- Revenue Cycle Management

- COVID-19

- Reimbursement

- Diabetes Awareness Month

- Risk Management

- Patient Retention

- Staffing

- Medical Economics® 100th Anniversary

- Coding and documentation

- Business of Endocrinology

- Telehealth

- Physicians Financial News

- Cybersecurity

- Cardiovascular Clinical Consult

- Locum Tenens, brought to you by LocumLife®

- Weight Management

- Business of Women's Health

- Practice Efficiency

- Finance and Wealth

- EHRs

- Remote Patient Monitoring

- Sponsored Webinars

- Medical Technology

- Billing and collections

- Acute Pain Management

- Exclusive Content

- Value-based Care

- Business of Pediatrics

- Concierge Medicine 2.0 by Castle Connolly Private Health Partners

- Practice Growth

- Concierge Medicine

- Business of Cardiology

- Implementing the Topcon Ocular Telehealth Platform

- Malpractice

- Influenza

- Sexual Health

- Chronic Conditions

- Technology

- Legal and Policy

- Money

- Opinion

- Vaccines

- Practice Management

- Patient Relations

- Careers

Demystifying Social Security

Despite the fact that Social Security is a safety net for senior citizens, many Americans aren't all that knowledgeable about benefits and claiming strategies.

Despite the fact that Social Security is a safety net for senior citizens, many Americans aren’t all that knowledgeable about benefits and claiming strategies, according to an AARP survey. A little crash course in the program couldn’t hurt for those close to retirement, even if the fund is expected to run dry by 2033.

The Social Security Act was passed in 1935, when the poverty rate of senior citizens exceeded 50% during the Great Depression. Since then, it has been amended to encompass several social welfare and social insurance programs, such as Medicare and Medicaid. These programs cover workers in situations of retirement, disability, and death.

Employees contribute 6.2% of their pay into the Social Security Trust Fund, and their employer matches this. For 2011 and 2012, this has been reduced to 4.2%. Employees also pay 1.45% of their pay into Medicare, which is also matched by their employer.

If you’re one of the many physicians who are self-employed, you pay 12.4% into Social Security and 2.9% into Medicare. This is also reduced for 2011 and 2012 to 10.4% into Social Security. The Social Security tax is capped on earnings up to $110,000, while the Medicare tax is on all earned income.

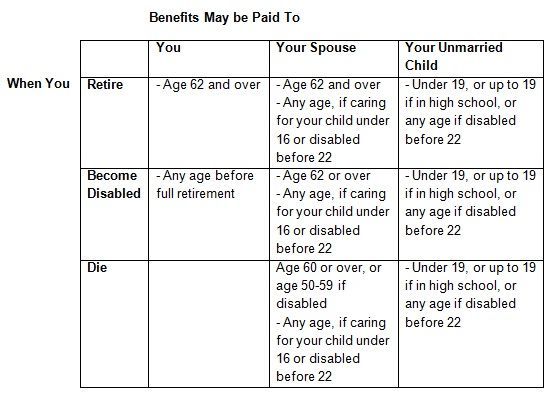

Your earnings history is compiled on a record known as a Social Security earnings record, and is identified by your Social Security number. This earnings record is eventually used to calculate the amount of your Social Security benefit. There are certain eligibility requirements for workers, their spouse, ex-spouse, widow(er), or parent. Each benefit has its own unique requirements.

All monthly benefits are based on your Primary Insurance Amount (PIA), which is the amount you would receive at your full retirement age (FRA). The FRA is 65 for people born before 1938, gradually increasing to 67 for those born in 1960 or later. You can take a reduced benefit as early as age 62.

When is the best time to take Social Security benefits? It depends on your personal situation including your income needs, health, family longevity, whether you’re working or not, and other sources of retirement income. As a doctor, you’re uniquely attuned to both the importance, and cost, of medical care — something that many fail to account for as they age.

If you begin benefits before your FRA, in 2012, you can earn $14,640 per year in wages without having your benefits reduced. If your earnings exceed this amount, then $1 of benefits is withheld for every $2 earned above $14,640. Once you obtain FRA, the Senior Citizen’s Freedom to Work Act of 2000, allows retirees to earn as much as they can, without any reduction in benefits. However, the retirement earnings test will still apply to spouses under their FRA.

If you are eligible for retirement benefits, you can choose not to receive them and earn delayed retirement credits (DRC) for any month from your FRA to age 70. DRCs increase the benefit for retirees but not for the spouse. They will, however, increase the benefit for widow(er)s.

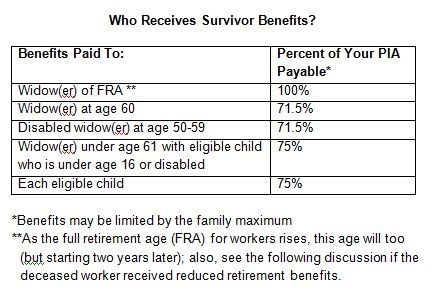

A widow(er) can receive benefits as early as age 60. If there are eligible children, the widow(er) can receive benefits at any age. The survivor’s benefits are based on your PIA on the date of death.

As mentioned earlier, part of your tax withholdings goes towards Medicare. Medicare is a federal health insurance program for people age 65 and over and many disabled people.

Medicare has four parts

(Hospital Insurance) pays some of the costs of hospitalization, limited skilled nursing home care, home health services, and hospice care.

Part A

(Medical Insurance) primarily covers physicians’ services, most outpatient hospital services, and certain related services. Long-term nursing home care is not currently covered.

Part B

(Medicare Advantage Plans) include managed care plans, Private Fee-for-Service plans, and Medical Savings Accounts. These plans were formerly called Medicare+Choice.

Part C

(Outpatient Prescription Drug Plan) is voluntary prescription drug coverage.

Part D

Depending on your unique financial, medical and health professional needs, you can choose to receive these services or not.

As you can see your decision as to when to receive Social Security and Medicare benefits, is a very personal one, and is dependent on many variables. Therefore, a conversation with the Social Security office, and/or your financial advisor is critical before you commit to one option over another.

You can contact Social Security visiting its website or 1 (800) 772-1213. For the deaf or hard of hearing, you can call TTY 1-800-325-0778.

Kevin M. O'Brien, CFP, an Accredited Investment Fiduciary, and founder and president of PEAK Financial Services, Inc., has helped hundreds of individuals and organizations reach their financial goals since 1986. He is a certified financial planner and a Chartered Advisor to Philanthropy.

2 Commerce Drive

Cranbury, NJ 08512

All rights reserved.