- Revenue Cycle Management

- COVID-19

- Reimbursement

- Diabetes Awareness Month

- Risk Management

- Patient Retention

- Staffing

- Medical Economics® 100th Anniversary

- Coding and documentation

- Business of Endocrinology

- Telehealth

- Physicians Financial News

- Cybersecurity

- Cardiovascular Clinical Consult

- Locum Tenens, brought to you by LocumLife®

- Weight Management

- Business of Women's Health

- Practice Efficiency

- Finance and Wealth

- EHRs

- Remote Patient Monitoring

- Sponsored Webinars

- Medical Technology

- Billing and collections

- Acute Pain Management

- Exclusive Content

- Value-based Care

- Business of Pediatrics

- Concierge Medicine 2.0 by Castle Connolly Private Health Partners

- Practice Growth

- Concierge Medicine

- Business of Cardiology

- Implementing the Topcon Ocular Telehealth Platform

- Malpractice

- Influenza

- Sexual Health

- Chronic Conditions

- Technology

- Legal and Policy

- Money

- Opinion

- Vaccines

- Practice Management

- Patient Relations

- Careers

Four Technology Stocks Too Hot to Handle

With social-networking shares on fire after the sizzling Yandex and LinkedIn IPOs, investors may be eager to chase the next "winner." These four tech companies may be generating a lot of buzz, but their stocks are too hot to handle.

Why all the shock on Wall Street and in the media about LinkedIn Corp.'s initial public offering doubling on its first day?

Jim Cramer announced on CNBC that it was "outrageously overvalued" and "preposterous." Other pundits are saying that this is a sign of the "bubble." They're acting as if LinkedIn is the first technology company to be overvalued.

Valuations Are Already Crazy

But many of the technology names, especially in the trendy social media and cloud areas, have been too hot to handle for months now. Some technology stocks are trading with forward price-to-earnings (P/E) ratios of more than 50, and one well known name is trading at 181 times forward estimates.

Why isn't anyone showing outrage about these stocks?

While it's easy for investors to chase the latest "in" stock (especially in the tech sector), and to pay higher valuations for growth, when no one bats an eyelash over P/E ratios of more than 100, it's time to be cautious. For example, these four technology stocks are too hot to handle.

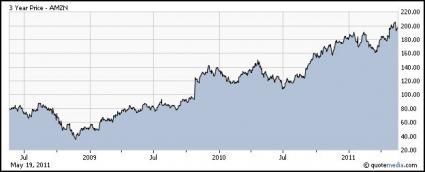

1. Amazon.com Inc. (NASDAQ: AMZN)

Okay, so maybe Amazon.com isn't a "tech" company, per se, since it's essentially a retailer. But with an estimated 8 million Kindles e-readers sold, according to some analysts, and a big footprint in cloud computing, the Seattle-based company is more of a hybrid retail and "hot" technology stock.

But getting into Amazon.com now won't be cheap:

Forward P/E: 82

Price-to-book: 12

Price-to-sales: 2.4

It's also ranked by Zacks Investment Research as a “sell.” The 2011 Zacks earnings consensus has fallen to $2.47 a share from $3.17 a share in the last 30 days. Earnings are expected to fall 2% from the $2.53 a share the company earned in 2010.

Check out the smoking hot three-year chart. Shares are still trading near the three-year high, even though estimates are falling.

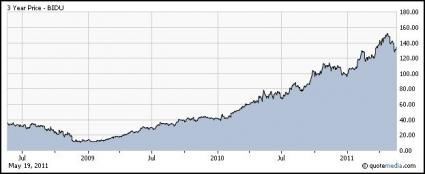

2. Baidu Inc. (NASDAQ: BIDU)

Baidu is formerly known as Baidu.com, or the "Google of China." Baidu is the least expensive out of these four companies by P/E, but that's not saying much as it still has incredibly high valuations.

Forward P/E: 54

Price-to-book: 23

Price-to-sales: 25

At least the Beijing company has earnings growth: It’s is expected to grow earnings by 75% in 2011 to $2.64 a share. Zacks Investment Research ranks Baidu a “hold.” Its American depositary share (ADS) price has come down in the last few weeks, but given the massive three-year run that hasn't made it much cheaper.

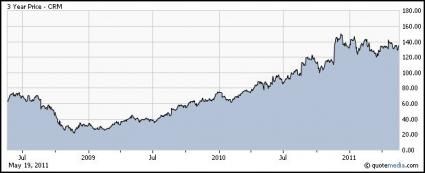

3. Salesforce.com Inc. (NYSE: CRM)

This cloud-computing company just reported first-quarter results. Currently, it's trading at 181 times forward fiscal 2012 estimates. It looks like the San Francisco company’s guidance is higher than analysts’ estimates, but even using those numbers would mean shares are trading at 100 times forward P/E.

Sizzle!

Forward P/E: 181x (current Zacks Consensus Estimate, but it just reported earnings)

Price-to-book: 13.8

Price-to-sales: 10.7

Earnings are moving upward on Salesforce.com, as well. It is expected to post year-over-year earnings growth in fiscal 2012. Zacks Investment Research ranks Salesforce.com a “hold.” Shares have been treading water recently, but are up on the earnings numbers.

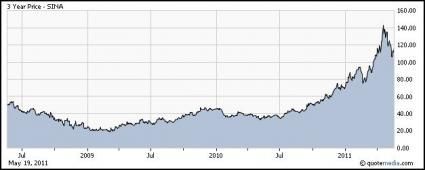

4. Sina Corp. (NASDAQ: SINA)

Sina is a Shanghai-based online media company which also operates Sina Weibo, better known as the "Twitter of China." The thinking goes, since you can't invest in Twitter (yet), why not get the Chinese version instead? Sina Weibo had 100 million users by the end of 2010.

Forward P/E: 80.2

Price-to-book: 5.1

Price-to-sales: 16.3

Full-year 2011 estimates have been dropping. The company is expected to earn $1.04 per share in 2011, but made $1.52 a share last year, which is an earnings decline of 31%. Sina is rated a “Strong sell” by Zacks Investment Research.

Check out the three-year chart. It's been nearly straight up until recently. But with social networking stocks hot again with the LinkedIn IPO, its shares are on the move again.

Valuations Do Matter

While some of these companies are showing earnings growth, estimates are falling on the others. That's a bad sign. Yet, P/Es and other valuations are sky-high, while share prices have soared.

Something's got to give. Don't get caught playing the trend. Sina is ranked “strong sell” and Amazon.com is ranked “sell” for a reason.

For the long haul, valuations do matter. Yes, even on LinkedIn.

Tracey Ryniec is the Value Stock Strategist at Zacks Investment Research. She is also the editor in charge of the Turnaround Trader and Insider Trader services. You can follow her at twitter.com/traceyryniec. You can also access Zack's data free for 30 days by trying Zacks Premium.

To analyze, choose and track winning stocks in any market for 30 days free, click here.