- Revenue Cycle Management

- COVID-19

- Reimbursement

- Diabetes Awareness Month

- Risk Management

- Patient Retention

- Staffing

- Medical Economics® 100th Anniversary

- Coding and documentation

- Business of Endocrinology

- Telehealth

- Physicians Financial News

- Cybersecurity

- Cardiovascular Clinical Consult

- Locum Tenens, brought to you by LocumLife®

- Weight Management

- Business of Women's Health

- Practice Efficiency

- Finance and Wealth

- EHRs

- Remote Patient Monitoring

- Sponsored Webinars

- Medical Technology

- Billing and collections

- Acute Pain Management

- Exclusive Content

- Value-based Care

- Business of Pediatrics

- Concierge Medicine 2.0 by Castle Connolly Private Health Partners

- Practice Growth

- Concierge Medicine

- Business of Cardiology

- Implementing the Topcon Ocular Telehealth Platform

- Malpractice

- Influenza

- Sexual Health

- Chronic Conditions

- Technology

- Legal and Policy

- Money

- Opinion

- Vaccines

- Practice Management

- Patient Relations

- Careers

10 Weapons to Terminate Your Student Loans

Do you have student loans? Wouldn't you love to destroy them and be debt-free? I'd like to invite you to join me in a movement to terminate the deadly burden of student loans.

Let's free ourselves from the death grip of our giant student debt. Image courtesy of SavingAdvice.com

Do you have student loans? Wouldn't you love to destroy them and be debt-free? What would you do with the cash flow you free up once your student loans are paid off? I'd like to invite you to join me in a movement to terminate the deadly burden of student loans.

Under my cover as a mom, radiology resident, blogger, gourmet chef, USMLE tutor, my true identity is a terminator, specifically programmed to terminate deadly student debts. Below, I will share my weapons of termination in hopes of eliminating student debt on the scale of an entire generation.

Intentionally using credit cards can help you pay off your student debt much sooner. Borrow with 0% or even negative interest credit cards to pay down your student loan faster.

1. Credit Cards

- I charge all my expenses that are chargeable to my credit cards and funnel my (limited) cash flow towards debts with interests. There are lots of variations in terms of what can be charged on a credit card. Some people’s circumstances even allow them to pay for rent on credit card. At one point, I used to pay my landlord by charging her necessities such as gas and groceries on my credit cards. This takes a little more effort than just writing a check. Now, I buy thousands of dollars’ worth of grocery gift cards (enough to last 6-12 months because once a year there’s a 10% discount on gift cards). I also pay my electricity one year in advance. Funneling cash this way often got me negative 1-5% interest, which gave me more cash to pay down student loans. But there’s a limit to this.`

- This second method, balance transfer checks, usually allows for more aggressive paying down of a higher interest debt. The cheapest balance transfer checks I got was with Travelocity American Express at 1% transaction fee for 0% APR for a year. So by writing a check of $15,000 towards a debt such as student loan at a 6.8% interest rate, I would save 5.8% for the next 12 months. The balance transfer transaction fee is charged up front, so just be sure that if your limit is $15,000, you write a check in an amount lower than the limit, leaving enough room for the fee. This way you ensure that the check goes through, and you’re not charged an additional fee. (I have never gotten a fee before, as I always err on the safe side.)

- There is one card that does not charge a transaction fee for balance transfers if you use it within 60 days of opening your account. You can read about it here.

- Some banks allow you to open a new checking account by funding it with a credit card. You need to be very cautious with this. You need to make sure that funding is equivalent to a purchase, and not considered a cash advance. When your credit card company processes funding a new bank account as a purchase, that purchase will give you cash back (if your card offers cash back features). When your credit card company processes funding a new bank account as a cash advance, you will be charged an interest of 20-30% starting the day the transaction posts. So this method only works if your credit card company processes your act of funding a banking account as a purchase.

2. Refinancing

For a while, residents and fellows had no refinancing options to lower their student loan interest rates. However, in mid-2015, private banks began to offer student loan refinancing to residents and fellows so no one needs to suffer the three to seven years of debt snowballing at 6.8+% during training. The only drawback is that you forego loan forgiveness when you refinance. (My mentor Dr. James Dahle at whitecoatinvestor.com commented that "student loan refinancing isn't new. It just went away for a few years. My class all refinanced at 1-2% back in 2003.") To think that the refinancing option disappeared for a while and all the PGY's who suffered through their debt snowballing during training, until two private banks come along and start refinancing student loans during PGY.

