- Revenue Cycle Management

- COVID-19

- Reimbursement

- Diabetes Awareness Month

- Risk Management

- Patient Retention

- Staffing

- Medical Economics® 100th Anniversary

- Coding and documentation

- Business of Endocrinology

- Telehealth

- Physicians Financial News

- Cybersecurity

- Cardiovascular Clinical Consult

- Locum Tenens, brought to you by LocumLife®

- Weight Management

- Business of Women's Health

- Practice Efficiency

- Finance and Wealth

- EHRs

- Remote Patient Monitoring

- Sponsored Webinars

- Medical Technology

- Billing and collections

- Acute Pain Management

- Exclusive Content

- Value-based Care

- Business of Pediatrics

- Concierge Medicine 2.0 by Castle Connolly Private Health Partners

- Practice Growth

- Concierge Medicine

- Business of Cardiology

- Implementing the Topcon Ocular Telehealth Platform

- Malpractice

- Influenza

- Sexual Health

- Chronic Conditions

- Technology

- Legal and Policy

- Money

- Opinion

- Vaccines

- Practice Management

- Patient Relations

- Careers

Americans Get Lax with Retirement Savings

Americans are becoming complacent with their retirement savings. Overall, they are saving the same amount of money as a year earlier and those closest to retirement age are most likely to be saving less.

Americans are becoming complacent with their retirement savings, according to the results from a Bankrate poll.

The survey of working Americans found that 54% are saving the same amount for retirement as last year and 17% are actually saving less. Just 18% reported saving more for retirement now than they were a year ago.

These results are roughly the same as last year’s. However, this is an improvement from the 2011 survey results, which revealed that 29% of working Americans were saving less than they were in 2010.

Americans closest to retirement are the most likely to be saving less. Also, 21% upper-middle-income households are saving less for retirement than a year ago.

"This is troubling considering the availability of catch-up contributions for those 50 and up, as well as the higher 2013 contribution limits for all eligible IRA and 401(k) contributors," Greg McBride, CFA, Bankrate.com's senior financial analyst, said in a statement.

More men say they feel better about their savings compared to women while 28% of people between the ages of 18 and 29 feel comfortable with their savings compared to just 15% of people 30 years and older.

The younger the respondent, the most likely they are to be comfortable with their debt, while suburbanites were more comfortable with their debt than urban respondents were.

The Bankrate survey also find a division along political lines with 38% of Democrats saying they are doing better financially today compared to 12 months ago while 23% of Republicans say the same. Roughly a quarter of Republicans (27%) and Independents (25%) reported that they have a higher net worth compared to a year ago, compared to 39% of Democrats.

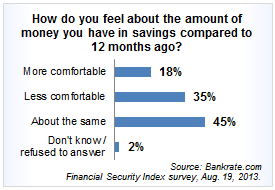

While the overall Bankrate.com Financial Security Index is down for the second straight month, it is still at a higher level than a year ago. Savings are the weakest component, according to Bankrate, with twice as many people saying they’re less comfortable with their savings now.