- Revenue Cycle Management

- COVID-19

- Reimbursement

- Diabetes Awareness Month

- Risk Management

- Patient Retention

- Staffing

- Medical Economics® 100th Anniversary

- Coding and documentation

- Business of Endocrinology

- Telehealth

- Physicians Financial News

- Cybersecurity

- Cardiovascular Clinical Consult

- Locum Tenens, brought to you by LocumLife®

- Weight Management

- Business of Women's Health

- Practice Efficiency

- Finance and Wealth

- EHRs

- Remote Patient Monitoring

- Sponsored Webinars

- Medical Technology

- Billing and collections

- Acute Pain Management

- Exclusive Content

- Value-based Care

- Business of Pediatrics

- Concierge Medicine 2.0 by Castle Connolly Private Health Partners

- Practice Growth

- Concierge Medicine

- Business of Cardiology

- Implementing the Topcon Ocular Telehealth Platform

- Malpractice

- Influenza

- Sexual Health

- Chronic Conditions

- Technology

- Legal and Policy

- Money

- Opinion

- Vaccines

- Practice Management

- Patient Relations

- Careers

Construction and Use of a Credit Score

An often overlooked asset by most physicians is their credit score, but the importance of credit and the significance of monitoring your credit score on a consistent basis cannot be understated.

An often overlooked asset by most physicians is their credit score. If you are in your training years, one consideration relevant to your long-term financial strategy should be to start to monitor your score and to begin to strengthen it. While in practice, you should continue to utilize credit no matter how great your cash flow is.

Some physicians are in a fortunate position while in practice and they never need to take out a loan again or utilize a credit card. This cash flow trap should be avoided, as it may come back to haunt you when/if you try to apply for a mortgage on a second home or a larger purchase down the road that you would prefer to finance in a low interest environment.

The importance of credit and the significance of monitoring your credit score on a consistent basis cannot be understated. The

financial information included in this report will be a huge factor on whether you can obtain a loan, get auto or home insurance, rent an apartment or even apply for a job. Your credit score is often the most important factor in determining the rate at which you can obtain loans as well. The higher the score, the better off you will be. A higher score can be the difference in saving thousands of dollars in interest throughout the duration of a loan.

As a starting point, I would suggest developing the habit of monitoring your credit score.

It’s a good idea to review your credit report at least once per year. I would suggest starting at Annual Credit Report. Contact the credit bureaus, and correct any errors you find immediately. I recommend these frequent checks to monitor identity theft issues and accidentally missed payments that can have a catastrophic affect on your credit score.

The three credit bureaus are

Equifax, Experian and TransUnion, which all allow you to pull your credit report for free once a year. Each of these bureaus can contain dissimilar information and calculate your scores in slightly different ways.

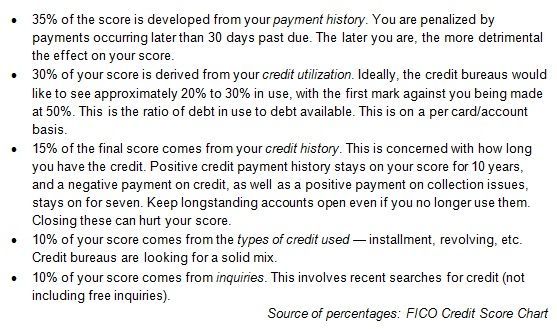

A key aspect to the credit score is realizing what activities contribute to the score and to what degree they do. This is helpful to prioritize financial activity and decision-making as you take a proactive approach to improving and increasing your personal score.

If you and your credit score are in great shape, it would be savvy to take out a small loan (only if terms are favorable) or a credit card either jointly or solely in your child’s name. This will help establish the history, utilization and payment history on their behalf… they will thank you when buying their first home or getting that first vehicle loan out of college!

443552/ DOFU 1-2012

Jon C. Ylinen is a Financial Advisor with North Star Resource Group and offers securities and investment advisory services through CRI Securities, LLC. and Securian Financial Services, Inc., members FINRA/SIPC. CRI Securities, LLC. is affiliated with Securian Financial Services, Inc. and North Star Resource Group. North Star Resource group is not affiliated with Securian Financial Services, Inc. The answers provided are general in nature and are not intended to be specific recommendations. Please consult a financial professional for specific advice in relation to your individual circumstances. This should not be considered as tax or legal advice. Please consult a tax or legal professional for information regarding your specific situation.