- Revenue Cycle Management

- COVID-19

- Reimbursement

- Diabetes Awareness Month

- Risk Management

- Patient Retention

- Staffing

- Medical Economics® 100th Anniversary

- Coding and documentation

- Business of Endocrinology

- Telehealth

- Physicians Financial News

- Cybersecurity

- Cardiovascular Clinical Consult

- Locum Tenens, brought to you by LocumLife®

- Weight Management

- Business of Women's Health

- Practice Efficiency

- Finance and Wealth

- EHRs

- Remote Patient Monitoring

- Sponsored Webinars

- Medical Technology

- Billing and collections

- Acute Pain Management

- Exclusive Content

- Value-based Care

- Business of Pediatrics

- Concierge Medicine 2.0 by Castle Connolly Private Health Partners

- Practice Growth

- Concierge Medicine

- Business of Cardiology

- Implementing the Topcon Ocular Telehealth Platform

- Malpractice

- Influenza

- Sexual Health

- Chronic Conditions

- Technology

- Legal and Policy

- Money

- Opinion

- Vaccines

- Practice Management

- Patient Relations

- Careers

Are Your Parents Really to Blame for Your Financial Habits?

Where do we really pick up attitudes about money. New research offers some insight.

Where do we pick up our financial habits? This question is often asked but rarely does it seem to have a satisfying, solid, or definitively tangible answer.

We are quick to point at the low hanging fruit of parents, and the families that raised us. This may be deservedly so, as that is the environment in which we spend a great majority of our formative years.

There is plenty of support around this idea, with many popular books like “Rich Dad Poor Dad” by Robert Kiyosaki that advocate emulating positive financial habits that may not necessarily have been within your immediate environment.

And without a doubt, it is hard to argue that as children we mimic and absorb our surroundings like insatiable sponges, but is that the whole picture or is there something else?

I wanted to delve into this question and see what evidence existed within the financial literature in an attempt to shed some light on this question. In the process, I came across varied but all very interesting thoughts.

Are Genetics at Play?

There is growing support that for some of us, some of our behaviors positive or negative many be completely out of our control.

It is of no surprise that our society is becoming more obese over time, and much of that has been attributed to various items in our social environment that lead to a less active lifestyle. Things like screen time and video games are often blamed, and the growing "supersize” portions being marketed as “value” meals are never too far from the conversation.

However, there is also thought that genetics may play a role in all of this, in that some of us may be more likely than others to fall into unhealthy habits given particular social cues and environments.

I know this has been extensively studied in behaviors like gambling and that with certain social cues, brain activity changes in comparison to others.

Could there be similar events that influence our thoughts, feelings, and decision-making abilities when it comes to finances that nudge in one direction or the other? If so, this adds a whole new level of complexity to how we should be approaching this issue.

Out of Our Control

There are so many factors that are out of our control in this regard. Every day brings a new adventure, and even more so when you are a kid.

- Where did you grow up?

- Who are your parents?

- Who are your classmates?

- What interests do you have?

- Do you tend to be more analytical?

- …and on and on and on it goes.

Does any of it really matter in the end and to what extent?

Because this topic by its very nature has so many moving parts, it will most likely always be difficult to pin down what is truly to blame, but hopefully we can learn what factors may have more weight when compared to others.

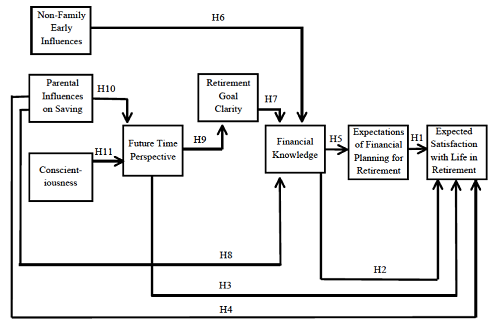

The following proposed model is interesting. The model attempts to put a framework around all the various factors that play into how you and I approach and treat our finances. I understand that looking at this may immediately bring flash backs of statistics that you had sufficiently suppressed but it's definitely interesting, so let's take a moment to break this down and see what we can take from it.

Image credit: Hershey et al.

