- Revenue Cycle Management

- COVID-19

- Reimbursement

- Diabetes Awareness Month

- Risk Management

- Patient Retention

- Staffing

- Medical Economics® 100th Anniversary

- Coding and documentation

- Business of Endocrinology

- Telehealth

- Physicians Financial News

- Cybersecurity

- Cardiovascular Clinical Consult

- Locum Tenens, brought to you by LocumLife®

- Weight Management

- Business of Women's Health

- Practice Efficiency

- Finance and Wealth

- EHRs

- Remote Patient Monitoring

- Sponsored Webinars

- Medical Technology

- Billing and collections

- Acute Pain Management

- Exclusive Content

- Value-based Care

- Business of Pediatrics

- Concierge Medicine 2.0 by Castle Connolly Private Health Partners

- Practice Growth

- Concierge Medicine

- Business of Cardiology

- Implementing the Topcon Ocular Telehealth Platform

- Malpractice

- Influenza

- Sexual Health

- Chronic Conditions

- Technology

- Legal and Policy

- Money

- Opinion

- Vaccines

- Practice Management

- Patient Relations

- Careers

Why Did Your Stock Underperform?

It's best to not to determine success based on the daily swings of the market. To be profitable, you just need up days to outnumber the down - and that takes endurance.

This article was originally published by Zacks.com.

"why is the stock I just bought losing money?"

There's a question I hear and see far too often. I hear it in the office, on the train, at parties and picnics, and on investment blogs. You would think that investors could come to some level of understanding, and the question wouldn't come up as often. It's something that can take various forms, but the gist is:

The story usually starts with someone buying a stock that was recommended by someone or highly rated by an analyst or ranking system. After learning about the stock, the investor buys it. Then, for some unknown reason perhaps, the stock goes down over the short-term. Understandably, the investor feels disappointed and begins to question his or her decision. Often, the investor will blame the source of the tip and possibly label it as "no good." There are many reasons why the stock might have gone down and I'll touch on a few "big picture" points.

The reasoning behind the why

The first and foremost question you should ask is whether or not your source has a proven track record of success. Does the source or strategy actually provide information to help you pick winning stocks with proof to back it up? Although past performance doesn’t guarantee future success, it's a good place to start. While not as good as real-time performance, historical testing or backtesting is another way to discover profitable ideas. The point is, if you don't have actual proof that something works, then you shouldn't even consider the information provided by the source or strategy.

Once a proven, solid source has been determined, you have to give it time to reveal its worth. Frequently, I hear of someone buying a stock at a certain price and, within days or even hours, becoming concerned when the stock is trading at a lower price. The reality of the stock market is that there are significant amounts of short-term noise that dissipate when you look at longer horizons. Therefore, it's best to not to determine success based on the daily swings of the market. There will be days your portfolio will be up and days it will be down. To be profitable, you just need those up days to outnumber the down — and that takes endurance.

How you determine success is also important. Do you judge success based solely on whether or not you are losing money? Or do you look at performance relative to a market benchmark? For example, your portfolio might have a +3% return, but underperforming the market's +8%. That means you left some money on the table by following your strategy rather than your benchmark. Additionally, if you find a strategy that experienced a -2% return while the benchmark had a -5% return … well then, you just saved yourself some money.

This next point is one of my favorites. As I discussed in a previous article, all strategies will have misses. You're never going to be able to find something that has a 100% success rate. In fact, it's going to be much lower than that. Even the Zacks Rank with its fantastic, live, annualized performance figure (26% from 1988 through March 2012) has an individual stock success rate of just over 55%. So even with one of the best stock ranking systems available to individual investors, your likelihood of picking just one winning stock is just above 55%. That means about 55% of the time the Zacks Rank will identify a profitable stock and 45% of the time it will not. That's considering just one stock.

So, as with the "Vote Early and Often" approach that Chicago was known for, you need to ensure the odds are stacked in your favor. The only way to do that is to turn it into a numbers game and use a proven scoring system as often as you can. So if you bought 100 stocks based on the Zacks Rank, you should expect, on average, 55 to be winners. Obviously you're not going to be able to buy 100 stocks at once, so you'd need to, once again, give it time and trading to prove itself.

Given the need to have a large sample size to prove its worth, I chuckle when I hear a strategy branded as a failure based on the fact that a single recommended stock has a disappointing performance. In reality, one should feel disappointed if they bought 100 stocks and only 45 proved profitable. And I can't help but ponder on the investor who begins to follow a strategy that only has a 45% win rate and buys the first stock or two that subsequently go up. They may think they have found the Golden Goose. But by following that strategy, they're going to slowly end up in the poor house. Unfortunately, it'll take them a long time to realize it.

Discover a proven strategy

By now it should be crystal clear that not only do you need an outperforming strategy, you need to follow it as closely as possible. To do the latter, you need to make it an individual habit to follow and not deviate from the strategy. As with many things in life, it takes two to tango. Accordingly, if you could bring the disciplined habit to the table, I could show you how to find a winning strategy.

Enter the Zacks Research Wizard (RW). It's just the tool you'll need to discover those winning strategies on your own or to use of one of the many that we've already identified. If truth be told, one of my preferred strategies in RW is the pre-built Analyst Anomaly strategy. We tend to like things we design ourselves, and perhaps that's why I like this one.

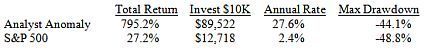

Here's how the Analyst Anomaly portfolio compared to the S&P 500 on a historical test from 2002 to 2011.

Those results show that over time, the strategy made more than 10 times from the market’s return even with a smaller maximum loss. For 2012, the Analyst Anomaly portfolio has returned over 20% in real-time compared to the S&P 500’s 13%. Consequently, the Analyst Anomaly has proven its value both in historical backtesting and through a real-time portfolio.

Those that subscribe to RW can see the entire detail. For the rest of you, I’ll provide only some highlights of the strategy:

• Buys high volume, large-cap U.S. stocks

• Takes a look at a company’s valuation

• Evaluates at earnings estimate revisions

Click here to see five stocks that passed the screen.

Kip Robbins is a Quantitative Analyst with Zacks.com. He analyzes screens and strategies for Zacks customers and for use in Zacks Research Wizard which empowers individual investors to use market-beating screens, build their own, and backtest their results.

Disclosure: Officers, directors and/or employees of Zacks Investment Research may own or have sold short securities and/or hold long and/or short positions in options that are mentioned in this material. An affiliated investment advisory firm may own or have sold short securities and/or hold long and/or short positions in options that are mentioned in this material.

Disclosure: Performance information for Zacks’ portfolios and strategies are available at: http://www.zacks.com/performance.