- Revenue Cycle Management

- COVID-19

- Reimbursement

- Diabetes Awareness Month

- Risk Management

- Patient Retention

- Staffing

- Medical Economics® 100th Anniversary

- Coding and documentation

- Business of Endocrinology

- Telehealth

- Physicians Financial News

- Cybersecurity

- Cardiovascular Clinical Consult

- Locum Tenens, brought to you by LocumLife®

- Weight Management

- Business of Women's Health

- Practice Efficiency

- Finance and Wealth

- EHRs

- Remote Patient Monitoring

- Sponsored Webinars

- Medical Technology

- Billing and collections

- Acute Pain Management

- Exclusive Content

- Value-based Care

- Business of Pediatrics

- Concierge Medicine 2.0 by Castle Connolly Private Health Partners

- Practice Growth

- Concierge Medicine

- Business of Cardiology

- Implementing the Topcon Ocular Telehealth Platform

- Malpractice

- Influenza

- Sexual Health

- Chronic Conditions

- Technology

- Legal and Policy

- Money

- Opinion

- Vaccines

- Practice Management

- Patient Relations

- Careers

Top 5 Reasons to Achieve Financial Independence

Financial Independence, also known as financial freedom, can give you benefits beyond the obvious financial implications.

Welcome to another Top 5 list, the Top 5 Reasons to achieve Financial Indendence (FI). I’ll admit, it wasn’t easy whittling this list down to just five reasons.

1. Give yourself options.

Being FI, you’ve got a nest egg that should support you indefinitely. Work becomes optional. That’s right, you can choose how to spend your days.

If you’ve longed for a three-day workweek, now is the time to make that a reality. If you’ve wanted to do some teaching or research, but had chosen private practice for the better pay, now is the time to explore that academic position. If you’re fed up with the shenanigans of your hospital and governmental administrators, and you’re mad as hell and can’t take this anymore, you don’t have to take it anymore. You can afford to take a sabbatical or walk away for good. By investing in your future, you’ve bought yourself options.

“I’m as mad as hell and I’m not gonna take this anymore!"

- News anchor Howard Beale in Network

2. You are now self-insured.

Remember the nice, young gentlemen who bought you dinner during residency and sold you some necessary insurance products? The one who sends you a “Happy Holidays” card every year and sends random e-mails to make sure your insurance needs are being met? You’ve got an unpleasant task ahead, because breaking up is hard to do.

Disability insurance is a very good idea for any young physician, and if you’ve got a family depending on your income, term life insurance is paramount as well. You need money in case you can’t work due to injury, and your family needs money if you can’t work because you died. Guess what? If you already have enough money to support yourself and your family without a biweekly paycheck, you don’t need to insure against losing that income. I would guesstimate that many physicians spend about $5,000 a year on these insurance premiums. Being FI allows you to put that money to work somewhere else. You could put $5,000 into a child’s 529 fund or donate about $9,000 to your donor advised fund or other charity.

3. Start working for others.

Why strive for financial independence when you have no interest in retiring early? You can keep working, of course, but now you can start working for the benefit of other people. You don’t need the money, but there are others that do. By virtue of having a high salary for a number of years, you have been “donating” all along, but the government decided where the money went. Now, you can give your earnings freely to people and projects that are meaningful to you. You may want to help a relative who is struggling. You may want to fund an expansion at the local dog shelter or food shelf. Giving to charity not only lowers your taxes, but it makes you feel good too.

Functional MRI has shown that we like to give, with areas of the brain associated with pleasure lighting up when we choose to give our money to causes we deem worthy. Achieving FI allows you to give more freely and generously, helping others in need while simultaneously boosting your own happiness.

4. The future is uncertain.

To paraphrase a common saying, “stuff happens.” All kinds of stuff. And some stuff is bad enough to require a leave of absence from your day job. If you are in your 40s or 50s, you might have parents in the 70s or 80s. You might even have grandparents, perhaps now in their 90s. All kinds of bad can happen to people at those advanced ages. Wouldn’t it be wonderful to have the ability to leave work behind without worrying about how your bills will be paid?

Badness can befall you too, or a spouse or close friend, or God forbid, one of your children. Financial Independence gives you the irreplaceable ability to be with loved ones in a time of need. Money can’t buy compassion, but it can buy the time you need to show compassion when it’s needed most.

5. Evaluate the relationship between your spending and happiness.

Recall that the key variables in the FI equation are the size of your nest egg and the amount of your annual spending. You are FI when the nest egg has X years of expenses, where X is a number like 25 (or perhaps 33 or 40 if you want to be really safe).

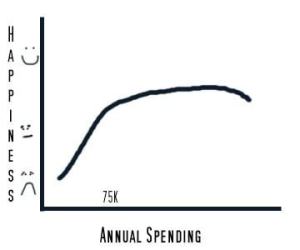

You can get closer to FI by growing your nest egg and/or by decreasing your expenses. Injecting a dose of frugality into your life can help you learn what truly makes you happy. Studies show that happiness pretty much plateaus once the household income hits $50,000 to $75,000. If you’re spending twice that much, you may be squandering a lot of money for very little added enjoyment. I like to think of the spending/happiness ratio in terms of a Frank Starling Curve of Happiness.

Replacing stroke volume with happiness and LVEDP with spending and leaving the overall shape alone gives us a pretty good representation of reality. When we start from 0, we see increasing levels of happiness with each additional dollar of annual spending. Once we reach a level of spending in the $50,000 to $75,000 range, the curve nearly plateaus. Additional spending may give us little boluses of happiness, but they are fleeting. Once our spending approaches or exceeds our take-home pay, we see a decrease in happiness. Call it congestive spending failure. We’re adding stress to our lives by going deeper into debt, not saving for retirement, and living a life that is unsustainable.

What do you think? Are these good enough reasons for you to choose to work towards Financial Independence?