- Revenue Cycle Management

- COVID-19

- Reimbursement

- Diabetes Awareness Month

- Risk Management

- Patient Retention

- Staffing

- Medical Economics® 100th Anniversary

- Coding and documentation

- Business of Endocrinology

- Telehealth

- Physicians Financial News

- Cybersecurity

- Cardiovascular Clinical Consult

- Locum Tenens, brought to you by LocumLife®

- Weight Management

- Business of Women's Health

- Practice Efficiency

- Finance and Wealth

- EHRs

- Remote Patient Monitoring

- Sponsored Webinars

- Medical Technology

- Billing and collections

- Acute Pain Management

- Exclusive Content

- Value-based Care

- Business of Pediatrics

- Concierge Medicine 2.0 by Castle Connolly Private Health Partners

- Practice Growth

- Concierge Medicine

- Business of Cardiology

- Implementing the Topcon Ocular Telehealth Platform

- Malpractice

- Influenza

- Sexual Health

- Chronic Conditions

- Technology

- Legal and Policy

- Money

- Opinion

- Vaccines

- Practice Management

- Patient Relations

- Careers

Put Your Retirement Plan on Steroids: What to do When a 401(k) Just Isn't Enough

Whether you work in a solo or group practice, you can turbo charge your retirement with a cash balance plan on top of your existing 401(k) plan.

Would an extra $2.5 million come in handy at retirement? Would you like to defer taxes on over $200,000 of current income each year?

Whether you work in a solo practice or in a physician group practice, you can turbo charge your retirement with a cash balance plan on top of your existing 401(k) plan.

A shaky start

Cash balance plans got a bad rap in 1999 when IBM terminated its traditional plan in favor of a cash balance plan that severely reduced benefits for a number of its long-term employees. The employee lawsuit went all the way to the Supreme Court, created an HR debacle and, in the process, generated lots of bad press. If that wasn’t bad enough, cash balance plans were in regulatory uncharted ground.

That’s not the case anymore. The regulatory issues have been resolved by the Pension Protection Act of 2006, and a typical cash balance/401(k) combo plan is a win-win for everybody.

Is this you?

You are at the top of your profession, in your peak earning years but are looking forward to eventually winding down and enjoying a more relaxed retirement lifestyle.

Your kids are through school, yours and their student loans are finally paid off, most of the big expenses are behind you, and you now have the ability to save more.

Unfortunately, when you look at your retirement accounts, you get an uneasy feeling that they may not support your lifestyle. Worse yet, at this rate, you are not likely to get there. Uncle Sam and his companion from your state government are deep in your pocket every year, and even though you have maxed out your 401(k) contribution, it’s just not enough.

Many Americans have hit a few bumps in the road. The financial meltdown of 2008 and 2009, a divorce, a few kids in grad school, a bad real estate deal, student loans, or just getting a late start on saving may put even high-income professionals behind in their retirement savings.

Two-and-a-half million dollars extra in your retirement piggy bank would help, especially if the account were tax deferred and creditor proof.

The solution

If the above professional sounds like you, then you may be the perfect candidate for a cash balance plan. Depending on your age a cash balance plan might allow you to put away an additional $200,000 each year into a tax deferred, qualified retirement plan. You can recover from a financial setback, or compress 25 years of savings into 10.

Simply put, a cash balance plan is a cousin of the defined benefit plan with more flexibility. In some respects it looks somewhat like a 401(k) that you probably already have. It’s an additional qualified plan which generally sits side by side with a profit sharing/401(k) plan. Because a cash balance plan is a type of defined benefit plan, it greatly favors its older and higher compensated participants. This makes it ideal for many professional practices.

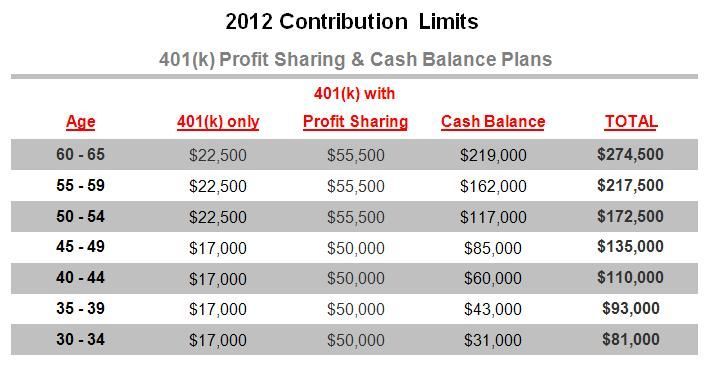

Here is a quick view of the maximum contributions available with a combination of 401(k) and a cash balance plan. Of course, you could take any amount benefit level that meets your needs. And certainly not all participants will want to take the maximum. You can see that maximum contributions increase with age. But, the numbers really grab your attention when you pass age 50.

Let’s take a second to discuss defined contribution and defined benefit plans in plain English:

• A defined contribution plan sets a formula based on compensation to determine the annual contribution for each participant’s account in the plan. Upon termination or retirement, the benefit is whatever value the account has attained. So, the final value is dependent on deposits, time, and rate of return. There is no guarantee of any particular benefit.

• On the other hand, a defined benefit plan sets a percentage of compensation as a benefit due at retirement, and then works backwards to determine annual contributions. The accrued vested benefit of contributions compounding at 5% is a guarantee by the plan and the plan sponsors, and in the event of a funding shortfall, the plan sponsor must make up the deficiency.

