- Revenue Cycle Management

- COVID-19

- Reimbursement

- Diabetes Awareness Month

- Risk Management

- Patient Retention

- Staffing

- Medical Economics® 100th Anniversary

- Coding and documentation

- Business of Endocrinology

- Telehealth

- Physicians Financial News

- Cybersecurity

- Cardiovascular Clinical Consult

- Locum Tenens, brought to you by LocumLife®

- Weight Management

- Business of Women's Health

- Practice Efficiency

- Finance and Wealth

- EHRs

- Remote Patient Monitoring

- Sponsored Webinars

- Medical Technology

- Billing and collections

- Acute Pain Management

- Exclusive Content

- Value-based Care

- Business of Pediatrics

- Concierge Medicine 2.0 by Castle Connolly Private Health Partners

- Practice Growth

- Concierge Medicine

- Business of Cardiology

- Implementing the Topcon Ocular Telehealth Platform

- Malpractice

- Influenza

- Sexual Health

- Chronic Conditions

- Technology

- Legal and Policy

- Money

- Opinion

- Vaccines

- Practice Management

- Patient Relations

- Careers

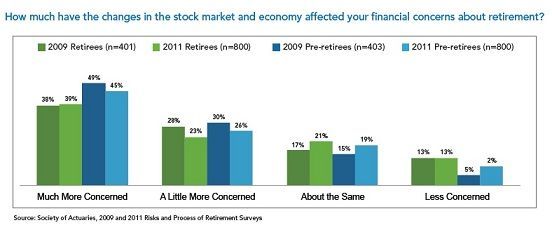

Biggest Retirement Concerns

Retirees and pre-retirees weigh in on the challenges and concerns that worry them most about retirement from health care to home equity.

Whether you’re close to retirement or at the beginning of your career, you’ve likely become acquainted with the fact that you can’t predict everything that might go wrong. But while planning for retirement, there are some concerns you should keep in mind. Because according to a Society of Actuaries (SOA) survey, these challenges cause the most concern for older Americans.

hile the results of the 2011 survey show that concerns have increased since the 2009 survey, SOA also reports that retirees and pre-retirees don’t seem to have changed much when it comes to basic risk management.

Click to enlarge

The top concern that retirees and pre-retirees between the ages of 45 and 80 have is inflation. More than three-quarters of pre-retirees (77%) and 69% or retirees are somewhat or very concerned that inflation will outpace their investments. However, this can be overcome by staying invested in stocks, which historically outpace inflation. Also, 57% of retirees acknowledged that their income during retirement could change based on interest rates.

Health care is a hot topic and will remain so. And for both retirees and pre-retirees having enough money to pay for adequate health care is a very big concern according to 61% and 74%, respectively. Tied to that, 60% of retirees and 66% of pre-retirees are very or somewhat concerned about having the money to pay for long-term care.

healthy lifestyle habits.

According to 59% of retirees, another concern is being unable to maintain a reasonable standard of living, while 45% of respondents worry that their spouse/partners won’t be able to maintain the same standard of living after their deaths.

As people live longer and longer, they run the risk of depleting their savings by outliving them, something 54% of retirees are concerned about and 63% of younger, pre-retiree respondents worry about.

A new addition to the list is that retirees and pre-retirees is related to falling home values. There has been no agreement on if the country has hit the bottom yet or when that can be expected. As a result, 44% of retirees and 46% of pre-retirees are very or somewhat concerned that the equity in their homes won’t support retirement plans.

Lastly, 38% of retirees and 41% of pre-retirees worry there won’t be any money to leave to heirs. Although, sometimes this is also the results of poor estate planning.

“So, what action is being taken to mitigate these retirement risks? The short answer is not enough.” Anna Rappaport, FSM, MAAA, chair of SOA’s Committee on Post-Retirement Needs and Risks, wrote in a blog post. “While the recession could have been the catalyst for some to take retirement planning more seriously, consideration of risk management strategies does not appear to have changed much.”

WTo offset health care concerns almost all of the respondents said they are (82%) or plan to (10%) maintain