- Revenue Cycle Management

- COVID-19

- Reimbursement

- Diabetes Awareness Month

- Risk Management

- Patient Retention

- Staffing

- Medical Economics® 100th Anniversary

- Coding and documentation

- Business of Endocrinology

- Telehealth

- Physicians Financial News

- Cybersecurity

- Cardiovascular Clinical Consult

- Locum Tenens, brought to you by LocumLife®

- Weight Management

- Business of Women's Health

- Practice Efficiency

- Finance and Wealth

- EHRs

- Remote Patient Monitoring

- Sponsored Webinars

- Medical Technology

- Billing and collections

- Acute Pain Management

- Exclusive Content

- Value-based Care

- Business of Pediatrics

- Concierge Medicine 2.0 by Castle Connolly Private Health Partners

- Practice Growth

- Concierge Medicine

- Business of Cardiology

- Implementing the Topcon Ocular Telehealth Platform

- Malpractice

- Influenza

- Sexual Health

- Chronic Conditions

- Technology

- Legal and Policy

- Money

- Opinion

- Vaccines

- Practice Management

- Patient Relations

- Careers

Spectrum Pharma's Long-Term Potential

The strong set of drugs in Spectrum Pharmaceuticals' pipeline could mean that the company has some long-term potential for investors.

The trial data that Spectrum Pharmaceuticals (SPPI) presented at the American Society of Clinical Oncology conference could mean that the company has some long-term potential for investors.

A Phase II study of Zevalin showed a 100% three-year overall survival and a 90% three-year progression-free survival. According to the findings, Zevalin could reduce the need chemotherapy.

There was also positive data on belinostat, showing patients with partial remission at five and 13 months and an overall response rate of 10.5%. Four patients (21%) had no progression for more than two years.

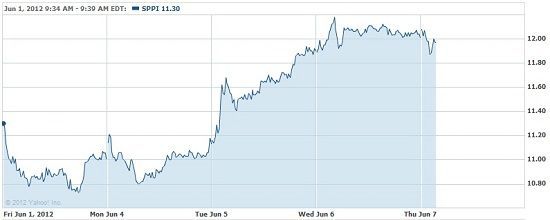

Spectrum has jumped up just over 11% after its ASCO presentations. It is currently trading at $11.70. The mean price target for Spectrum is $18.20, according to five brokers on Yahoo! Finance.

Click to enlarge

Spectrum has a number of drugs at various stages in its pipeline. Apaziquone, for non-invasive bladder cancer, is in late stage development. Prostate cancer treatment Ozarelix is in Phase II clinical trials. RenaZorb, a lanthanum-based nanoparticle phosphate-binding agent, is just beginning the preclinical stage. MeanwhileSPI-014, for hyperphosphotemia in end-stage renal disease, and SPI-205, chemotherapy induced neuropathy, are both in development.

Right now, one drug, Fusilev, seems to be driving sales up, so investors are fearful that when the generic drug leucovorin enters the market sales will drop.

However, SeekingAlpha’s Scott Matusow is confident in Spectrum’s management, and top-notch management can mean the difference between a small cap company fizzling and succeeding. Spectrum already has the pipeline in place, so Matusow believes that Spectrum’s strong management can only help the company.

The information contained in this article should not be construed as investment advice or as a solicitation to buy or sell any stock.

Read more: