- Revenue Cycle Management

- COVID-19

- Reimbursement

- Diabetes Awareness Month

- Risk Management

- Patient Retention

- Staffing

- Medical Economics® 100th Anniversary

- Coding and documentation

- Business of Endocrinology

- Telehealth

- Physicians Financial News

- Cybersecurity

- Cardiovascular Clinical Consult

- Locum Tenens, brought to you by LocumLife®

- Weight Management

- Business of Women's Health

- Practice Efficiency

- Finance and Wealth

- EHRs

- Remote Patient Monitoring

- Sponsored Webinars

- Medical Technology

- Billing and collections

- Acute Pain Management

- Exclusive Content

- Value-based Care

- Business of Pediatrics

- Concierge Medicine 2.0 by Castle Connolly Private Health Partners

- Practice Growth

- Concierge Medicine

- Business of Cardiology

- Implementing the Topcon Ocular Telehealth Platform

- Malpractice

- Influenza

- Sexual Health

- Chronic Conditions

- Technology

- Legal and Policy

- Money

- Opinion

- Vaccines

- Practice Management

- Patient Relations

- Careers

What's Driving Investors Out of Stocks?

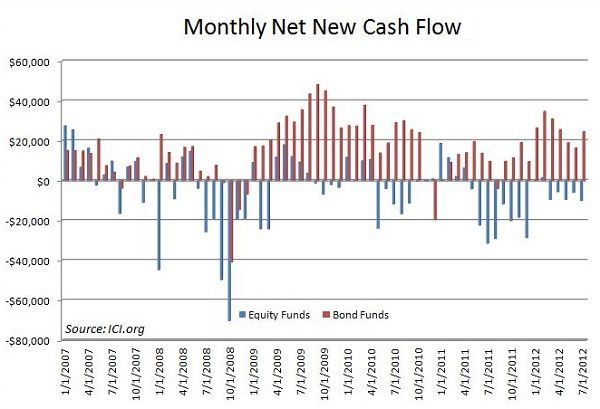

Despite a rising stock market and nearly record low interest rates, investors continue to pull money out of stocks and into bonds. What exactly is the catalyst behind this move?

This article was originally published by Zacks.com.

Despite a rising stock market and nearly record low interest rates, investors continue to pull money out of stocks and into bonds.

According to estimates from the Investment Company Institute, investors pulled a net -$5.158 billion out of equity mutual funds last week while plowing +$7.997 billion into bonds funds:

But this is no recent phenomenon. There has been a steady flow out of equity funds since May of 2011:

But what is the catalyst behind this move?

Conventional wisdom would say that retail investors got burnt in 2008 and are simply swearing off stocks. But that doesn't explain the massive inflows into equity funds in mid-2009, early 2010 and early 2011.

Could it be that Baby Boomers are simply shifting out of "risky" stocks and into the "safety" of bonds as they near retirement? Or is there something else going on here? Is the "cult of equity" dying as PIMCO co-founder Bill Gross recently suggested?

Either way, it's clear that the average investor has largely missed out on this year's stock market rally.

Todd Bunton is the Growth & Income Stock Strategist for Zacks Investment Research and Editor of the Income Plus Investor service.

This article originally appeared at Zacks.com. Reprinted with permission. Disclosure: Officers, directors and/or employees of Zacks Investment Research may own or have sold short securities and/or hold long and/or short positions in options that are mentioned in this material. An affiliated investment advisory firm may own or have sold short securities and/or hold long and/or short positions in options that are mentioned in this material. Neither Zacks Investment Research, Inc., Physician's Money Digest, nor the information providers have any liability, contingent or otherwise, for the accuracy, completeness, timeliness, or correct sequencing of the information or for any decision made or action taken by you in reliance upon information or "Zacks.com," "PhysiciansMoneyDigest.com," or "HCPLive.com" or for interruption of any data, information or any other aspect of "Zacks.com," "PhysiciansMoneyDigest.com," or "HCPLive.com." The past performance of a mutual fund, stock or investment strategy cannot guarantee its future performance.