- Revenue Cycle Management

- COVID-19

- Reimbursement

- Diabetes Awareness Month

- Risk Management

- Patient Retention

- Staffing

- Medical Economics® 100th Anniversary

- Coding and documentation

- Business of Endocrinology

- Telehealth

- Physicians Financial News

- Cybersecurity

- Cardiovascular Clinical Consult

- Locum Tenens, brought to you by LocumLife®

- Weight Management

- Business of Women's Health

- Practice Efficiency

- Finance and Wealth

- EHRs

- Remote Patient Monitoring

- Sponsored Webinars

- Medical Technology

- Billing and collections

- Acute Pain Management

- Exclusive Content

- Value-based Care

- Business of Pediatrics

- Concierge Medicine 2.0 by Castle Connolly Private Health Partners

- Practice Growth

- Concierge Medicine

- Business of Cardiology

- Implementing the Topcon Ocular Telehealth Platform

- Malpractice

- Influenza

- Sexual Health

- Chronic Conditions

- Technology

- Legal and Policy

- Money

- Opinion

- Vaccines

- Practice Management

- Patient Relations

- Careers

Reverse Churning: Are You a Victim?

How much you make from your investments can be greatly affected by how much you pay your financial advisor and whether you pay on a fee-based or commission-based model. Unfortunately, many investors don't realize they're using an ineffective payment model until it's too late.

This maid is churning butter. A brokerage account can be churned too much, resulting in excessive broker fees. On the other hand, if it is traded little or not at all and the account is fee-based, the client is not receiving benefit for her dollar either. Read on to determine if this is happening to you.

Doctors see a patient and receive a fee for their services. This is true of most of the service industry in the rest of the world as well.

In the investment universe, however, things are not so simple. A broker can get paid for doing absolutely nothing and it’s presently legal.

Now, however, the Securities and Exchange Commission (SEC) is beginning to put their foot down. Brokers who place the accounts of clients who trade little in a fee-based (rather than commission-based) account are under scrutiny. This practice is called reverse-churning.

More About Churning

Reverse churning is the opposite of “churning,” which occurs when brokers trade excessively in a client’s account to generate commissions for themselves. Sadly, the client rarely benefits. This is because research demonstrates that frequent trading is overall detrimental to returns rather than positive.

Churning is an illegal and unethical practice that violates SEC rules and securities laws. I wrote about this recently for Physician Money Digest in an article entitled, Bad Boy and Bad Girl Brokers, “The broker had traded his client’s account 21 times in the previous month making $1,488 in commissions. For the entire year, if this trading was sustained, he would be taking about 2% of his client’s account assets in commissions for himself.”

More About Reverse Churning

Reverse churning is the opposite of churning. The client directs that her account should not be traded or at least not often. Or, the broker makes that decision on her own. As a result, the broker is not receiving commissions. A way for the broker to work around this is to place that client in a fee-based account. Then, she gets paid for doing virtually nothing.

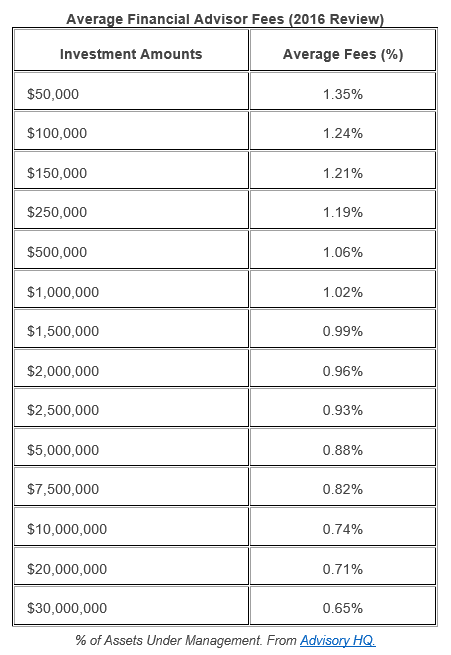

The average financial advisor fee for 2016 is stiff (see below). For an account of $2 million, clients are paying on average nearly 1% of their assets under management per year to their broker. For smaller accounts, the percentage is more.

If the broker is not providing any benefit, this is simply a transfer of money from the client to the broker for services not rendered. Some might say this is stealing. Others might suggest that the client is not caring for her money as well as she should be.

Now, the SEC has an opinion about this broker ploy. They want to see justification by a broker for putting one client into a commission-based versus a fee-based account. In an article by Kenneth Corbin in OnWallStreet, Brian Rubin, a compliance expert at the securities law firm of Sutherland, Asbill & Brennan, said, "… the SEC is now coming and saying justify that account, and how is the firm supervising that account?"

My Take

First, buyer beware. It is the responsibility of the client to know what kind of account she is in. This may be as simple as asking the question, “What kind of account am I in, commission or fee-based?” Then, ask why.

If benefit and fee don’t seem to match, you, the client, will have to delve deeper. This can be sticky. People generally like their brokers. Making her or him feel uncomfortable can also be painful for the client. Still, it’s your money and you need to protect it.

The very least that can happen from this conversation is that the broker knows you are interested. That can increase her attention to your account and the consideration of whether she is handling it in a way that benefits you as well as herself. On the other hand, if the broker is too defensive about this conversation, it might be time to look for a new broker.

Can the SEC really be effective?

I wonder. Only extreme cases would be clear cut. Take, for example, a fee-based account of $2 million that is never traded by the broker/financial advisor, not even to re-balance. In such a case, a fee-based account is of no value and the SEC could act against the broker and her firm. But, in most cases, I would guess, the situation is gray.

Though I applaud the SEC for initiating action in this “soft” area, I also think that unless they have extra time and resources, it may not be as productive as other areas of abuse in the investment industry that they can tackle.

This brings us back to buyer beware. We really are ultimately responsible for the care and shepherding of our own money.