- Revenue Cycle Management

- COVID-19

- Reimbursement

- Diabetes Awareness Month

- Risk Management

- Patient Retention

- Staffing

- Medical Economics® 100th Anniversary

- Coding and documentation

- Business of Endocrinology

- Telehealth

- Physicians Financial News

- Cybersecurity

- Cardiovascular Clinical Consult

- Locum Tenens, brought to you by LocumLife®

- Weight Management

- Business of Women's Health

- Practice Efficiency

- Finance and Wealth

- EHRs

- Remote Patient Monitoring

- Sponsored Webinars

- Medical Technology

- Billing and collections

- Acute Pain Management

- Exclusive Content

- Value-based Care

- Business of Pediatrics

- Concierge Medicine 2.0 by Castle Connolly Private Health Partners

- Practice Growth

- Concierge Medicine

- Business of Cardiology

- Implementing the Topcon Ocular Telehealth Platform

- Malpractice

- Influenza

- Sexual Health

- Chronic Conditions

- Technology

- Legal and Policy

- Money

- Opinion

- Vaccines

- Practice Management

- Patient Relations

- Careers

Five Health Care Stocks Worth Looking At

While the stock market continues to fall, here are five health care that may be worth purchasing while they're cheap.

While the stock market continues its wild ride — down again Wednesday by more than 300 points — the majority of losses seem to be coming from bank stocks. Last week there was a sharp fall in health care stocks, but a Reuters article laid to rest some investor’s worries by stating that it was a “premature sell-off” and that the “sector’s underlying fundamentals remain strong.”

All of the sectors are down for the year except for Consumer Staples. Health Care is down by 14.21%, with Health Care Equipment and Services faring slightly worse than Pharmaceuticals, Biotechnology and Life Science stocks. Adventrx Pharmaceuticals Inc.’s stock recently tumbled when regulators rejected the company’s lung-cancer drug. The stock is down 55.51% from where it opened the day at $2.55.

But there may be hope yet. Seeking Alpha listed its five health care stocks that are likely to see a rebound.

recently fell to $34 but climbed up to its current price of $36.89. The stock is pretty cheap right now and might be worth picking up, according to Seeking Alpha.

Aetna Inc. (AET)

BioSante Pharmaceuticals, Inc. (BPAX) recently touched down to its 200-day moving average, but has since climbed up 6.34% and is trading at $2.31. According to Seeking Alpha, “Though the company has been unable to escape net losses over recent quarters, analysts and investors alike appear to remain confident in its future. … BioSante's current price should prove a tempting entry point for confident investors.”

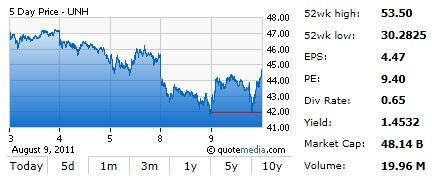

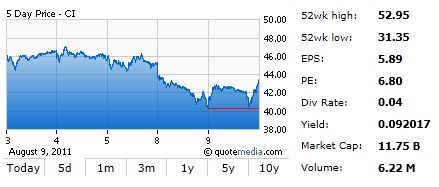

CIGNA Corporation (CI) is down to $43.47 from a 52-week high of $52.95. “Though the stock has lost 13.32% of its value over the past month it still remains above its 200-day SMA and could easily bounce off of this resistance and continue upward,” according to Seeking Alpha.

Humana Inc. (HUM) recently fell from its 52-week high of $84.32 and is now trading at $71.75. According to Seeking Alpha, “The company holds a current analyst recommendation of 9 strong buys, 5 buys and 12 holds with a mean profit target of $88.74, 23.68% above the stock's current price.”

Unitedhealth Group, Inc. (UNH) fell from its 52-week high of $53.50 and is now trading at $44.73. Seeking Alpha liked Unitedhealth because it has continually increased its net profit. It has an analyst profit target that is 33.94% above its current price, which indicates confidence is strong in this stock.