- Revenue Cycle Management

- COVID-19

- Reimbursement

- Diabetes Awareness Month

- Risk Management

- Patient Retention

- Staffing

- Medical Economics® 100th Anniversary

- Coding and documentation

- Business of Endocrinology

- Telehealth

- Physicians Financial News

- Cybersecurity

- Cardiovascular Clinical Consult

- Locum Tenens, brought to you by LocumLife®

- Weight Management

- Business of Women's Health

- Practice Efficiency

- Finance and Wealth

- EHRs

- Remote Patient Monitoring

- Sponsored Webinars

- Medical Technology

- Billing and collections

- Acute Pain Management

- Exclusive Content

- Value-based Care

- Business of Pediatrics

- Concierge Medicine 2.0 by Castle Connolly Private Health Partners

- Practice Growth

- Concierge Medicine

- Business of Cardiology

- Implementing the Topcon Ocular Telehealth Platform

- Malpractice

- Influenza

- Sexual Health

- Chronic Conditions

- Technology

- Legal and Policy

- Money

- Opinion

- Vaccines

- Practice Management

- Patient Relations

- Careers

3 Ways a Trump Presidency Could Affect Doctors Financially

How will a Trump Presidency affect physicians financially?

I don’t pretend to be a political writer; there are much smarter people than I who are doing a fantastic job talking about the social aspects of a new term under Mr. Trump. However, I am interested in writing on how physicians might be impacted financially by his presidency.

Understand that most of these changes still require constitutional and due process and that the system of checks and balances may change things along the way. However, going by what he’s said throughout his campaign, here are major things that might affect you financially as a physician over the next few years:

1) The Affordable Care Act

Trump has made it very clear that he intends to call for a repeal of the Affordable Care Act (ACA), otherwise known as Obamacare. If that happens to pass, however, expect it to take a little while before anything takes effect. According to Senator Frist’s article, the main points that will be addressed will be “the elimination of individual and employer mandates,

reducing both the minimum essential benefit packages and the subsidies paid to individuals on the new exchanges.”

In place of the ACA, expect to be able to deduct health insurance premiums from your income taxes if you purchase them outside of work. Also, expect there to be more competition amongst insurers as they will be able to sell policies across state lines. That should in essence expand your choice of insurers as a consumer.

As a provider, without the exchanges, hospitals and provider groups can expect to have a larger array of choices when it comes to accepting insurance carriers.

Are HCAHPS scores going to be a thing of the past? It was implemented as part of the ACA and so it may be on its way out. Doc Vader, the hilarious character by ZdoggMD, would be thrilled.

2) Retirement

The answer here as far as we know it is that there shouldn’t be any dramatic changes to Social Security and Medicare benefits for retirees. In fact, Trump vowed to protect benefits such as Social Security and Medicare.

However, if his plan for large tax cuts stresses the federal budget significantly, expect Social Security to be strained even further. It’s already predicted that with the current Baby Boomer population steaming towards retirement age, it’ll face a shortfall in 18 years (2034).

Something to keep watch over.

3) Lastly, the subject that could affect you the most financially - TAXES.

