- Revenue Cycle Management

- COVID-19

- Reimbursement

- Diabetes Awareness Month

- Risk Management

- Patient Retention

- Staffing

- Medical Economics® 100th Anniversary

- Coding and documentation

- Business of Endocrinology

- Telehealth

- Physicians Financial News

- Cybersecurity

- Cardiovascular Clinical Consult

- Locum Tenens, brought to you by LocumLife®

- Weight Management

- Business of Women's Health

- Practice Efficiency

- Finance and Wealth

- EHRs

- Remote Patient Monitoring

- Sponsored Webinars

- Medical Technology

- Billing and collections

- Acute Pain Management

- Exclusive Content

- Value-based Care

- Business of Pediatrics

- Concierge Medicine 2.0 by Castle Connolly Private Health Partners

- Practice Growth

- Concierge Medicine

- Business of Cardiology

- Implementing the Topcon Ocular Telehealth Platform

- Malpractice

- Influenza

- Sexual Health

- Chronic Conditions

- Technology

- Legal and Policy

- Money

- Opinion

- Vaccines

- Practice Management

- Patient Relations

- Careers

Lazy Self-Investing Choices that Worked

It is so refreshing to find investing options that are not only easy and successful but that an individual investor can execute himself.

It is so refreshing to find investing options that are not only easy and successful but that an individual investor can execute himself. That is the case for the results of the last 10 years with the “Lazy Portfolios” that Paul Farrell summarizes periodically on Market Watch. All eight portfolios performed dramatically better than the S&P over the decade as of October 3, 2011. Their annualized returns ranged from 6.78% for the Aronson Family Taxable to 4.67% for the Second Grader’s Starter. Compare this to the S&P’s comparable gain of 2.81%.

This news is powerful. It means simple self investing can be effective. This could potentially, and should, be the catalyst for investors who pay for money management to have some serious conversations with themselves about whether or not to take charge of their own investable money.

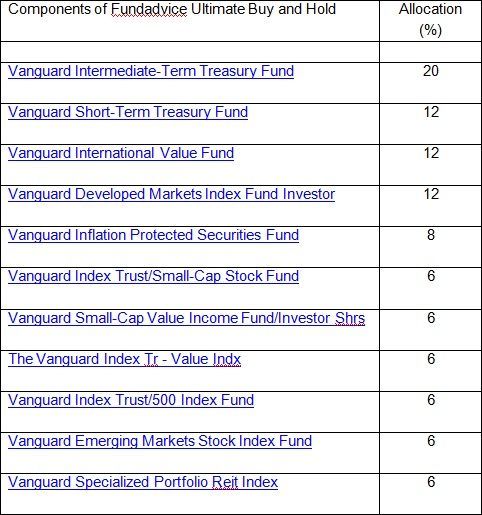

One of the funds, shown below, is especially appealing in my mind. This is because it is a buy and hold strategy so little has to be done with it year to year. It is the Fundadvice Ultimate Buy and Hold and is indexed for easy use as shown below. The yield from it for the last 10 years was 6.23%, the second highest among the eight lazy portfolios.

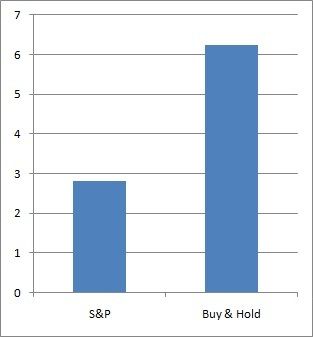

This return of this fund compared to the S&P is demonstrated visually below. It is almost too good to be true. It is important to be aware, however, that, if the comparison between the two were longer or shorter than 10 years the results would be different and there is no guarantee that they would be weighted toward the direction of the Fundadvice Ultimate Buy and Hold portfolio. On the other hand, this kind of logic is a consideration with every investment, so it is certainly not a reason to not seriously consider the fund.

In the last 10 years as of October 3, 2011, the Fundadvice Ultimate Buy and Hold portfolio has gained 6.23% where the S&P has increased 2.81%.

In an earlier article I talked about several tactics that self investors could take in managing their own portfolios. This included a totally independent approach or one guided by others. The lazy portfolio could be executed either way.

For those looking for help, I do offer custom guidance for an hourly fee. This limits the money a client needs to spend both up front and on a continuing basis. Since the lazy portfolio profiled is buy and hold, there is little maintenance needed once it is set up. This means minimum further cost. The lazy portfolios are yet another tool for investors who are motivated toward self investing.