- Revenue Cycle Management

- COVID-19

- Reimbursement

- Diabetes Awareness Month

- Risk Management

- Patient Retention

- Staffing

- Medical Economics® 100th Anniversary

- Coding and documentation

- Business of Endocrinology

- Telehealth

- Physicians Financial News

- Cybersecurity

- Cardiovascular Clinical Consult

- Locum Tenens, brought to you by LocumLife®

- Weight Management

- Business of Women's Health

- Practice Efficiency

- Finance and Wealth

- EHRs

- Remote Patient Monitoring

- Sponsored Webinars

- Medical Technology

- Billing and collections

- Acute Pain Management

- Exclusive Content

- Value-based Care

- Business of Pediatrics

- Concierge Medicine 2.0 by Castle Connolly Private Health Partners

- Practice Growth

- Concierge Medicine

- Business of Cardiology

- Implementing the Topcon Ocular Telehealth Platform

- Malpractice

- Influenza

- Sexual Health

- Chronic Conditions

- Technology

- Legal and Policy

- Money

- Opinion

- Vaccines

- Practice Management

- Patient Relations

- Careers

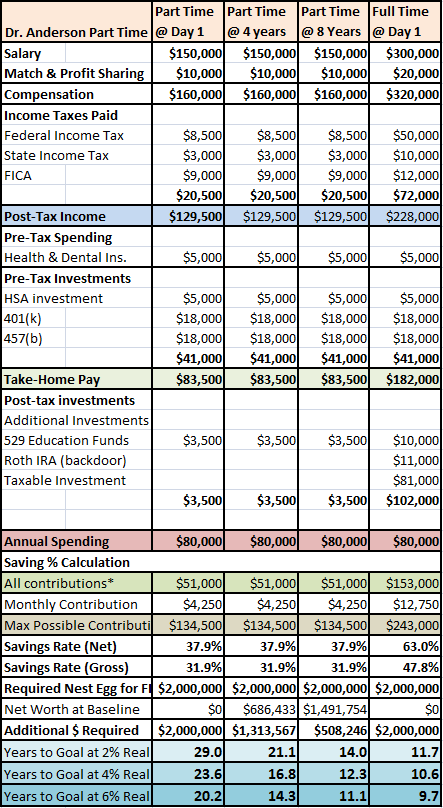

The Financial Impact of Part-Time Work at Various Career Stages

The timing of a part-time transition can make a big difference in your ability to build wealth. Just a few years of full-time work first can shave years off a career.

Today, we'll add another chapter to the saga of the 4 Physicians. We've already explored the benefits of Dr. Anderson continuing to work beyond attaining FI. In today's remix, we'll revisit Dr. A and see how things might pan out if she were to work part-time.

To recap, Dr. A was relatively frugal when compared to her colleagues, spending $80,000 a year on a $300,000 household income, which gave her a gross savings rate of nearly 50%.

Content to drive her Honda, live in a nice if not extraordinary home, and send her children to well regarded public schools, Dr. A thought perhaps she was putting in too much time at work. Working 50 to 60 hours a week for about 10 years was one way for her to become financially independent, but it couldn't be the only way. Could she make it happen without sacrificing so much time while her children were young? Could she cut her hours and stave off the physician burnout that was starting to gnaw at her well-being and affecting her more experienced coworkers more noticeably?

Let's take a look at the financial ramifications of Dr. A taking a part-time job with half the pay, while keeping her annual spending constant. Dr. A could go part time from day 1, or decide to go part time after some years of full-time work, let's say four or eight years. This gives us four scenarios:

- Dr. A starts her career working part time.

- Dr. A goes part time after four years full time.

- Dr. A goes part time after eight years full time.

- Dr. A works full time until she is FI.

As in other exercises, the assumed real return was 4% real until our Doctor decided to enact change. When Dr. A works part-time from day one, she more than doubles the length of time to FI, as compared to full-time work. She is looking at a 20 to 29 year path to FI with real returns of 2% to 6%. Working just four years part time gives her a shorter route, shaving six to eight years off her path to FI.

Allow me to repeat that: working the first 4 years full-time rather than half-time can shorten her working career by six to eight years. And those four years of full-time work come when she is young and used to working harder as a resident. I would take that trade-off 11 times out of 10.

