- Revenue Cycle Management

- COVID-19

- Reimbursement

- Diabetes Awareness Month

- Risk Management

- Patient Retention

- Staffing

- Medical Economics® 100th Anniversary

- Coding and documentation

- Business of Endocrinology

- Telehealth

- Physicians Financial News

- Cybersecurity

- Cardiovascular Clinical Consult

- Locum Tenens, brought to you by LocumLife®

- Weight Management

- Business of Women's Health

- Practice Efficiency

- Finance and Wealth

- EHRs

- Remote Patient Monitoring

- Sponsored Webinars

- Medical Technology

- Billing and collections

- Acute Pain Management

- Exclusive Content

- Value-based Care

- Business of Pediatrics

- Concierge Medicine 2.0 by Castle Connolly Private Health Partners

- Practice Growth

- Concierge Medicine

- Business of Cardiology

- Implementing the Topcon Ocular Telehealth Platform

- Malpractice

- Influenza

- Sexual Health

- Chronic Conditions

- Technology

- Legal and Policy

- Money

- Opinion

- Vaccines

- Practice Management

- Patient Relations

- Careers

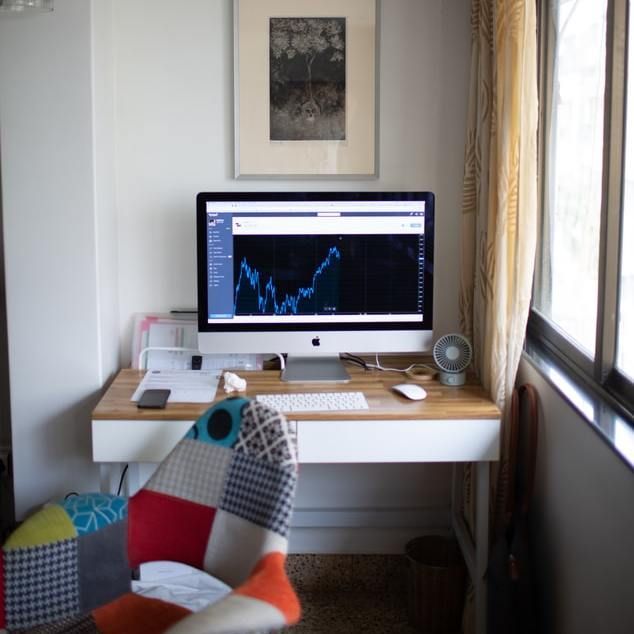

Pruning Big Stock Gains to Preserve Them

By pruning gains incrementally over time and moving the cash into lower-risk assets, you can preserve gains and thus grow your account values in preparation for retirement.

Anyone who owns stocks has seen their account values rise and fall widely from market volatility, wide fluctuations in company performance, or both.

Thus, the gains in their investment accounts that investors gaze at with great affection can prove evanescent. Vanishing gains can wreak havoc with your retirement planning because, when you need to make withdrawals to pay expenses during retirement, this can mean far less cash in hand than you’d expected.

Many investors are reluctant to sell shares and take gains periodically because they expect or just hope that shares will continue to rise. Many long-term investors who take a set-it-and-forget-it approach may be slow to notice over-concentrations in some stocks or funds over time, especially if they’ve chosen to have dividends reinvested automatically.

As a result, they may develop severe over-concentrations in stocks or sectors that can render overall portfolios unbalanced. This can mean taking much more equity risk than originally intended, and a lopsided equity allocation relative to bonds.

Instead of 60/40 stocks-to-bonds allocation, they could be 70/30 or 80/20 before they realize it. Then they’re at greater risk from dips in equity values during a decline or, more pronounced, at the onset of a bear market.

The best way to deal with stock concentrations is to prune gains like fruit from an orchard by selling shares and then investing the cash in a lower-risk asset class, such as bonds. This increases the likelihood of growing your portfolio’s value over time because these gains are now exposed to less risk. Your investment principal could be viewed as the tree or bush, and gains as the fruit to be preserved.

The decision of when to sell should be governed by the growth of your position in a stock—the current value versus the value of the shares on the day you purchased them.

When should you trim? This depends on your intended allocation to stocks as an asset class and to specific sectors and industries. But a good rule of thumb for many investors is to limit a given stock position to 5 percent of your equity portfolio.

If you’re reluctant to sell winners, look at it this way: A well-performing stock can over time deliver these gains again. If it doesn’t—if it loses value—then at least you took the gains when you could.

Pruning gains enables you to:

- Stay within your asset allocation. Reducing concentrations in individual stocks or sectors and reinvesting gains is a key element of rebalancing, so it’s essential to maintaining your allocation’s original risk-management goals to avoid being overweight in a given industry or sector. Holding too much asset value in any one stock or sector poses more risk.

- Increase your long-term accumulation of lower-risk assets, relative to your stock holdings, in accordance with a sound asset allocation plan that should call for decreasing equity holdings as you near retirement.

- Avoid a trap that many retirees fall into: Running short of resources to pay retirement expenses, too many investors are forced to sell once-appreciated shares low after they’re brought down by market volatility, a bear market, or company underperformance

Trimming or altogether eliminating appreciated stock positions can take on urgency when recognizing, from the direction a company is taking, that a company’s shares will soon be headed down. In this scenario, you might be looking not at risk but imminent reality.

Mark Fiedler, CFA, managing partner of Autus Asset Management in Scottsdale, Ariz., puts the decision to trim gains—and even your principal investment—in newly wobbly stocks this way: “To improve or sustain the health of portfolio, it’s oftentimes necessary to sell holdings that have lost their competitive advantage, have deteriorating fundamentals or have made strategic missteps. Any or all of these factors can reduce potential future cash flow and reduce the present value of an investment.”

Of course, the goal is to spot these weaknesses and sell early, rather than after steep declines. This is one advantage of having a qualified advisor managing your investments.

While many investors conscientiously harvest losses at the end of the year to reduce capital gains tax, it may not occur to them to also harvest gains because they don’t want to pay the tax.

Yet assuring that you can pay Uncle Sam is simply a matter of putting some of the gains aside. This is easily done by linking your brokerage account with an online savings account and making transfers. In tax-deferred accounts—such as IRAs—selling doesn’t incur tax for that year if you don’t remove cash from the account.

By pruning gains incrementally over time and moving the cash into lower-risk assets, you can preserve gains and thus grow your account values in preparation for retirement.

David Robinson, a Certified Financial Planner, is founder/CEO of RTS Private Wealth Management, an SEC-registered firm in Phoenix that provides fiduciary services to help clients achieve their financial goals. His practice focuses on helping wealthy individuals with custom financial plans, using a holistic approach to grow/protect wealth, manage taxes, identify insurance solutions, prepare for retirement and manage estate plans.