- Revenue Cycle Management

- COVID-19

- Reimbursement

- Diabetes Awareness Month

- Risk Management

- Patient Retention

- Staffing

- Medical Economics® 100th Anniversary

- Coding and documentation

- Business of Endocrinology

- Telehealth

- Physicians Financial News

- Cybersecurity

- Cardiovascular Clinical Consult

- Locum Tenens, brought to you by LocumLife®

- Weight Management

- Business of Women's Health

- Practice Efficiency

- Finance and Wealth

- EHRs

- Remote Patient Monitoring

- Sponsored Webinars

- Medical Technology

- Billing and collections

- Acute Pain Management

- Exclusive Content

- Value-based Care

- Business of Pediatrics

- Concierge Medicine 2.0 by Castle Connolly Private Health Partners

- Practice Growth

- Concierge Medicine

- Business of Cardiology

- Implementing the Topcon Ocular Telehealth Platform

- Malpractice

- Influenza

- Sexual Health

- Chronic Conditions

- Technology

- Legal and Policy

- Money

- Opinion

- Vaccines

- Practice Management

- Patient Relations

- Careers

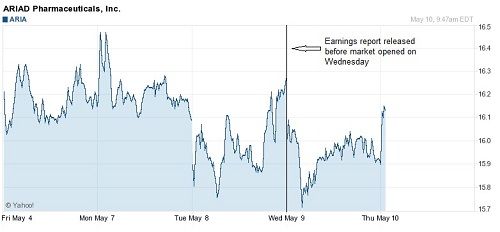

Ariad Rebounds After Reporting Wider Loss in Q1

Ariad Pharmaceuticals posted a wider Q1 loss after spending more money to guide its leukemia treatment through late-stage clinical trials and preparing for possible regulatory approval.

After spending more money to guide its leukemia treatment through late-stage clinical trials and preparing for possible regulatory approval, Ariad Pharmaceuticals posted a wider Q1 loss.

Ariad lost $55.9 million, or 35 cents per share in the first quarter of 2012. However, the company had doubled research and development costs to $28.8 million due to the development of its leukemia drug, ponatinib. Ariad will present clinical data from the ponatinib trial at ASCO this year. The plan is to file with the FDA in Q3 2012.

Click to enlarge

Source: Yahoo! Finance

Ariad is also working on a Phase 1/2 trial of AP26113, an investigational dual inhibitor of EGFR and ALK in patients with solid tumors, especially non-small cell lung cancer. Phase 2 will begin in the middle of the year.

The Jefferies Group boosted its price target for Ariad shares to $18. The mean price target for 15 analysts is $18.53, according to Yahoo! Finance. For the current quarter, ending June 12, the 15 analysts are expecting Ariad will post $-0.25 earnings per share.

“With regulatory catalysts within next 12 months (ponatinib NDA filing in 3Q12/potential FDA approval early-2013), we believe ARIA is well positioned for meaningful upside,” the analysts wrote in a research note.

Analysts at UBS initiated coverage of Ariad shares with a “buy” rating. According to Yahoo! Finance, eight analysts recommend Ariad as a “strong buy,” seven as a “buy” and two as “hold.” There are no analysts recommending Ariad’s stock to “underperform” or as a “sell.”

After the earnings report came out on Wednesday, Ariad’s stock dropped sharply, going as low as $15.72. But it had more than recovered by Thursday afternoon, climbing to $16.50.

The information contained in this article should not be construed as investment advice or as a solicitation to buy or sell any stock.

Read more: