- Revenue Cycle Management

- COVID-19

- Reimbursement

- Diabetes Awareness Month

- Risk Management

- Patient Retention

- Staffing

- Medical Economics® 100th Anniversary

- Coding and documentation

- Business of Endocrinology

- Telehealth

- Physicians Financial News

- Cybersecurity

- Cardiovascular Clinical Consult

- Locum Tenens, brought to you by LocumLife®

- Weight Management

- Business of Women's Health

- Practice Efficiency

- Finance and Wealth

- EHRs

- Remote Patient Monitoring

- Sponsored Webinars

- Medical Technology

- Billing and collections

- Acute Pain Management

- Exclusive Content

- Value-based Care

- Business of Pediatrics

- Concierge Medicine 2.0 by Castle Connolly Private Health Partners

- Practice Growth

- Concierge Medicine

- Business of Cardiology

- Implementing the Topcon Ocular Telehealth Platform

- Malpractice

- Influenza

- Sexual Health

- Chronic Conditions

- Technology

- Legal and Policy

- Money

- Opinion

- Vaccines

- Practice Management

- Patient Relations

- Careers

The Oil and Gas Formula:

At the end of 2012, the International Energy Agency reported that the United States will become the world’s top oil-producing nation by 2017. Many investors will try to profit, but what is the best way to do so?

Should you buy more shares of Exxon Mobile or, perhaps, another master limited partnership? Instead, investors should consider a drilling program so they can enjoy the monthly income and smart tax play.

The drilling program is a partnership created to own a series of oil and gas wells. There are a lot of reasons why this type of investment makes sense for a portion of your portfolio — here are the top three:

1. Income Generator

The best programs are designed to return the capital you invested in the first four to six years and may continue to generate income for an additional 10 to 50 years. The income from the investment can be used to support monthly lifestyle expenses or be reinvested so the cash is immediately put back to work.

New drilling and completing techniques are allowing drillers to re-enter existing fields and in essence manufacture oil and gas. Since the drilling is being done in a known oil and gas field, this considerably reduces the risk of a dry hole. In addition, investing in partnerships that will own pieces of multiple wells spreads that risk even more.

At the end of the day, you want to own a piece of hundreds, if not thousands, of wells so that your overall monthly income is not dependent upon any one well or program. Invest a similar amount of money in oil and gas each year to diversify into more wells and build your monthly income stream.

2. Tax Tool

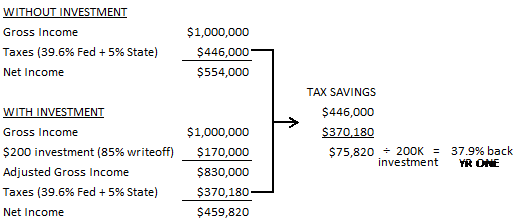

Drilling program investments are a great tax tool and now the tax deduction is even more valuable to taxpayers in the 39.6% bracket. When you do the math, 33 percent to 40 percent, and possibly more, of the money you invest comes immediately back to you in tax savings. This is money you would have owed in taxes if not for the investment.

This tax deduction allows an early return in the investment that helps reduce your exposure. Don’t let the tax component drive the investment decision, but don’t ignore it either. This is a strategy of taking would-be tax dollars and turning them into an income stream.

“Over and over again courts have said that there is nothing sinister in so arranging one’s affairs as to keep taxes as low as possible, Supreme Court Justice Learned Hand wrote in a judicial opinion in 1947 for Commissioner v. Newman, 159 F2d 848. “Everybody does so, rich or poor; and all do right, for nobody owes any public duty to pay more than the law demands: taxes are enforced extractions, not voluntary contributions.”

Here’s a simple example of how the tax component to the investment works. The example below is for an annual income of $1 million. The strategy of the oil and gas partnership can work well for incomes above $200,000, but is not appropriate below that threshold absent a sizeable net worth. The difference is the person with a $200,000 income makes investments at the minimum threshold of $20,000 to $25,000.

3. Non-Correlated Real Asset

Owning real assets vs. paper assets reduces stock market risk as a true alternative investment does not trade on an exchange and generally doesn’t have immediate liquidity. Markets tend to be very efficient and benefit those with access to the best information and fastest computers. However, when you choose to invest a portion of your assets in alternatives, you are seeking a potentially higher return by taking advantage of the inefficiencies present in investments outside of the stock market.

Owning a piece of a bunch of oil and gas wells gives you direct, long-term access to commodities. Let’s not forget that since our country is printing billions of dollars most experts anticipate some level of inflation, which causes oil and gas prices to rise. This isn’t good for you at the pump or when you open your gas bill at home, but great if you own oil and gas production. Your income stream is tied directly to the current commodity pricing for oil and gas.

Research

All investment comes with risk. Look at all the drilling program risks, and pay attention to the two main ones — drilling a dry hole and the ups and downs of commodity pricing.

Lastly, take a deeper dive in understanding the long-term benefits to owning a bunch of oil and gas wells. That’s why you should spend time and evaluate investing in drilling oil and gas wells. This industry is growing and capital intensive. It will be well worth your time.

Marshall H. Dean JD, MBA is a registered representative at Alliance Affiliated Equities Corporation, a FINRA-registered broker/dealer specializing in the evaluation and acquisition of tangible, real asset investments. Reach out to him with questions and comments at (913) 428-8278 or marsh@aaeconline.com.