- Revenue Cycle Management

- COVID-19

- Reimbursement

- Diabetes Awareness Month

- Risk Management

- Patient Retention

- Staffing

- Medical Economics® 100th Anniversary

- Coding and documentation

- Business of Endocrinology

- Telehealth

- Physicians Financial News

- Cybersecurity

- Cardiovascular Clinical Consult

- Locum Tenens, brought to you by LocumLife®

- Weight Management

- Business of Women's Health

- Practice Efficiency

- Finance and Wealth

- EHRs

- Remote Patient Monitoring

- Sponsored Webinars

- Medical Technology

- Billing and collections

- Acute Pain Management

- Exclusive Content

- Value-based Care

- Business of Pediatrics

- Concierge Medicine 2.0 by Castle Connolly Private Health Partners

- Practice Growth

- Concierge Medicine

- Business of Cardiology

- Implementing the Topcon Ocular Telehealth Platform

- Malpractice

- Influenza

- Sexual Health

- Chronic Conditions

- Technology

- Legal and Policy

- Money

- Opinion

- Vaccines

- Practice Management

- Patient Relations

- Careers

Protect Against Tax Increases on Investment Income

We can't control our government, which may make laws that don't benefit us directly. But, we can manage our response to these laws. Here are two options for dealing with tax increases coming Jan. 1.

Starting Jan. 1 a whole lot of people may get poorer. What could happen seems like a fulfillment of a joke that circulated before President Obama was elected, that he would promote, “trickle down poverty.” Now, it is imminent unless the Bush tax cuts are extended indefinitely and certain revisions are made to Obamacare.

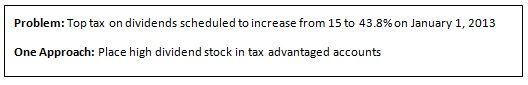

On Jan. 1, the top dividend tax is scheduled to accelerate from 15% to 43.8%, a nearly three times increase. Likewise, the highest capital gains and income tax will fast track from 15% to 23.8% and 35% to 39.6%, respectively. This is because the Bush tax cuts expire on the first day of next year.

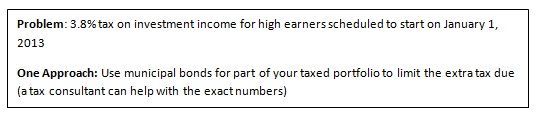

As if this isn’t enough pain, there will be a 3.8% tax on investment income for most joint filers with an adjusted gross income over $250,000 and single filers above $200,000. We have Obamacare to thank for this. The tax is a scheme to help pay for it.

The prudent high-earner taxpayer is no doubt taking this all in, getting depressed and then, when she or he recovers, wondering what to do now, if anything.

There is a lot of fancy footwork that could be executed in response to this conundrum. But, it would seem to me that since nothing is set in stone as yet, an expectant “wait-and-see” strategy rather than a headstrong approach might be better.

One easy and uncomplicated tactic is to revisit dividend paying stocks in your portfolio. Are the high-dividend payers in the tax-advantaged accounts rather than the taxed? The amount of money this can save over time is enormous and is especially true if the dividend tax increases from the present 15% to 43.8% come Jan. 1.

And then there is that potential intrusive 3.8% tax on investment income over $250,000 for joint filers and $200,000 for single filers. This tax is complicated and covered in more detail elsewhere plus depends on a tax consultant for the precise figures. In brief though, income gleaned from municipal bonds is not subject to the 3.8% tax and is one way high investment income earners could begin to go to avoid or diminish the impact of the tax.

In summary, we can’t control our government, which may make laws that don’t benefit us directly. But, we can manage our response to these laws. We owe it to ourselves to do just that.