- Revenue Cycle Management

- COVID-19

- Reimbursement

- Diabetes Awareness Month

- Risk Management

- Patient Retention

- Staffing

- Medical Economics® 100th Anniversary

- Coding and documentation

- Business of Endocrinology

- Telehealth

- Physicians Financial News

- Cybersecurity

- Cardiovascular Clinical Consult

- Locum Tenens, brought to you by LocumLife®

- Weight Management

- Business of Women's Health

- Practice Efficiency

- Finance and Wealth

- EHRs

- Remote Patient Monitoring

- Sponsored Webinars

- Medical Technology

- Billing and collections

- Acute Pain Management

- Exclusive Content

- Value-based Care

- Business of Pediatrics

- Concierge Medicine 2.0 by Castle Connolly Private Health Partners

- Practice Growth

- Concierge Medicine

- Business of Cardiology

- Implementing the Topcon Ocular Telehealth Platform

- Malpractice

- Influenza

- Sexual Health

- Chronic Conditions

- Technology

- Legal and Policy

- Money

- Opinion

- Vaccines

- Practice Management

- Patient Relations

- Careers

I made a bad $10,000 investment. Intentionally.

There are times when it makes sense to make an investment that may not have favorable terms. This was one of those times.

Our post-recital ice cream social was in full swing. The kids were running rampant, the leftover ice cream was slowly melting in the tubs, and the adults were enjoying some adult beverages and some non-violin music. If there's one thing I've learned from children's music recitals, it's that the violin must be a really difficult instrument to learn to play well. Fortunately, our boys play piano.

I was chatting with another proud father, learning a little more about his line of work. He works for the local small business development corporation, funded by the federal Small Business Administration (SBA). He helps entrepreneurs start and grow small businesses. Pretty cool if you ask me.

The Investment Opportunity

Knowing that I am an avid homebrewer with a small stake in a craft brewery, he mentioned that he was working with a young man with microbrewery aspirations of his own. He had a location just off the freeway between a large city and a popular recreation area, a bargain-priced building lined up, and a solid business plan. With an SBA loan, and another $20,000, he could get this business going and the beer flowing.

Golden goodness

After talking it over with my wife, I agreed to meet up with my friend and the young man with a plan. I was impressed with his enthusiasm and strategy, and I figured his chances of success were pretty good. On the other hand, the craft brewing market is getting saturated. But he's not looking to be the next Sierra Nevada; he wants to serve the local and surrounding communities, and the weekend commuters who might stop off for a growler fill on their way up north. Without any nearby competition, I think he's in a good spot.

Unfortunately, the terms of the investment were not what I would consider favorable for the investor. Rather than partial ownership or shares in the brewery, he was looking for a loan to bridge the gap between a bank loan and his own funds. The loan would be paid back incrementally after a 2-year grace period if and when the operation is deemed by the owner to be profitable.

After the principal is eventually returned, a 20% bonus payment would be paid. If all goes well, I would end up seeing a return of 3-5%, depending on the time frame of repayment. A guaranteed return at that rate would be reasonable, but this is far from a sure thing.

The loan is similar in many ways to the crowdfunded real estate deals I've been reading about, but the returns on those invesments are at least double, and the risk is probably lower. I walked away from my meeting with the would-be brewer thinking it was a no-go for me.

Looking at the Investment in a Different Light

Later that evening, my SBA friend came by to enjoy an impromptu campfire we hosted, complete with marshmallows, homebrewed kombucha, and pale ale. We talked some more about the investment "opportunity" and he understood my position that it was, at face value, not the greatest proposition. Then he told me something very interesting.

"We don't tithe," he said, "But I've made investments like this as a way of givingback." Some of them have worked out for him, and some of them haven't. He sees making a risky investment to help someone realize a dream as a way to use money to do some good. The concept doesn't hold water if the startup company doesn't somehow plan to make our world a better place.

Does a microbrewery / taproom make our world a better place? That's certainly debatable, but compared to other drinking establishments, tap rooms tend to be more family-friendly places where people gather and socialize over a beer or two. This particular brewery will also be part of an attempt to revitalize a neglected old downtown.

Beers with friends

I don't think a brewery would qualify for any of Mr. Firestation's charitableone more year fund, and I wouldn't allow a brewery loan to replace any of my owncharitable giving, but I understand what my SBA friend was saying. My "No" answer was now a "Maybe." I guess he's pretty good at his job.

I decided that $20,000 was too rich for my blood, but I could maybe part with $10,000 if the investment could produce something more tangible than a subpar return for my money. Other investors had a more intimate interest; they were family members and community members, but I live 90 miles away and barely know the guy.

When Life Hands You an Investment Lemon...

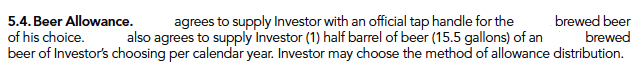

A lightbulb popped into place, hovering right above my head. What about beer dividends? My ownership stake in the other brewery entitles to me to a couple free beers in the tap room. Unfortunately, I now live over 500 miles away, so free beer doesn't happen as often as I'd like. I completed my brainstorm, which has now been incorporated into our mutually agreed upon investor agreement as "Section 5.4 Beer Allowance."

When life hands you lemons, make lemonade. Or make beer. My once not-so-great investment now includes a keg of beer for life, or at least the life of the brewery. I'll even have my very own tap handle to install on mykeezer, and I'll probably take my 15.5 gallons annually in three 5-gallon Cornelius kegs, which is how I serve my homebrew, and a half-gallon growler if I want to squeeze out every last drop I've got coming to me.

Thinking outside the box scored me a fun perk that would not have been offered or considered otherwise. The perk also gives me a reason to go a little out of my way to visit the brewery to see how my dollars are being spent. I'll be more involved on a personal level than I would be if I invested in a multi-unit housing in Coral Gables, Florida, even if the latter offers a better return.

Last year, I did something similar when I bartered our sectional sofa to a restaurateur in exchange for a $500 gift certificate to his restaurant. I couldn't have asked for nearly as much in cash, but he liked the idea of the trade at that price. My family and I enjoyed a quality dinner at his joint the other night, and the bartered sofa will continue to provide good meals and more for months or perhaps years to come. Did I mention that his restaurant has 16 craft beers on draft?

In a show of serendipity, the S&P 500 dropped 1.6% in the four trading days after my check to the fledgling brewery was cashed, putting me $160 ahead of where I would have been if I had bought some VFIAX instead.

Cheers!