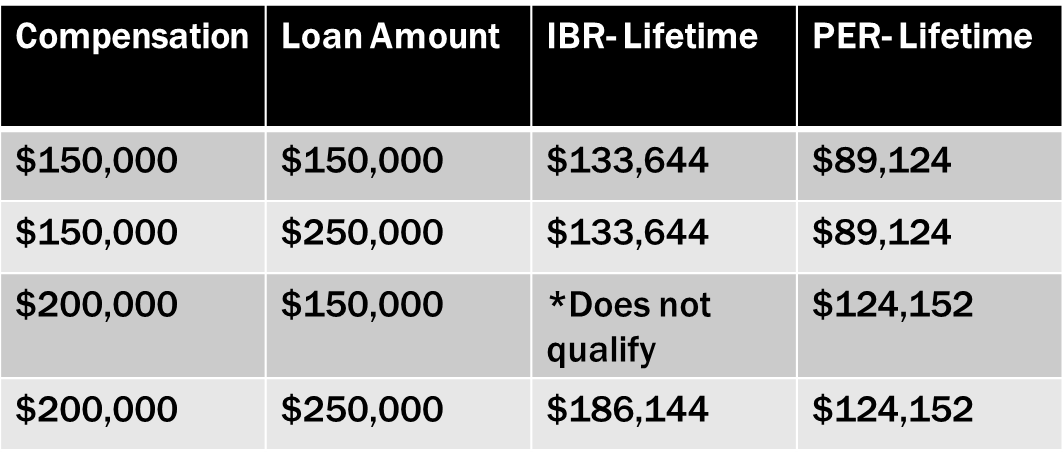

The table below adds up the monthly payments from the previous example and multiplies them over 7 years. There is no increase in salary. I’m keeping it simple and flat. The lifetime payments in the table are the combination of interest AND principal over those 7 years.

At the end of the 7 years (assuming continued nonprofit employment), the remaining portion of their debt would be forgiven.

For example, with $250,000 of loans and $150,000 worth of compensation, after 7 years in practice you will have paid about $90,000 in PER relative to about $130,000 in IBR assuming your taxable income is $150,000.

After Dr. Smith completes 84 remaining payments now that he is in practice, this would be approximately $225,000 worth of forgiveness with IBR versus $265,000 of forgiveness with PER.

This is why PER is superior to IBR when you tie in the student debt forgiveness programs with them.

Additionally, the higher your loans, the more beneficial it will be to be enrolled in PER. Let’s say that you have $250,000 in student loans.

Consider this: at an interest rate of 6.8%, you are accruing interest of about $17,000 annually or $1,416 per month. With PER, you would have been paying $1,478 per month — barely tapping into principal.

Then, over 7 years, you will have paid about $124,000 and will have debt forgiveness of almost $250,000 of principal- and likely tax-free!

Giving up this gift is the tax equivalent of almost $360,000 or $51,000 per year over 7 years assuming a 30% tax bracket.

Even with IBR, you would still have debt forgiveness of nearly $200,000 or the approximate tax equivalent of $285,000.

Either is wonderful, but PER is better for debt forgiveness purposes!

Remember — like we mentioned earlier, to qualify for PER, you must have student debt that originated after October 2007. This will likely start affecting residents and fellows that started in 2012 and even more so over the next few years.

Final Thoughts

As a physician, you’ve made a commitment to helping others and your community. Make a similar commitment to your finances.

What can we conclude from all of these programs?

If you are working for a nonprofit entity, PER is probably a better option unless you do not qualify due to the origination of your student debt. IBR will still be a fine choice.

I would strongly suggest NOT to put extra payments towards your debts if you are enrolled in the 10-Year Public Service Loan Forgiveness program unless you think you may not be ready to make a 10-year commitment to staying in the nonprofit community.

If you are currently working for a nonprofit and are considering transitioning to a for-profit practice after residency, IBR would be my recommendation. Keep in mind that you can make extra payments beyond the minimum that IBR requires to pay it off sooner once you are in practice.

If, as a young physician, you focus on paying off your debts, save for a rainy day, live within your means and put money away for retirement, you can then do the things you’ve long dreamed of doing and be well down the road to financial independence.

About the Author

Dave Denniston, Chartered Financial Analyst (CFA), is an author and authority for physicians providing a voice and an advocate for all of the financial issues that doctors deal with. He is also the author of 5 Steps to Get out of Debt for Physicians, The Insurance Guide for Doctors, and The Tax Reduction Prescription. You can contact him at (800) 548-1820, at dave@daviddenniston.com, or visit his website at http://www.MDRetire.com to get the Top 5 Financial Tools for Doctors and a FREE video course.

You can check out more about the various programs mentioned above by visiting the following websites:

http://studentaid.ed.gov/repay-loans/understand/plans/pay-as-you-earn

http://studentaid.ed.gov/repay-loans/understand/plans/income-based

http://studentaid.ed.gov/repay-loans/forgiveness-cancellation/charts/public-service