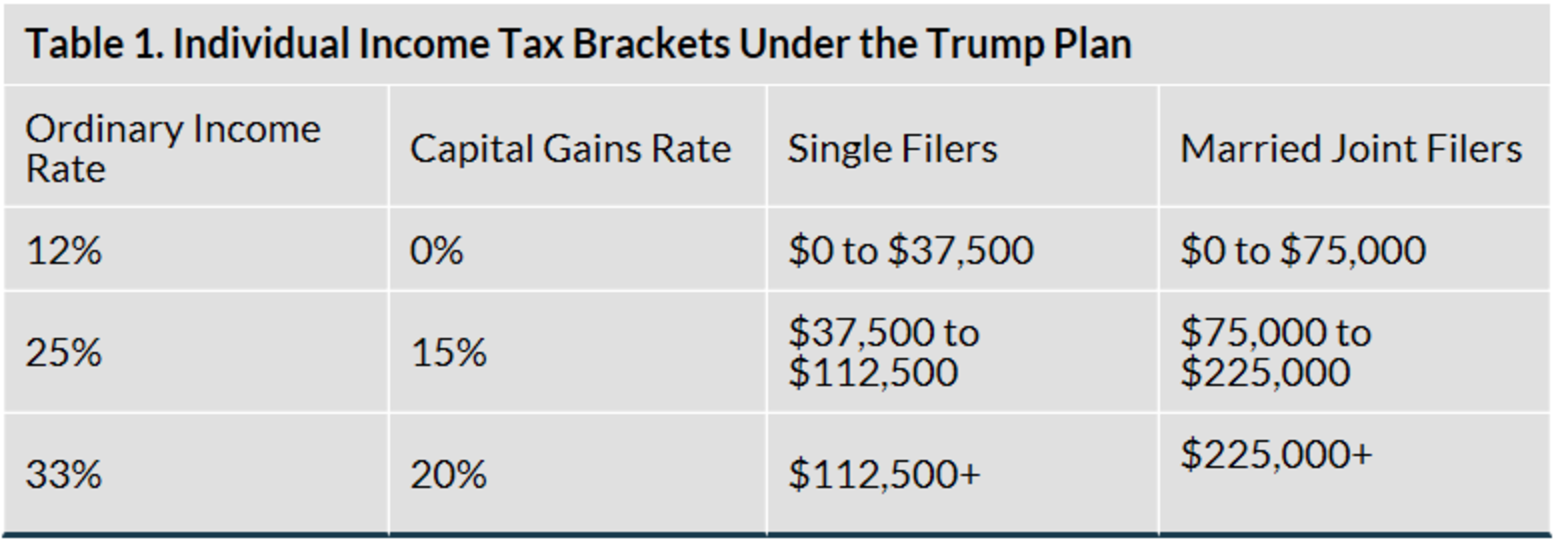

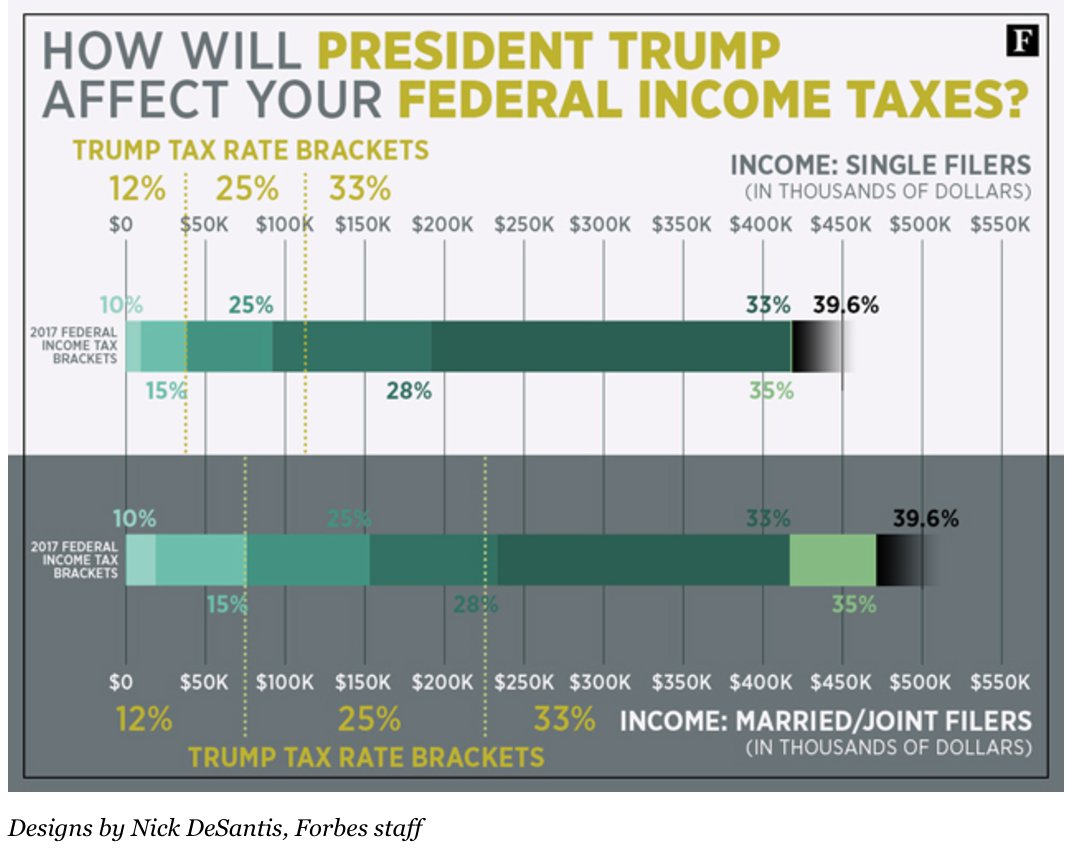

Trump’s stance on taxes has been to lower them across the board. Tax brackets would also be simplified from the current seven to three (

12%, 25%, and 33%) and c

apital gains would be capped at 20%.

Here are two great charts courtesy of Forbes.com.

The biggest impact might be if you receive a 1099 and

% to 15%. All business p

operate under a corporation (LLC, S-corp, C-corp). Your corporate tax rate may be lowered from 35rofit, even income earned by a physician from an S corporation, will be subject to the 15% rate.

Many doctors such as Emergency Medicine doctors and Anesthesiologists receive income through a corporate entity.

I've even seen where Trump proposed that all business tax income, even the income earned by a doctor from an S corporation, partnership, or sole-proprietorship and reported on the individual’s tax return could be subject to the same 15% rate. This would mean that under the Trump presidency, a physician today earning a significant business income would see a drop in top tax rate from 33%, 35% or 39.6% to 15%. Obviously that’s a radical change and could make a huge impact on your bottom line.

“Passive Income, MD” is a physician who blogs at his self-titled site, Passive Income M.D.