- Revenue Cycle Management

- COVID-19

- Reimbursement

- Diabetes Awareness Month

- Risk Management

- Patient Retention

- Staffing

- Medical Economics® 100th Anniversary

- Coding and documentation

- Business of Endocrinology

- Telehealth

- Physicians Financial News

- Cybersecurity

- Cardiovascular Clinical Consult

- Locum Tenens, brought to you by LocumLife®

- Weight Management

- Business of Women's Health

- Practice Efficiency

- Finance and Wealth

- EHRs

- Remote Patient Monitoring

- Sponsored Webinars

- Medical Technology

- Billing and collections

- Acute Pain Management

- Exclusive Content

- Value-based Care

- Business of Pediatrics

- Concierge Medicine 2.0 by Castle Connolly Private Health Partners

- Practice Growth

- Concierge Medicine

- Business of Cardiology

- Implementing the Topcon Ocular Telehealth Platform

- Malpractice

- Influenza

- Sexual Health

- Chronic Conditions

- Technology

- Legal and Policy

- Money

- Opinion

- Vaccines

- Practice Management

- Patient Relations

- Careers

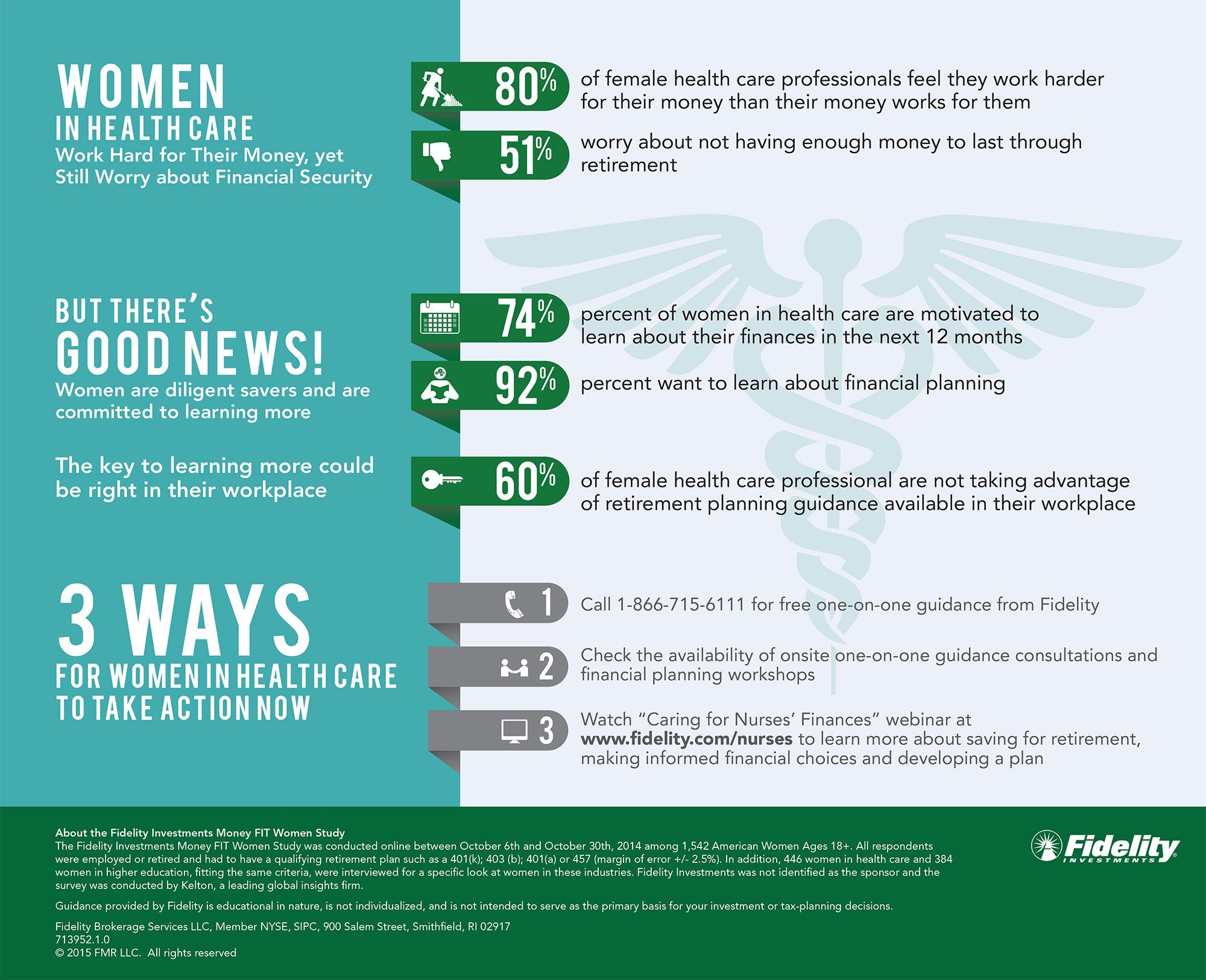

Study: Women in Healthcare Eager to Learn More About Finance

A new study finds lack of time and confidence are keeping many women in healthcare from taking charge of their finances.

A new study finds lack of time and confidence are keeping many women in healthcare from taking charge of their finances.

Those results come from Fidelity Investments’ Money Fit Women Study. The investment firm asked 716 women in healthcare, split roughly evenly between nurses and physicians.

The survey found women tend to be strong savers, but 39% said they lack confidence about investing wisely for retirement. Among men, only 29% admitted to lacking confidence in retirement planning.

Alexandra Taussig, senior vice president of marketing and business strategy, tax-exempt retirement services at Fidelity, said women in healthcare spend their days looking after the wellbeing of others.

“As others lean on them, it’s important they make time to address their own financial future,” Taussig said, in a press release. “The good news is that many women have already taken a positive first step and are proven savers.”

Taussig said establishing discipline is the hardest part. The next step is to focus on long-term planning, she said.

Fidelity notes that women dominate the healthcare industry. According to US Census Bureau data, women outnumber men in healthcare by a 10:1 ratio. And each year, about 48% of new MD recipients are women, according to the Advisory Board Company.

When asked if they feel confident when choosing where to invest money, 51% of women said no; only 34% of men said the same. When asked why, 43% of women cited a lack of sufficient time to deal with finances; 41% said they lack experience; and 39% said they simply haven’t done research about their options.

Nearly two-thirds of respondents said they are motivated to learn more about their finances in the next year, and 92% say they want to learn more about financial planning specifically.

Still, 60% of those who are offered financial guidance don’t take advantage of it, the survey found. Fidelity said employers can help in that cause by providing retirement guidance in the workplace. Respondents said they would be more likely to take advantage of workplace guidance if it was offered during work hours and if the advice was provided in terms a layman can understand.

The findings are summarized in this infographic: