- Revenue Cycle Management

- COVID-19

- Reimbursement

- Diabetes Awareness Month

- Risk Management

- Patient Retention

- Staffing

- Medical Economics® 100th Anniversary

- Coding and documentation

- Business of Endocrinology

- Telehealth

- Physicians Financial News

- Cybersecurity

- Cardiovascular Clinical Consult

- Locum Tenens, brought to you by LocumLife®

- Weight Management

- Business of Women's Health

- Practice Efficiency

- Finance and Wealth

- EHRs

- Remote Patient Monitoring

- Sponsored Webinars

- Medical Technology

- Billing and collections

- Acute Pain Management

- Exclusive Content

- Value-based Care

- Business of Pediatrics

- Concierge Medicine 2.0 by Castle Connolly Private Health Partners

- Practice Growth

- Concierge Medicine

- Business of Cardiology

- Implementing the Topcon Ocular Telehealth Platform

- Malpractice

- Influenza

- Sexual Health

- Chronic Conditions

- Technology

- Legal and Policy

- Money

- Opinion

- Vaccines

- Practice Management

- Patient Relations

- Careers

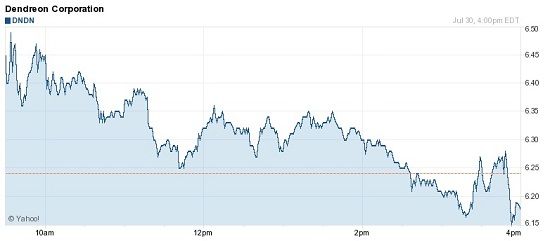

Dendreon Misses, Trading Halted

Dendreon tries to temper earnings disappointment with restructuring news, but trading in its shares was halted after closing on Monday.

In anticipation for its earnings report release, Dendreon’s stock had been trying to keep its gain all day on Monday. However, after the biotech’s stock lost the battle, the company announced it had missed estimates.

The stock started the day up by 3.7%, but it lost some of that cheer as the day went on, finally closing down by 0.96%. The biotech’s stock first spiked last week, shooting up 12% early on Tuesday, July 24, in anticipation of the second quarter earnings report.

Dendreon released its earnings report after the market closed on Monday, reporting net loss 61 cents a share. Analysts were estimating a net loss of 59 cents per share. Last quarter the company missed estimates by 5 cents, but the quarter before that Dendreon beat estimates by 57 cents per share.

Click to enlarge

After the market closed, trading in Dendreon’s shares was halted at $6.19. All in all, it seems tough times have fallen on Dendreon, which is trading 83% below where it was a year ago.

[Edit 7/31/12] When trading resumed on Tuesday morning, Dendreon's stock opened down by 19% at $5.

Following the disappointing news that the company misses estimates, Dendreon also announced that it would be reducing costs by $150 million annually by closing its Morris Plains, N.J., manufacturing facility.

“We are confident in the long-term opportunities for Provenge,” said John H. Johnson, chairman, president and chief executive officer, in a statement. “We believe the strategic restructuring plan announced today will accelerate our path to profitability and future growth as we execute on our core mission of providing Provenge to patients around the world.”

Dendreon is facing some pretty strong headwinds right now. During ASCO 2012, Dendreon’s stock took a dive after Johnson & Johnson presented impressive data on Zytiga, which competes with Dendreon’s Provenge.

Right now the two prostate cancer drugs are supposed to be used at different stages: Dendreon is for patients whose disease has worsened after chemical castration treatment, but who haven’t undergone chemotherapy while Zytiga is approved for use after chemotherapy fails. Unfortunately for Dendreon, Zytiga is prescribed off-label for patients in earlier stages of the disease. That alone cut into the expensive Provenge’s market.

However, things might get worse. J&J is planning to file for expanded approve for the use of Zytiga, making it compete even more directly with Dendreon. This decision was based on the data from ASCO on the use of Zytiga in pre-chemo patients.

Read more: