- Revenue Cycle Management

- COVID-19

- Reimbursement

- Diabetes Awareness Month

- Risk Management

- Patient Retention

- Staffing

- Medical Economics® 100th Anniversary

- Coding and documentation

- Business of Endocrinology

- Telehealth

- Physicians Financial News

- Cybersecurity

- Cardiovascular Clinical Consult

- Locum Tenens, brought to you by LocumLife®

- Weight Management

- Business of Women's Health

- Practice Efficiency

- Finance and Wealth

- EHRs

- Remote Patient Monitoring

- Sponsored Webinars

- Medical Technology

- Billing and collections

- Acute Pain Management

- Exclusive Content

- Value-based Care

- Business of Pediatrics

- Concierge Medicine 2.0 by Castle Connolly Private Health Partners

- Practice Growth

- Concierge Medicine

- Business of Cardiology

- Implementing the Topcon Ocular Telehealth Platform

- Malpractice

- Influenza

- Sexual Health

- Chronic Conditions

- Technology

- Legal and Policy

- Money

- Opinion

- Vaccines

- Practice Management

- Patient Relations

- Careers

Five Years Later, Investors Benefited from Financial Crisis

Experiencing significant personal financial losses and hardship during the recession has benefited investors, according to a study from Fidelity Investments.

By examining investor attitudes and behaviors since the 2008 financial crisis, the “Five Years Later” study revealed the crisis actually helped boost investor confidence by spurring positive and permanent behaviors.

“Emerging from the depths of the crisis, many investors found resolve and started taking control of their personal economy,” Kathleen Murphy, president of Personal Investing at Fidelity Investments, said in a statement.

Nearly half (47%) of respondents said their household lost significant assets from the crisis. At the lowest point in the recession, households lost, on average, 34% of their assets. While 17% reported the head of the household lost his or her job, more than a third reported they experienced a large drop in income.

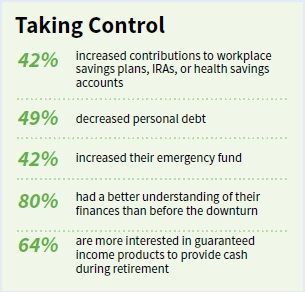

Experiencing this hardship was beneficial, though. More than half of the respondents said they moved past being scared and confusion and significantly changed their financial mindset and behavior for the better.

“Whether it was increasing contribution rates to a 401(k) or IRA, adjusting asset allocation or increasing the frequency of financial discussions with family, the silver lining of this crisis is that it spurred investors to reassess and take action to improve their finances,” Murphy said. “We have seen this firsthand with seminar attendance at our local branches nearly doubling since 2007.”

More than three-quarters of respondents who now feel “prepared and confident” said that their changes in behavior are permanent ones.