- Revenue Cycle Management

- COVID-19

- Reimbursement

- Diabetes Awareness Month

- Risk Management

- Patient Retention

- Staffing

- Medical Economics® 100th Anniversary

- Coding and documentation

- Business of Endocrinology

- Telehealth

- Physicians Financial News

- Cybersecurity

- Cardiovascular Clinical Consult

- Locum Tenens, brought to you by LocumLife®

- Weight Management

- Business of Women's Health

- Practice Efficiency

- Finance and Wealth

- EHRs

- Remote Patient Monitoring

- Sponsored Webinars

- Medical Technology

- Billing and collections

- Acute Pain Management

- Exclusive Content

- Value-based Care

- Business of Pediatrics

- Concierge Medicine 2.0 by Castle Connolly Private Health Partners

- Practice Growth

- Concierge Medicine

- Business of Cardiology

- Implementing the Topcon Ocular Telehealth Platform

- Malpractice

- Influenza

- Sexual Health

- Chronic Conditions

- Technology

- Legal and Policy

- Money

- Opinion

- Vaccines

- Practice Management

- Patient Relations

- Careers

Grandparents Give Financial Assistance Until it Hurts

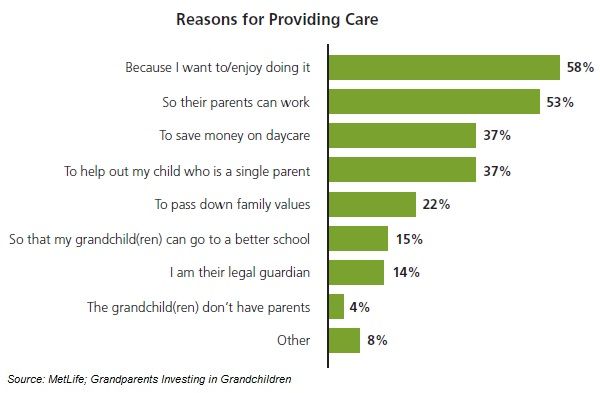

Increasingly grandparents in the U.S. are finding themselves taking on the role of financial safety net for their children and grandchildren, even if it is to their own detriment.

Retirement and old age don’t mean your finances can take it easy. Yet, increasingly grandparents in the U.S. are finding themselves taking on the role of financial safety net for their children and grandchildren, according to a new survey.

MetLife Mature Market Institute’s “Study on How Grandparents Share Their Time Values and Money,” revealed that 62% of grandparents have provided financial support or monetary gifts for grandchildren in the last five years. And these aren’t small gifts either: half gave up to $5,000. The average amount given for all grandchildren over the last five years was $8,289.

“Grandparents give abundantly, sometimes to the detriment of their own current and future financial security,” according to the report. “Many are most likely not fully aware of the extent to which they are sacrificing their own financial security in retirement and may need support later in life.”

A little less than half (43%) reported they are providing more financial support because of the economic downturn and a third (34%) said they are doing so even though they believe it is having a negative effect on their own financial security.

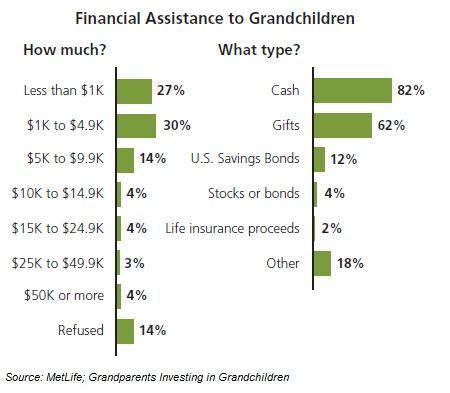

For the most part, grandparents provide cash (82%) or gifts (62%), while only 18% give financial products. And while 62% of grandparents have provided financial assistance, 8% report having offered assistance that was refused.

The main reason (43% of grandparents) for providing financial assistance for was clothing (average of $990), followed by 33% offering for general support (average of $3,987) and 29% offering for education (average of $8,276).

Of the financial advice offered to grandchildren, 87% of grandparents say to start saving and invest early in life; while 75% say not to get into too much debt; 49% say to have basic financial security (i.e. health insurance); and 47% say not to put all your financial eggs in one basket.

All of this generosity could come back to haunt both the grandparents and family who benefit from their giving, according to the report.

“If grandparents jeopardize their own financial security in retirement by giving too much to their families, they may someday be financially dependent upon these loved ones, which isn’t such a gift in the long run.”