If she works eight years full-time before going part time, she's already got a $1.5 million dollar nest egg. An additional three to six years of part time work will get her to FI. Alternatively, two to three years of full time work at that point will get her the same $2 million dollar nest egg required.

As she approaches her FI goal, going part time has a lesser effect. It will delay FI certainly, because she is only contributing one-third of what she could when working full time. But the difference is more linear. One year of full time work is roughly equal to two years at half time. Some of the heavy lifting is being done by her $1.5 million portfolio bulit up over the first eight years of her career.

It's worth noting a couple more differences in the part-time versus full-time scenarios. Note that at part-time pay, Dr. A doesn't have money left over to contribute to a taxable account or a backdoor Roth IRA. These are investments that are very useful for an early retiree. Also, she is contributing less to the 529 accounts for her children. In this exercise, we are looking at a $150,000 income as a part-time income. The math would be identical if we were comparing two different specialties or jobs where the income differential was 2:1, illustrating the financial benefit of a higher paying position / specialty.

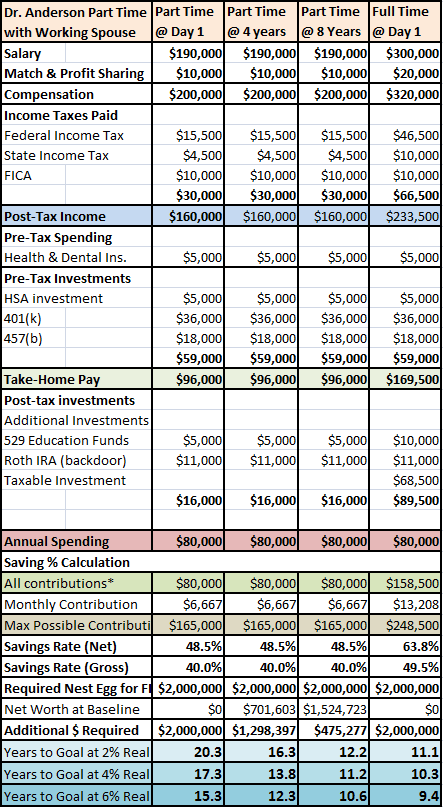

The Benefit of a Working Spouse

In the first set of scenarios, we assumed that Dr. A was the sole provider (not to be confused with the Soul Provider). How might the different scenarios change if her spouse was working full time? Keeping household income the same at $300,000, we'll assume Dr. A's full time pay is $220,000, while her spouse earns $80,000 and maxes out a 401(k).

With a gainfully employed spouse earning $80,000 and Dr. A in a part-time position paying $110,000, their household income is $190,000, compared to $150,000 in the first round of number crunching. As a couple, they will achieve FI in a maximum of 20 years in the "worst-case scenario" provided, which is Dr. A working part time from day one and 20 years of 2% real returns.

If Dr. A works full time the first four years, they will be FI five around years earlier. The longer she works full time, the less impact each additional year has. Extending her full-time work from four to eight years only shaves off one to four years in this scenario. Not such a great trade-off at this point.

Notable differences from the "sole provider" scenarios stem from the extra $40,000 in salary. The couple is able to fully fund a backdoor Roth IRA and contribute more to the 529s. Also, the 401(k) portion of the nest egg will be double, as each income earner can contribute the $18,000.

What did we learn from this exercise?

- Part-time work early in one's career has a profound effect on delaying FI. No earths shattered with that revelation. Money needs time for compound interest to work its magic. Still, I was impressed with the difference that even a few years of full-time work can make.

- Taxes on a $150,000 income are surprisingly low. Plugging the numbers into TaxCaster after reducing taxable income by $46,000 (deductible insurance, HSA, 401(k), and 457(b) contributions), with a spouse and two children, a mortgage and $5,000 in charitable giving leaves you with a four-figure federal income tax. The progressive nature of our tax code is on display here.

- Going part time as I approach my financial goals before an early retirement may be a viable option. My competitive drive makes me want to keep the pedal to the metal, but in a few years, my portfolio should contribute nearly as much towards the target as my salary will. More importantly, working less could ease the transition to not working at all. The financial piece is easy to calculate, but there are myriad psychosocial aspects to ending a career that I probably won't understand for myself until I start to experience them.