- Revenue Cycle Management

- COVID-19

- Reimbursement

- Diabetes Awareness Month

- Risk Management

- Patient Retention

- Staffing

- Medical Economics® 100th Anniversary

- Coding and documentation

- Business of Endocrinology

- Telehealth

- Physicians Financial News

- Cybersecurity

- Cardiovascular Clinical Consult

- Locum Tenens, brought to you by LocumLife®

- Weight Management

- Business of Women's Health

- Practice Efficiency

- Finance and Wealth

- EHRs

- Remote Patient Monitoring

- Sponsored Webinars

- Medical Technology

- Billing and collections

- Acute Pain Management

- Exclusive Content

- Value-based Care

- Business of Pediatrics

- Concierge Medicine 2.0 by Castle Connolly Private Health Partners

- Practice Growth

- Concierge Medicine

- Business of Cardiology

- Implementing the Topcon Ocular Telehealth Platform

- Malpractice

- Influenza

- Sexual Health

- Chronic Conditions

- Technology

- Legal and Policy

- Money

- Opinion

- Vaccines

- Practice Management

- Patient Relations

- Careers

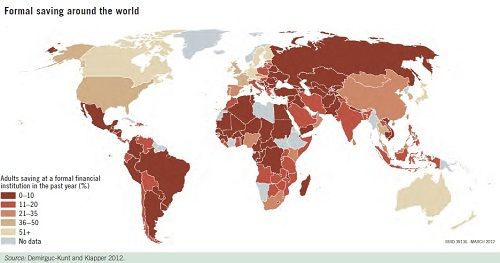

Formal Accounts Unpopular Worldwide

Although formal financial services are used widely for savings in some countries, much of the world avoids formal accounts.

Although formal financial services are used widely for savings in some countries, much of the world is actually using other methods to save or set aside money.

Adults living in high-income countries, East Asia and the Pacific, and sub-Saharan Africa were the most likely to have saved money in the past year, according to a new study. Overall, only slightly more than one-third of adults around the world saved or set aside money.

The study was a joint effort between Gallup and the World Bank. In the past year, more adults in high-income countries (58%) saved money, while adults in Europe and Central Asia saved the least (20%).

Click to enlarge

While adults in high-income countries, East Asia and the Pacific, and South Asia all use formal financial services the most, the rest of the region all have higher use of other methods. Adults in sub-Saharan Africa overwhelmingly set aside their money in other ways. Formal savings — using a bank, credit union or micro-finance institution — are less common (15%), while 36% of adults in these countries reported use other methods to save money.

“In developing econo­mies savings clubs are one common alternative (or complement) to saving at a formal financial institution: in sub-Saharan Africa 19% of adults report hav­ing saved in the past year using a savings club or person outside the family,” according to the report.

In sub-Saharan Africa, mobile money has achieved the most success. In the past year, 16% of adults used a mobile phone to pay bills or send and receive money. In other regions, less than 5% use mobile money.

Only 7% of residents in Europe, Central Asia, the Middle East and North Africa are the least likely to save formally. According to the report, 65% of adults said they don’t have a formal account because they don’t have enough money to use one.

Other reasons why people reported not using formal accounts were religious reasons (5%), lack of trust (13%), lack of necessary documentation (18%), too far away (20%) and too expensive (25%).

Around the world, when adults aren’t using formal accounts to save money, then they are likely using alternative methods such as saving money at home or in commodities such as livestock and gold.

Overall, males with higher incomes and more education are more likely to report saving formally. In developing countries, adults in the richest income quintile are more than three times as likely to save formally as those in the poorest income quintile.