- Revenue Cycle Management

- COVID-19

- Reimbursement

- Diabetes Awareness Month

- Risk Management

- Patient Retention

- Staffing

- Medical Economics® 100th Anniversary

- Coding and documentation

- Business of Endocrinology

- Telehealth

- Physicians Financial News

- Cybersecurity

- Cardiovascular Clinical Consult

- Locum Tenens, brought to you by LocumLife®

- Weight Management

- Business of Women's Health

- Practice Efficiency

- Finance and Wealth

- EHRs

- Remote Patient Monitoring

- Sponsored Webinars

- Medical Technology

- Billing and collections

- Acute Pain Management

- Exclusive Content

- Value-based Care

- Business of Pediatrics

- Concierge Medicine 2.0 by Castle Connolly Private Health Partners

- Practice Growth

- Concierge Medicine

- Business of Cardiology

- Implementing the Topcon Ocular Telehealth Platform

- Malpractice

- Influenza

- Sexual Health

- Chronic Conditions

- Technology

- Legal and Policy

- Money

- Opinion

- Vaccines

- Practice Management

- Patient Relations

- Careers

Your Brain Matters: Making Money

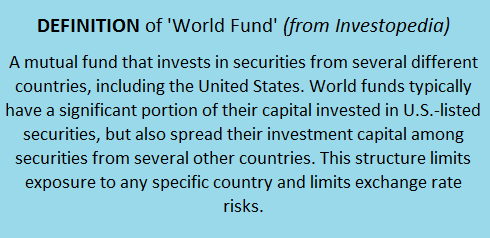

World funds are convenient choices for portfolios because they combine foreign and US investments. This is good. What is less optimal, however, and even overwhelming, is that there are many different choices.

Instead of working harder to make more money, execute better investing decisions. Then, let them run.

World funds are convenient choices for portfolios because they combine foreign and US investments. This is good. What is less optimal, however, and even overwhelming, is that there are many different choices.

This abundance of possibilities presents a conundrum to many investors. Yet, by using simple guidelines, this confusion can be contained. First and foremost, we know that passively managed funds perform better over time compared with those that are actively managed. BINGO: Choose a passively managed fund.

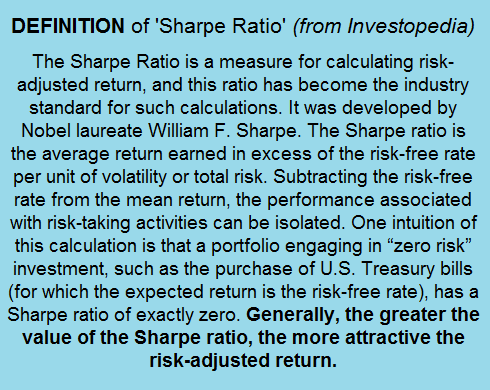

Secondly, we know that risk adjusted return is important. The Sharpe ratio is an excellent indicator of this parameter. The higher its value, normally the better the risk adjusted return.

BINGO: Choose a fund with a high Sharpe Ratio compared to its competitors or even equivalent if the comparable expense is lower.

A Comparison Case

(Executed Oct. 8; figures could be different for other dates)

Five year performance of VTWSX in blue compared to MCEGX in red. Notice that during the recent downturn VTWSX fell less. From Yahoo.com.

When selecting a world fund, compare management fees of passive to actively managed funds in this category. For example, the passively managed Vanguard Total World Stock Index Investor class (VTWSX) has an expense ratio annually of 0.27%. The category average is 1.28%. Its five-year Sharpe Ratio is 0.58.

The actively managed BlackRock Long-Horizon Equity Investor C (MCEGX) has an expense ratio of 1.79% annually compared to 1.06 for its category. Also, it has a 12B-1 fee of up to 1% and a deferred sales load of 1%. Its five-year Sharpe Ratio is 0.59.

The expense ratio is under category for each respective fund found on Yahoo.com. The Sharpe ratio is under risk.

Similar but Different

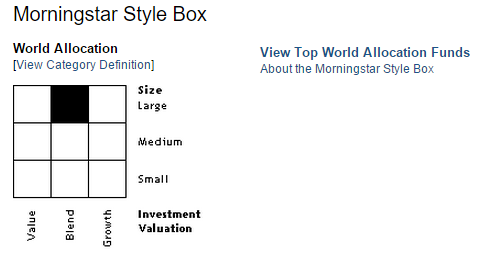

From Yahoo.com

Though both VTWSX and MCEGX are large blend (see above) they are not identical. This is supported by the fact that their yield is different as well as other comparisons made in Morningstar data. Still, they are both world allocation and thereby have many features in common. With a markedly lower expense ratio, my assumption is that the passively managed fund VTWSX will do better over time.

So, for a simpler way to invest that produces results, the above rules of thumb (think passive and Sharpe) can help. They give individual investors more power to make money with the money for which they have worked so hard.

This information and content is offered for informative and educational purposes only. MyMoneyMD, LLC is not acting as a Registered Investment Advisor, Investment Counsel, Tax Advisor, or Legal Advisor.