- Revenue Cycle Management

- COVID-19

- Reimbursement

- Diabetes Awareness Month

- Risk Management

- Patient Retention

- Staffing

- Medical Economics® 100th Anniversary

- Coding and documentation

- Business of Endocrinology

- Telehealth

- Physicians Financial News

- Cybersecurity

- Cardiovascular Clinical Consult

- Locum Tenens, brought to you by LocumLife®

- Weight Management

- Business of Women's Health

- Practice Efficiency

- Finance and Wealth

- EHRs

- Remote Patient Monitoring

- Sponsored Webinars

- Medical Technology

- Billing and collections

- Acute Pain Management

- Exclusive Content

- Value-based Care

- Business of Pediatrics

- Concierge Medicine 2.0 by Castle Connolly Private Health Partners

- Practice Growth

- Concierge Medicine

- Business of Cardiology

- Implementing the Topcon Ocular Telehealth Platform

- Malpractice

- Influenza

- Sexual Health

- Chronic Conditions

- Technology

- Legal and Policy

- Money

- Opinion

- Vaccines

- Practice Management

- Patient Relations

- Careers

Most Hated Stocks

Investors often look to stock analysts to gauge the potential of a company's stock. And analysts really don't like these 10 stocks.

Investors often look to stock analysts to gauge the potential of a company's stock and try to determine whether it is a buy or a sell opportunity.

Recently, Bloomberg ranked the top 10 most hated stocks, based on 2 factors: the Bloomberg consensus rating, which converts analysts’ recommendations into a number from one (strong sell) to 5 (strong buy) and averages them; and the 3-month change in the consensus rating.

Bloomberg included only US stocks with market capitalizations greater than $5 billion. The stock had to be coverage by at least 15 analysts, and at least 10% of them had to have given the stock a “sell” rating.

Based on their ratings, analysts do not like these 10 stocks:

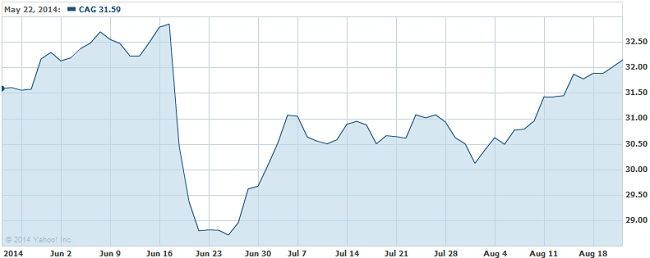

10. ConAgra Foods

Stock symbol: CAG

Hate scale: 82.2

Consensus: 3.24 (out of 5)

Sell ratings: 12%

ConAgra’s stock took a huge hit in the middle of June, when its share price fell 11% in just 3 days. Since then, however, the stock has been making a comeback and has made up almost all of its lost ground. Overall, in the last 3 months ConAgra has delivered a 2% return.

9. Southern

Stock symbol: SO

Hate scale: 83.8

Consensus: 2.56 (out of 5)

Sell ratings: 32%

Southern has the largest percentage of analysts with “sell” ratings out of any of the companies in the top 10, even the stock that landed on the top of the list. Over the last 3 months, Southern’s total return was almost flat at just 1%.

8. Mattel

Stock symbol: MAT

Hate scale: 84.2

Consensus: 3.12 (out of 5)

Sell ratings: 12%

Along with ConAgra, Mattel has one the lowest percentage of analysts with a “sell” rating for the company’s stock. And that is despite the fact that Mattel delivered total returns of -8% in the last 3 months — the second worst on the list.

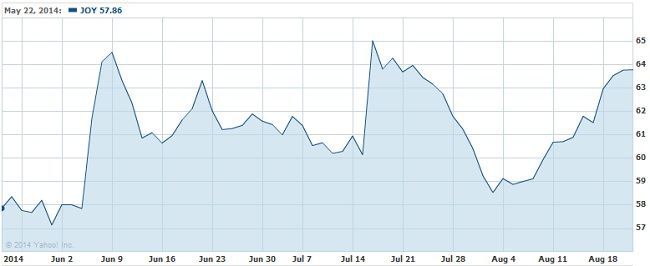

7. Joy Global

Stock symbol: JOY

Hate scale: 86.3

Consensus: 3.08 (out of 5)

Sell ratings: 21%

Joy Global has the second-highest stock price on the list at $63.24 (as of closing bell on Aug. 22). Plus, over the last 3 months the stock did deliver a respectable 6% total return. Admittedly, the stock has been volatile over that time period.

6. Kellogg

Stock symbol: K

Hate scale: 86.7

Consensus: 3 (out of 5)

Sell ratings: 23%

Analysts may not like Kellogg’s stock — possibly because it delivered a total return of -4% in the last 3 months — but its share price is the most expensive in the top 10 at $64.30 (as of closing bell on Aug. 22).

5. Western Union

Stock symbol: WU

Hate scale: 88.3

Consensus: 3 (out of 5)

Sell ratings: 24%

Western may have one of the highest percentages of analysts with “sell” ratings, but the stock provided the best return of the top 10 most hated stocks in the last 3 months with 11%. But, the company’s profit fell 2% in the second quarter.

4. Dr. Pepper Snapple

Stock symbol: DPS

Hate scale: 90.7

Consensus: 2.91 (out of 5)

Sell ratings: 18%

Dr. Pepper Snapple Group has one of the priciest stocks on this list, behind only Kellogg and Joy Global. And, its share price has been on the rise, with a short-lived spike occurring when UBS increased its price target from $61 to $64.

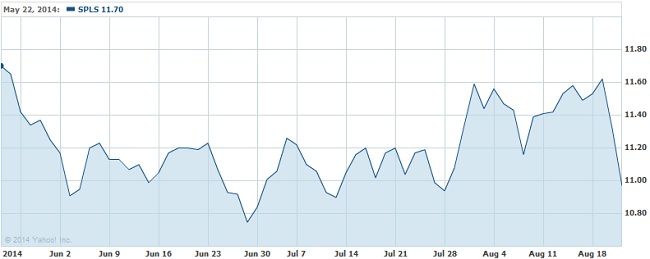

3. Staples

Stock symbol: SPLS

Hate scale: 91.1

Consensus: 2.86 (out of 5)

Sell ratings: 23%

Analysts’ hatred of Staples’ stock isn’t unfounded. In the last 3 months, the company delivered a total return of -12% — that will leave a sour taste in one’s mouth. Considering the next 2 stocks have provided far better returns, perhaps analysts should be more negative on Staples, or, at least, less harsh on the following 2 companies.

2. Campbell Soup

Stock symbol: CPB

Hate scale: 94

Consensus: 2.7 (out of 5)

Sell ratings: 25%

Over the last 3 months, Campbell’s stock delivered a -2% total return. The stock price fell 11% over the course of one-and-a-half months. Recently, it began to climb again on rumors of a deal and speculation that Campbell is the next big takeover candidate.

1. TW Telecom

Stock symbol: TWTC

Hate scale: 96.8

Consensus: 2.75 (out of 5)

Sell ratings: 25%

Despite delivering a 3-month total return of 20%, the company’s 3-month consensus rating has gone down by 0.36, which is the second-largest drop. Over the course of 4 days alone the stock climbed 28%, before losing some of those gains.