So what we want to get from this is in the center(Financial Knowledge), if all roads lead to Rome then our Rome is Financial Knowledge, and much like Rome was not built in a day, neither were your positive or deleterious financial habits.

The influences all come to meet in this center from all different directions, and to stick with our analogy of roads and Rome, we will look at all the numbered “highways” (i.e. “H7” denotes Highway 7).

All roads need a map:

Let's take “Non-family early influences.” If I lived or grew up in the town of “Non-Family Early Influences” and I wanted to get to “Financial Knowledge,” it looks fairly straight forward that I would hop on highway 6 and just take that until I reached my destination.

On the other hand, if I was coming from “Parental influences on saving” and I wanted to get to the center, I could take a couple routes:

I could either take highway “H8” and get a straight shot to "Financial Knowledge"

or

I could take highway “H10,” go through “Future time Perspective,” hop on “H9,” and pass by “Retirement Goal Clarity,” end up on “H7” and take that into our final destination of “Financial Knowledge.”

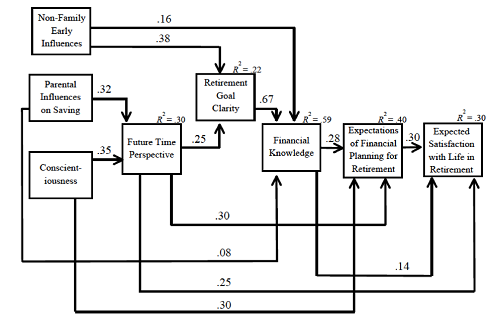

All roads need a speed limit:

This is where it gets a little more complicated but we will stay with our story and keep it simple. Now our map has numbers where our highway signs used to be, and for the sake of simplicity let's refer to these numbers as we would speed limits. The higher the number the faster we can go.

In the actual model, these numbers serve as weighted predictors for the influencers.

Image credit: Hershey et al.

R-squared is defined as the “percent of variance explained” by the model and generally the higher the value the better the model fits.

R-squared = Explained variation / Total variation

R-squared is always between 0 and 100%:

• 0% indicates that the model explains none of the variability of the response data around its mean.

• 100% indicates that the model explains all the variability of the response data around its mean.

Models like this are used to try and better explain a lot of different relationships across a broad range of fields in addition to finance, and for the math/statistics purists out there here is a link to delve in as deep as your heart desires.

For the rest of us, we now return to our journey to the center of financial knowledge:

Of the three roads that lead to Rome (Financial Knowledge), it looks like the road from “Retirement Goal Clarity” has the highest speed limit or influence, followed by “non-family early influences,” and lastly by “Parental influences on saving.”

In regards to influencing “Retirement Goal Clarity,” non-family aspects seem to be slightly more influential than the more intimate/personal aspects like personality and parents and although parents are part of the equation they don't seem to bear the brunt of the burden.

Individual factors, like whether or not you are a conscientious person, are important.

• Conscientiousness: Speaks to whether or not a person is efficient and precise when engaged in a task or how they would respond if asked “Are you an organized person?”

• Future Time Perspective: This speaks to how often and to what degree you enjoy “dreaming or thinking” about how you will live in the future.

• Retirement Goal Clarity: speaks to how clearly you can estimate how you will live in the future and how much you will need in order to do that.

• Non-family Influences are also key as we grow we tend to gravitate towards different subjects and interests. Maybe you took classes in financial management starting at an early age, or happened to be involved in volunteer activities that exposed you to handling finances early on, such as fundraising or I remember as kids doing “door to door” sales to fund field trips. The good ol’ days of when it was still fairly safe to go door to door.

At the end of the day, there seems to be an interplay of family, non-family, and individual personality/disposition at play in formulating our financial knowledge. So next time we are quick to blame or praise parents, let's consider the other pieces of the puzzle.

In my mind, if our families are the car, the non-family factors are the road, and you (the individual) are definitely the driver! If we look around, no matter what our upbringing some people tend to have lead feet and constantly red lining, whilst others prefer Sunday afternoon drives without the slightest sense of urgency in the world.

Whether you get to your destination today or a little ways down the line, just make sure you keep checking the signs and get to a point of financial literacy.

Where do you feel you picked up your financial habits?