3. Home Equity Loans

A home equity loan is frequently much cheaper than 6.8%. It’s a perfectly simple, passive, effortless way to make your hard-earned dollar go further. With a lower interest rate, every dollar you dedicate to your debt pays down a greater percentage of principle.

4. Borrow From the IRS, Interest Free

If you receive 1099s both during training and as an attending, there is likely a big jump between your 1099 incomes during the transitional year. Since you pay taxes every quarter for your self-employment income (1099) based on prior year projections, you could seriously make a dent on your debt by delaying paying 1099 taxes for your first year out (higher 1099 income as attending) until the April tax filing deadline.

Effectively, you would have borrowed gobs of money from the IRS interest free, with the very first penny made at the beginning of the full year as an attending riding 0% interest loan from the IRS for 16 months.

Since the IRS loves borrowing money from taxpayers (including you) interest free (every time you get a tax refund, you have lent the IRS interest free money), you can return the favor.

5. Be Your Own Boss. Learn the Tax Codes.

America loves its businesses. If you are your own boss (or, in other words, you have tax forms other than W2 as an employee), you have much more leeway in getting tax deductions. You keep more of every dollar you earn if you learn the tax code and are your own boss. The more money you keep from what you earn, the more you can afford to pay down your student loans.

6. Monetize Your Hobby

Who says a hobby has to be an expense? What about making it into an income source? What’s this about consuming for fun? Why can’t we create something for others’ consumption and our fun?

7. Working Spouse, Working Kids

Hey, there’s no shame in working. My kid (Mini Wise Money) once said, “Mommy you are the hardest working and poorest person I know.” If we work this hard, why don’t we put our spouses and kids to work, too? Heck, it builds character! Mini has had three jobs (

lready at the tender age of 8, and she was her own boss in each case.

Walkie Dogie, her dog walking business; freelance art-DIY creations; and summer camp teaching assistant starting in 2017) a

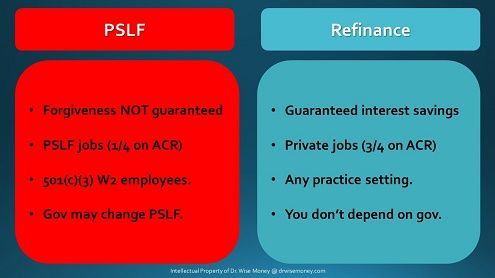

ACR stands for American College of Radiology, where almost all jobs in the field of radiology are listed.

PSLF stands for Public Service Loan Forgiveness: A federal program that will provide tax-free forgiveness of all remaining federal direct student loans if a PGY/attending works for a 501(c)(3) organization as a W2 employee and makes 120 Income-Driven Repayment payments.

8. Public Service Loan Forgiveness (if you’ve got the patience)

This is my least favorite option, but it's somewhat popular among my cohorts who face the reality of $400,000+ in student debt and are pretty sure they won’t make more than $200,000 per year as an attending. I find the latter presumption pretty self-defeating. I’ve met plenty of entrepreneur family practitioners who make north of $1 million per year. Income doesn’t depend on the specialty; it depends on the individual.

If you are dead set on getting PSLF, perhaps start a side brokerage account where you invest the money you would have used to pay down your debt.

Hopefully your money grows at a higher rate than the 6.8% interest on federal loans you're stuck with for the sole purpose of getting PSLF. If, for any reason, you can’t garner the 120 payments while employed by a 501(c)(3) organization, you can take the money out of the brokerage account and pay your debt off that way.

If you get PSLF, forget that much of what’s forgiven is the interest accrued from the deadly combination of the time value of money and a high interest rate. Enjoy your hefty brokerage account as a true boost to your net worth.

9. Band Together

We terminators must unite. We ought to share ideas and weapons. This article from me, the first prototype Student Loan Terminator 2015, is an invitation to all you soon-to-be terminators out there: it behooves us to help one another.

10. Time Machine: Debt Prevention

Don’t we all wish we could be John Connor and send a debt terminator back in time? Prevention is the best medicine. You want to destroy student loan Cyberdyne before Genesis. So I’ll be writing on debt prevention soon, until then...

I’ll be back.

This article is for informational purposes only and not intended as a substitute for professional advice. Please consult a professional accountant, financial adviser or lawyer, before making financial decisions.