- Revenue Cycle Management

- COVID-19

- Reimbursement

- Diabetes Awareness Month

- Risk Management

- Patient Retention

- Staffing

- Medical Economics® 100th Anniversary

- Coding and documentation

- Business of Endocrinology

- Telehealth

- Physicians Financial News

- Cybersecurity

- Cardiovascular Clinical Consult

- Locum Tenens, brought to you by LocumLife®

- Weight Management

- Business of Women's Health

- Practice Efficiency

- Finance and Wealth

- EHRs

- Remote Patient Monitoring

- Sponsored Webinars

- Medical Technology

- Billing and collections

- Acute Pain Management

- Exclusive Content

- Value-based Care

- Business of Pediatrics

- Concierge Medicine 2.0 by Castle Connolly Private Health Partners

- Practice Growth

- Concierge Medicine

- Business of Cardiology

- Implementing the Topcon Ocular Telehealth Platform

- Malpractice

- Influenza

- Sexual Health

- Chronic Conditions

- Technology

- Legal and Policy

- Money

- Opinion

- Vaccines

- Practice Management

- Patient Relations

- Careers

Why I Can Retire at 38, But Won't

I can retire 3 years after I finish fellowship, but I won't. Here's why.

Soar high and free like an eagle.

I will be able to retire at 38, but I won’t. Here’s why.

• At 38, I’ll be less than three years out of my fellowship. It would be the beginning of my professional prime as a radiologist. I’d like to use my skills and knowledge from 26 years of schooling to serve others. I get a wonderful sense of fulfillment from draining a patient’s pelvic abscess today; I will also relish saving someone’s life by making an imaging diagnosis in seven years.

• I want to care for others beyond myself and my daughter (Mini Wise Money). These people include my parents, MWM’s paternal grandparents, some of my extended family, and my sponsor child Mariela.

• I want to provide for MWM more than I was blessed with growing up. While I worked seven jobs in college trying to send meager money home to help my parents with their 30% interest rate credit card debts, I’d like MWM to have at least one (but no more than two) jobs while going to school full time.

• I’d like to keep blogging. Blogging costs money and a lot of time. I plan to support my blog because helping others succeed financially and personally is rewarding to me.

• I’d like to give more. I sponsor one child now. I’d like to sponsor more. I may even adopt a child one day, so that Mini is not so lonesome when I'm in heaven one day.

3 things to help you achieve financial independence and retire sooner:

• Lower the cost of your debt by refinancing.

• Be mindful in your financial practices.

• Make your money work for you.

Now, let’s see how I CAN retire at 38.

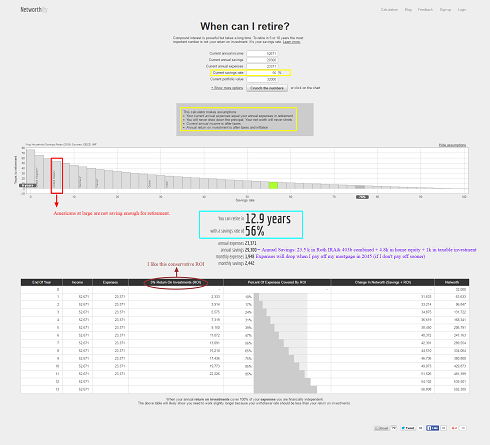

I began my calculations with my current post-tax annual income of $52,671 and annual savings of $29,300. My annual savings rate is 56%, which will give me financial independence (the ability to retire) in 13 years.

Living, earning, and saving like I do today, I can retire in 13 years. Click for a larger version of the image.

My savings include $23,000 in my Roth IRA and Roth 403(b), as well as $1,000 in taxable investments and $4,800 in home equity. Note that my home equity does not exactly grow at 5% ROI (return of investment) but I have $5,000 of additional savings that will make the $4,800 in home equity a bonus even if it’s getting negative ROI (the home value drops rather than grows).

This does not account for the fact that in July 2020, I will get a pretty big raise from PGY to attending-hood.

Accounting for the transition into attending-hood:

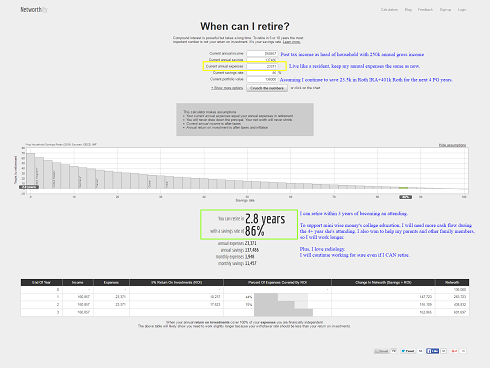

These are my calculations when I factor in the salary increase I’ll receive when I finish my fellowship:

My post-tax annual income as an attending will be $160,857 (based on an ultra-conservative estimate of $250,000 per year in income, when most rads I know are getting $300,000 to start at academic/VA jobs) and annual savings $137,486.

My annual savings rate is 86%, which gives me financial independence (ability to retire) 2.8 years after finishing my fellowship (8.8 years from finishing medical school).

Living, earning, and saving like I do today, with attending income in four years, I can retire in 6.8 years starting today. Click for a larger version.

Assumptions:

1. My employee job will pay $250,000 per year pre-tax. (I presume a contractor job will actually allow me to save more as business deductions are numerous and liberal.)

2. I will continue to live like I do now after becoming an attending. Like I have said before, I was blessed to be born a materially low-maintenance girl. I get free haircuts from Mini and I get free clothes from friends and family who can't stand my monotonous wardrobe (seven pairs of scrubs) and need more space in their own.

With the same expenses, I’d save the rest of my post-tax dollars, so I'd be able to save $137,486 each year.

I find it extremely liberating to learn that at 38, just seven years from now, I will work because I love to, not because I have to.

Financial independence does not mean that I will drop all that I love and care for today to travel the world or become a full-time gardener. It simply signifies that my motive for working and not retiring will be more profound than monetary necessity.

A final fun morsel to chew on:

If I lived as I do now (PGY2, with 22 years of schooling), but I chose plumbing instead of doctoring, I would have reached FI (financial independence) at 31. I would have also had more personal, family, and party time even before retiring at the tender age of 31.

My point is:

financial independence is not an end in itself;

it is a means to fully enjoy one’s life,

professionally and personally,

more than one otherwise could.

How many years before you reach FI?

I will continue to live, work, and love the way I do today when I reach FI. Would you do anything different?

Are there things you'd like to change today that may impact your time or path to FI?

Share your insights, experiences, and questions below!

This article is for informational purposes only and not intended as a substitute for professional advice. Please consult a professional accountant, financial adviser or lawyer, before making financial decisions.