- Revenue Cycle Management

- COVID-19

- Reimbursement

- Diabetes Awareness Month

- Risk Management

- Patient Retention

- Staffing

- Medical Economics® 100th Anniversary

- Coding and documentation

- Business of Endocrinology

- Telehealth

- Physicians Financial News

- Cybersecurity

- Cardiovascular Clinical Consult

- Locum Tenens, brought to you by LocumLife®

- Weight Management

- Business of Women's Health

- Practice Efficiency

- Finance and Wealth

- EHRs

- Remote Patient Monitoring

- Sponsored Webinars

- Medical Technology

- Billing and collections

- Acute Pain Management

- Exclusive Content

- Value-based Care

- Business of Pediatrics

- Concierge Medicine 2.0 by Castle Connolly Private Health Partners

- Practice Growth

- Concierge Medicine

- Business of Cardiology

- Implementing the Topcon Ocular Telehealth Platform

- Malpractice

- Influenza

- Sexual Health

- Chronic Conditions

- Technology

- Legal and Policy

- Money

- Opinion

- Vaccines

- Practice Management

- Patient Relations

- Careers

How to Minimize Tax Drag in a Taxable Brokerage Account

Simply stated, tax drag is the amount that your returns in a taxable account are decreased by taxes. It is commonly given as a percentage of the portfolio

Most of us start making our first investments in tax-sheltered accounts. These accounts, which include traditional and Roth IRAs, 401(k) and similar employer-based retirement accounts, allow your investments to grow tax-free.

Hopefully, we eventually reach a point in our lives where we have filled all available tax-sheltered space, and have money left over to invest. This is where a simple brokerage account, or taxable account comes into play.

There are advantages to a “taxable” account, despite that ugly word. You can access the money at any time without penalty. Your investment choices are not limited as they are in an employer’s retirement account. You can engage in tax loss harvesting to lower your taxable income by $3,000 a year.

But we hate taxes. Remember the Boston tea party? Me neither, but I remember learning about it.

How about when Ms. Stroud delivered this cynical, but more or less accurate line to the graduating seniors of the Lee High class of ’76:

“Okay guys, one more thing, this summer when you’re being inundated with all this American bicentennial Fourth Of July brouhaha, don’t forget what you’re celebrating, and that’s the fact that a bunch of slave-owning, aristocratic, white males didn’t want to pay their taxes.”

Fortunately for me, you, and the aristocrats, a taxable account doesn’t have to be subjected to a heavy tax burden. If you earn anything close to a physician’s salary, a taxable account will be subject to “tax drag.” We will discuss exactly what that means, and what we can do to minimize it.

What is tax drag?

Simply stated, tax drag is the amount that your returns in a taxable account are decreased by taxes. It is commonly given as a percentage of the portfolio.

How is tax drag calculated?

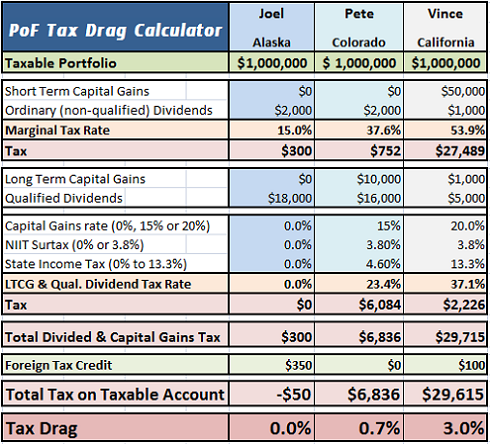

You must calculate your taxes paid on short and long term capital gains, and on ordinary and qualified dividends. Divide that number by the sum of your taxable investments, and you’ve got your tax drag. Wouldn’t it be nice if someone built a calculator for this?

Short-term capital gains and ordinary dividends are taxed at your marginal tax rate. At a physician’s salary, this is probably in the range of 30% to 50%.

Long-term capital gains and qualified dividends are taxed at a lower capital gains rate of 15% for most, or 20% for those in the highest federal tax bracket. On top of the 15% or 20% is state income tax for most, and a 3.8% surtax (known as the NIIT) for individuals with a modified adjusted gross income (MAGI) over $200,000 and couples with a MAGI over $250,000. Your rate can be as low as zero if your AGI is low enough (i.e. in early retirement), but will most likely owe somewhere between 15% and 35% while working.

Some “real life” examples

I’d like to introduce three hypothetical characters, each with a healthy one million dollar taxable portfolio. We’ll examine how tax drag can be affected by different investing strategies, incomes, and states of residence.

Joel

Joel is a retired family practitioner living in Alaska. A native of New York City who moved north to eliminate his student loans, he relishes in the fresh air and mountain scenery abundant in our nation’s 49th state.

Joel’s sweet ride

Joel invests in passive index funds and his portfolio sees very little turnover. In retirement, he and his wife Maggie keep their taxable income low enough to remain in the 15% tax bracket, avoiding all taxes on qualified dividends and long-term capital gains. Joel keeps the international portion of his asset allocation in his taxable account to take advantage of the tax credit.

Pete

Pete is a retired engineer turned successful blogger living in Colorado. Like Joel, he avoids actively managed funds in his taxable account. He did take some long-term capital gains this year when he sold a fund which held a large stake in a mining company that was found to have polluted the Colorado river. Some of those gains were offset by automatic tax loss harvesting in his Betterment account.

Pete doesn’t receive a foreign tax credit, as he has no international exposure. No, Pete. A road trip to Canada does not count as international exposure, at least not for this exercise.

Vince

Vince is a Hollywood actor living in [where else?] Hollywood, California. Vince sees more income in one year than Joel & Pete have earned in their lifetimes. He also spends money like it’s going out of style. To keep from going broke, Vinny asks his business manager Eric to handle a million dollar taxable portfolio for him.

Eric knows more about tossing pizzas than tax-efficient investing. He buys and sells “hot stocks” based on tips from Hollywood insiders. He got lucky this year, as novices sometimes do, and ended the year ahead while generating $50,000 in short-term capital gains.

Investing mainly in growth stocks in the tech industry, Eric unwittingly avoids receiving much dividend income, another good thing he does with the portfolio in spite of his naivety.

Care for a drag?

Adding up the total taxes paid on investment income, and dividing by the portfolio’s value, we can come up with a tax drag for each of the three taxpayers.

Looking at the tax drag on these million dollar accounts, we see a wide range from just under zero for Joel to 3% for Vince. Pete has a reasonable tax drag of 0.7%. Vince’s 3%may not sound like much, but it represents a >50% tax of nearly $30,000 on $57,000 in capital gains and dividends. Have you seen what a 3% reduction in returns can do over the long haul? It can cost you millions.

What can be done to minimize tax drag?

Fortunately, strategies exist to minimize tax drag in a taxable account:

- Choose funds with dividends that are mostly or all qualified (examples from my portfolio include VTSAX (total stock index) and VFIAX (S&P 500 index).

- Research funds @ Morningstar.com.

- Place international funds in a taxable account.

- Avoid actively managed funds in a taxable account.

- Minimize turnover. Buy-and-hold as opposed to buy-and-sell.

- Live in a state with low or no state income tax.

- Earn less (retire early), but don’t let the tax tail wag the dog.

The Excel file used in this sheet is available to use online or as a download with the other PoF calculators on my calculators page.

Do you have a taxable account? Do you know your tax drag? What strategies do you take to minimize it?