• While the cash balance plan is a defined benefit plan, the participant will see an account much like his/her 401(k) except that his/her contributions grow at a guaranteed 5%, and the participant does not exercise investment control. It’s all done for him/her.

• Defined contribution plans favor the younger worker because they have long time horizons for their deposits to grow. Younger workers with more time in the plan may attain higher account balances than their more highly compensated peers that have shorter time as participants. That’s good for workers with a long time horizon, but doesn’t address the problem of a worker with little time to go to retirement that needs a serious catch up program. You just can’t put away enough in a 401(k) in the next 10 or 15 years to solve a significant retirement shortfall.

• That’s where a well designed cash balance or defined benefit plan can save the day. If you are age 60, you can stash over $200,000-plus a year into your plan to accumulate an additional $2,500,000-plus at retirement. But, while it may look somewhat similar, it’s a completely different animal than a profit sharing/401(k). It’s the heavy duty, industrial strength catch up retirement plan for senior professionals.

Because most professionals have a fair understanding of a 401(k) but might never have encountered a cash balance plan, let’s go through some additional pros and cons.

• We target an exact amount at normal retirement date at a predetermined rate of return and then work backwards to calculate the annual deposit required to get to that amount. There is no reward for higher investment performance, but there is a penalty for a shortfall. Any shortfall must be made good by the plan sponsor. This calls for a very conservative asset allocation and investment policy, heavily or exclusively weighted to fixed income.

—

—

• Most plans but not professionals must pay an annual insurance cost to the Pension Benefit Guarantee Board (PBGC) for each participant to cover any shortfalls that the plan might have in the event of the failure of the plan sponsor. Even if you must pay it, the insurance cost is trivial in comparison to the potential tax savings and benefits. While PBGC insurance will cover much or all of the benefit of a rank and file worker it is capped at a low level so it will not cover a large part of the benefit for highly compensated professionals.

• Administrative costs which include actuarial certification of the plan are higher than a defined contribution plan, but again the costs are trivial when compared to the potential benefits.

• As few as 40% of the potential employees must participate, and there is a great deal of flexibility for professionals to opt out or take different levels of benefits. However, apportioning costs between professionals may have to be decided separately where benefit levels are significantly different.

• As a “qualified plan” certain testing requirements must be met. While these are designed to prevent discrimination, as a practical matter appropriate design may shift the vast majority of the benefits to the targeted professionals. In some cases the contribution to the defined contribution plan must be increased to allow the targeted professionals the maximum benefits. However, when looking at the combined plans most will see that the vast majority of the dollars spent will accrue to the targeted senior professionals.

• Like other qualified retirement plans, the funds are protected from creditors except for the two “super creditors”: a spouse or the IRS. In a litigious society, creditor proofing provides comfort to professionals that may feel targeted by the courts.

• Just as other qualified plans, the entire cost is tax deductible and tax deferred until distributed. At retirement, the proceeds may be rolled over in a lump sum to an IRA and the tax burden further deferred and spread over the remaining lives of the beneficiaries. Potentially these deferrals could extend to a third generation with appropriate estate planning.

Investment policy for cash balance plans

Investment policy for a cash balance plan is the inverse of that for a 401(k). The 401(k) plan maximizes benefits by maximizing rates of return on contributions over the career of the employee. The higher the balance of the plan, the higher the benefit. There is no downside to great performance.

The cash balance plan is an entirely different animal. The exact benefit is fixed in advance and excess funds are subject to an excise tax of 50%, while shortfalls must be made up by the sponsor. So, instead of a relative return policy we are all familiar with, we must adjust ourselves to an absolute return strategy. The investment policy has a one year time horizon. The best policy will generate exactly the target rate of return, no more, no less each year! Variations from target return on an annual basis can be very painful. So the funding mechanism relies not on equities to generate fat juicy returns, but a diversified bond portfolio generating as close to possible the exact target return with the smallest possible variation or risk.

Flexible design possibilities

Typically a cash balance plan will piggyback on top of a 401(k)/profit sharing plan. This arrangement greatly simplifies testing and offers extraordinarily flexible design possibilities.

No two law firms are alike. But, the cash balance plan may work equally well for a single practitioner, or a large, group practice.

As just one example a 300-person law firm with 50 partners might be able to benefit only the partners in the cash balance plan, while satisfying the cross testing requirements through a safe harbor 401(k) plan. Furthermore, some of those partners may opt out for all or part of their maximum possible benefit.

Summary

This quick, non-technical description is an informal introduction to this highly flexible retirement option. I’m not trying to turn you into an actuary, plan administrator, or investment adviser. Rather I’d like you to understand that there are some really powerful methods to augment a 401(k). While the rules are complex, the design possibilities are almost endless and a talented advisor may work economic miracles for you.

There is a chance that your practice may not benefit at all. Or, perhaps a traditional defined benefit plan will work better for you in your situation. However, most reputable investment advisors or pension design specialists will happily “run the numbers” for you with no obligation. When you see the costs and benefits laid out, you can determine if it’s right for you. And if it’s right for you, it could be the silver bullet that will save your retirement.

Frank Armstrong III, CFP®, AIFA®, is the President and Founder of Investor Solutions. He welcomes questions and comments at frank@investorsolutions.com. To learn more about Investor Solutions, visit www.investorsolutions.com.