- Revenue Cycle Management

- COVID-19

- Reimbursement

- Diabetes Awareness Month

- Risk Management

- Patient Retention

- Staffing

- Medical Economics® 100th Anniversary

- Coding and documentation

- Business of Endocrinology

- Telehealth

- Physicians Financial News

- Cybersecurity

- Cardiovascular Clinical Consult

- Locum Tenens, brought to you by LocumLife®

- Weight Management

- Business of Women's Health

- Practice Efficiency

- Finance and Wealth

- EHRs

- Remote Patient Monitoring

- Sponsored Webinars

- Medical Technology

- Billing and collections

- Acute Pain Management

- Exclusive Content

- Value-based Care

- Business of Pediatrics

- Concierge Medicine 2.0 by Castle Connolly Private Health Partners

- Practice Growth

- Concierge Medicine

- Business of Cardiology

- Implementing the Topcon Ocular Telehealth Platform

- Malpractice

- Influenza

- Sexual Health

- Chronic Conditions

- Technology

- Legal and Policy

- Money

- Opinion

- Vaccines

- Practice Management

- Patient Relations

- Careers

Good News for 401(k) Participants

New research shows people whose retirement savings are in 401(k) plans should be earning more than they did a few years ago.

401(k) Plans now hold $4.7 trillion in assets, up from $3.0 trillion in 2007. This is the money 401(k) participants rely on for income in retirement. Whether there is more or less depends in large part on the expenses of the 401(k) plan. The higher the expenses, the less there is for retirees. The lower the expenses, the more.

Now, there is good news for 401(k) participants. According to Bright Scope, a company that lends transparency to opaque markets, 401(k) costs are going down. This means more money for the very group the 401(k) is meant to benefit—its contributors (also known as participants).

The detailed 74-page Bright Scope report published in December reveals that the average total plan expense dropped from 1.02% of assets in 2009 to 0.89% in 2013. The analysis was based on data filed with the Department of Labor. The definition of total plan cost was advice and management fees plus administrative costs. It is important to note that 401(k) plans with fewer than 100 participants normally are not required to file audited reports like larger plans. Therefore, the Bright Scope analysis includes few small plans.

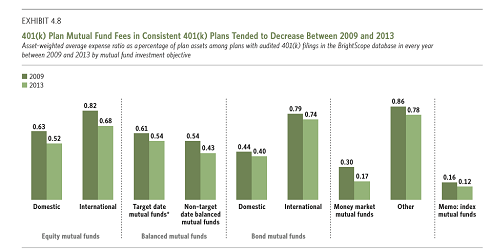

Chart illustrating the lowering of mutual fund fees between 2009 to 2013. From the Bright Scope report.

The trend toward fewer expenses from 2009 to 2013 is believed to be due to the recent availability of so many low cost options such as index funds (see chart above). In 2006, 79% of plans in the data population studied by Bright Scope offered index funds. In 2013, the proportion was 90%.

What is important here is that after years of pressure on the investment industry by private citizens and the government for transparency and lowering of fees, there finally is a shift in that direction. This is very good news for those in 401(k) plans.

For more:

President Obama Joins the 401K Fight