- Revenue Cycle Management

- COVID-19

- Reimbursement

- Diabetes Awareness Month

- Risk Management

- Patient Retention

- Staffing

- Medical Economics® 100th Anniversary

- Coding and documentation

- Business of Endocrinology

- Telehealth

- Physicians Financial News

- Cybersecurity

- Cardiovascular Clinical Consult

- Locum Tenens, brought to you by LocumLife®

- Weight Management

- Business of Women's Health

- Practice Efficiency

- Finance and Wealth

- EHRs

- Remote Patient Monitoring

- Sponsored Webinars

- Medical Technology

- Billing and collections

- Acute Pain Management

- Exclusive Content

- Value-based Care

- Business of Pediatrics

- Concierge Medicine 2.0 by Castle Connolly Private Health Partners

- Practice Growth

- Concierge Medicine

- Business of Cardiology

- Implementing the Topcon Ocular Telehealth Platform

- Malpractice

- Influenza

- Sexual Health

- Chronic Conditions

- Technology

- Legal and Policy

- Money

- Opinion

- Vaccines

- Practice Management

- Patient Relations

- Careers

4 Dividend Stocks for the Next Decade

As corporate earnings continue to sharply rebound from the depths of the recession, many public companies are deciding to step up their dividend payments. Here are four stocks with great potential for huge dividend increases over the next decade.

As corporate earnings continue to rebound significantly from the depths of the recession, many companies are deciding to step up their dividend payments, and for good reason.

The rebound in earnings has truly been dramatic, as companies have been able to turn modest revenue gains into exceptionally strong bottom line growth through expanding margins. As a result, cash flow has been surging.

In fact, cash flow hit a record $1.145 billion dollars for the S&P 500 in 2010, up from the previous record of $1.117 billion set in 2006. With U.S. companies sitting on nearly $2 trillion in cash and another solid earnings season well underway, many companies are finally deciding to up their dividend payments.

Major Commitment When a company decides to increase its dividend rather than just buy back stock or sit on the cash, it’s a signal to investors that management is confident in the outlook of the business.

The reason for this is that dividends represent more of a long-term commitment because companies can usually decide to simply stop buying back stock at any time without any major repercussions. On the other hand, if a company decides to stop paying its dividend, investors will flee the stock.

New York University finance professor Aswath Damodaran put it this way: "Dividends are like getting married; stock buybacks are like hooking up."

Dividend Growth Stocks

For investors with a long-term horizon, it’s important to not only look at a stock’s current dividend yield but also to look at its payout ratio. A payout ratio is simply the percentage of net income a company pays out in dividends.

A young, fast-growing company will likely have a very low payout ratio, assuming it even pays a dividend at all. As the company grows and matures, however, it will have less growth opportunities and will plow back less cash into the company and more into your wallet. This could mean a relatively small dividend yield today could become a huge yield for you in the future.

For example, assume you buy a stock trading at $50 per share. It retains most of its earnings now, but still pays an annual dividend of $1.25 per share, for a dividend yield of 2.5% ($1.25/$50). Say the company decides to start paying out more of its earnings in dividends however. If it raises its dividend by 20% per year over the next decade, at the end of year 10, you'll be getting $7.74 in dividends per share. That means your yield on cost will be a whopping 15.5% ($7.74/$50). This ignores any capital gains you might have, too.

For a company to consistently raise its dividend at such a high rate over a long period of time, it needs to generate solid free cash flow, have a strong competitive advantage, and more than likely raise its payout ratio.

Stocks with Excellent Potential

Listed below are four stocks with great potential for huge dividend increases over the next decade. They each have strong cash flow, a history of double-digit dividend increases, a relatively low payout ratio, and a competitive advantage in their respective markets.

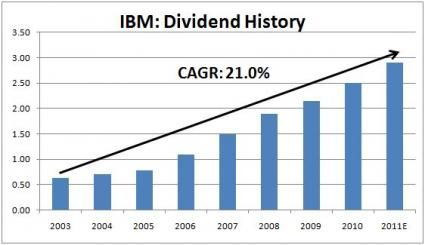

1. International Business Machines Corp. (NYSE: IBM) continues to generate exceptionally strong free cash flow, which has allowed it to simultaneously fund growth, buy back stock and substantially raise its dividend.

Big Blue recently announced a 15% dividend hike, marking its 16th consecutive year of an increase. Expect more increases in the future, too -- IBM's payout ratio is just 22%.

The stock currently yields 1.8%. Over the last 10-years, it has raised its dividend at a compound annual growth rate of 18%.

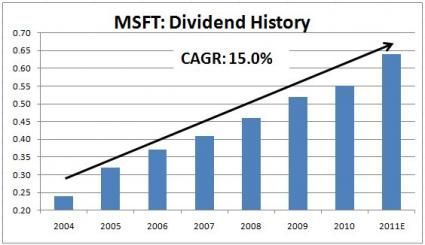

2. Microsoft Corp. (NASDAQ: MSFT) may be faced with the challenges of operating in a slowly declining industry as people shift from personal computers (PCs) to tablets and smartphones, but don't expect the software giant to go away anytime soon.

In fact, the company recently reported a 31% increase in third-quarter net income on revenue growth of 13%. Although revenue for Windows 7 slid 4% due to weak sales in the PC industry, its business division revenue surged 21% due to strong Office 2010 sales.

Microsoft has over $60 billion in cash and investments on its balance sheets and has generated nearly $20 billion in free cash flow in the first nine months of its fiscal year 2011. With a payout ratio of just 26%, expect the company to continue raising its dividend, boosting its already attractive 2.5% dividend yield.

Since it began paying a dividend in 2004, the company has raised it at an average annual rate of 15%, not including a $3 per share special dividend in 2004.

3. Walgreen Co. (NYSE: WAG) is the nation's largest drug-store chain and has increased its dividend for 35 straight years. It currently yields 1.6%.

Since 2000, the company has raised its dividend at an average annual rate of 16%. With over $2.5 billion in free cash flow in 2010 and a payout ratio of just 29%, expect more big dividend hikes on the way.

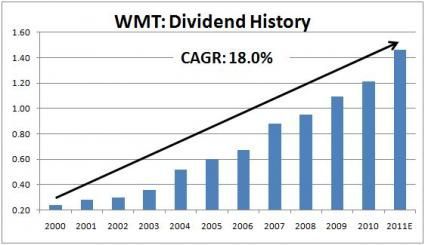

4. Wal-Mart Stores Inc. (NYSE: WMT) is another blue-chip name with billions of dollars in annual cash flow and a durable competitive advantage.

Now that the world's largest retailer is faced with fewer growth prospects, it is distributing more of its cash to shareholders through dividend increases. For instance, the company recently announced a 21% dividend hike. It currently yields 2.7%.

Wal-Mart's payout ratio is still fairly low at 30%, which leaves plenty of room for more big hikes down the road.

Over the last 10 years, Wal-Mart has raised its dividend at a compound annual rate of 18%, essentially doubling its dividend every four years. It has raised its dividend every year since 1974.

These four companies have all made strong commitments to shareholders through consistent dividend hikes. With strong competitive advantages, solid cash flows and low payout ratios, these companies are likely to continue boosting their dividends over the next decade.

Todd Bunton is the Growth & Income Stock Strategist for Zacks Investment Research Inc. in Chicago. (Disclosure: The author owns shares of IBM.)

“The information supplied above by Zacks Investment Research Inc. contains opinions based on factual research which may or may not be accurate. Zacks will not assume any liability for losses from investment decisions based on this information.”