- Revenue Cycle Management

- COVID-19

- Reimbursement

- Diabetes Awareness Month

- Risk Management

- Patient Retention

- Staffing

- Medical Economics® 100th Anniversary

- Coding and documentation

- Business of Endocrinology

- Telehealth

- Physicians Financial News

- Cybersecurity

- Cardiovascular Clinical Consult

- Locum Tenens, brought to you by LocumLife®

- Weight Management

- Business of Women's Health

- Practice Efficiency

- Finance and Wealth

- EHRs

- Remote Patient Monitoring

- Sponsored Webinars

- Medical Technology

- Billing and collections

- Acute Pain Management

- Exclusive Content

- Value-based Care

- Business of Pediatrics

- Concierge Medicine 2.0 by Castle Connolly Private Health Partners

- Practice Growth

- Concierge Medicine

- Business of Cardiology

- Implementing the Topcon Ocular Telehealth Platform

- Malpractice

- Influenza

- Sexual Health

- Chronic Conditions

- Technology

- Legal and Policy

- Money

- Opinion

- Vaccines

- Practice Management

- Patient Relations

- Careers

Traditional Safe Bets to Limit Costs and Maximize Returns

Savvy investors want to limit management fees while also earning a strong return. These three choices offer both.

Clients are asking, “Where can I put my money now?” As a group, these individuals are savvy and wary of expenses that cut into profits. They want the best of professional management without the cost. In a word, they want to have their cake and eat it too.

Enter three five-letter symbols (no four letter words here): VWELX, VWINX and OAKGX. They are managed mutual funds with a past (positive, that is). In fact, one won a popularity contest. The second of the three is so sought after and therefore so huge (90 billion) that it is closed to certain new investors. Who they are is covered later.

Dissecting the Symbols

Managed funds have the benefit of human intervention to hopefully improve fund results over their passive benchmarks. We know this happens no more than 20% or so of the time in any one year and the longer the time span, the less likely it will occur. But, two managed Vanguard funds and one Oakmark have performed close to this. Though past performance is no indication of the future, it is all we have to rely on.

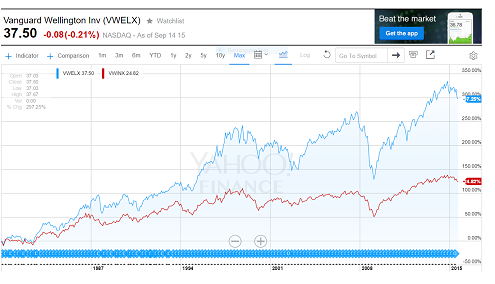

The relative performance of VWELX in blue to VWINX in red. VWELX consists of more stocks and thus has performed better over time than VWINX with fewer stocks. Also, VWELX carries more risk due to its larger stock component. Chart from Yahoo.

V stands for Vanguard for the first two funds, VWELX and VWINX. W represents Wellington, the management company. Each carries among the lowest expenses in the industry for their type of fund.

VWELX (Vanguard Wellington Investor Fund) consists of 60-70% dividend paying stocks and 30-40% bonds that provide moderate income. The current yield is 2.56%, meaning that if you owned enough shares to equal $100,000 your income would be $2,560 per year. This fund is closed to financial advisers and institutional customers but it is my understanding that individuals can still invest!

VWINX (Vanguard Wellington Income Investor Fund) is made up of 60-65% bonds and 35-40% stocks that pay above average dividends. Its current yield is 2.99%, meaning that if you owned enough shares to equal $100,000, your income would be $2,990 per year. This fund pays more in dividends because it has a higher percentage of bonds, some of which pay more per share in yield than stocks.

VWELX in blue consists of stocks and bonds whereas OAKGX is composed of all stocks. Therefore, OAKGX has a greater potential for growth but also can drop in value more sharply than VWELX when the market dips; it does not have a bond component to buffer it.

Our third player, OAKGX (Oakmark Global I), is from a different kettle of fish altogether. It consists of only stocks including international. The manager has a greater range of options than the equivalent at Vanguard in that he can invest 25-75% in the U.S. and the remainder in international or flip the formula. Additionally, he may invest in any size company (large, mid, or small). The current yield is 1.21%.

No Fund is Perfect

Even good funds have components that won’t work in every economic environment. Both Vanguard funds, for example, have a small position of long-term bonds that mature in 20 to 30 years. This means that when interest rates rise these bonds will lose value, thereby decreasing the overall price per share of the fund. In addition, the international component of the Vanguard funds is small (less than 6% in the stock portion) so foreign holdings have to be added from other sources to make a balanced portfolio.

The Skinny

In a nutshell, these three funds have historically done well. They offer management at a lesser cost, especially the Vanguard Wellington Funds. One is 60-40 (60% stock and 40% bonds) and the other is the reverse allocation. Together they place an investor in a 50-50 strategy if her monies are divided equally between them. The Oakmark fund offers a further opportunity, investment in a managed stock fund that includes international.

Though all three possibilities provide dividends, it is the Vanguards that are especially advantageous in that regard. Therefore, they would be better placed in tax-advantaged portfolios for the long term. The way I look at the situation now though is that there is so little for their price and past performance perhaps it is best to just invest and worry about taxes later (if we should be so lucky).

For those who want to go further afield than a 50-50 Vanguard strategy that includes only a minimum of foreign exposure, investing in one of the Vanguards with Oakmark as a companion is another option. Or for those wishing for more stock exposure and willing to take more risk, perhaps all three.

This information and content is offered for informative and educational purposes only. MyMoneyMD, LLC is not acting as a Registered Investment Advisor, Investment Counsel, Tax Advisor, or Legal Advisor.