- Revenue Cycle Management

- COVID-19

- Reimbursement

- Diabetes Awareness Month

- Risk Management

- Patient Retention

- Staffing

- Medical Economics® 100th Anniversary

- Coding and documentation

- Business of Endocrinology

- Telehealth

- Physicians Financial News

- Cybersecurity

- Cardiovascular Clinical Consult

- Locum Tenens, brought to you by LocumLife®

- Weight Management

- Business of Women's Health

- Practice Efficiency

- Finance and Wealth

- EHRs

- Remote Patient Monitoring

- Sponsored Webinars

- Medical Technology

- Billing and collections

- Acute Pain Management

- Exclusive Content

- Value-based Care

- Business of Pediatrics

- Concierge Medicine 2.0 by Castle Connolly Private Health Partners

- Practice Growth

- Concierge Medicine

- Business of Cardiology

- Implementing the Topcon Ocular Telehealth Platform

- Malpractice

- Influenza

- Sexual Health

- Chronic Conditions

- Technology

- Legal and Policy

- Money

- Opinion

- Vaccines

- Practice Management

- Patient Relations

- Careers

Early Retirement & the Likelihood of Regret

You may regret retiring too soon. Conversely, you may working too long. In this post, I do my best to help you find the ideal time to retire.

When my blog was first conceived sometime last year, I had a pretty good idea I would be ready and able to retire early at some point. Crunching numbers and considering some family dynamics, I came up with a five to six year plan to retire quite comfortably with a healthy margin of safety.

Nearly a year into this venture, I have done a lot more number crunching, brainstorming, and talking with my wife about our future. The five or six year plan has essentially been cut in half. I’m thinking more in terms of a two and a half to three year plan, with perhaps an additional year working abroad.

When is the best time to retire?

First, you must satisfy some pre-requisites:

• Financial Independence achieved or

• Passive plus active income will cover your expenses

• Career aspirations fulfilled (or willfully abandoned)

• A plan to retire to something

If you can check those boxes, I would say you are ready to consider an early retirement. It’s time to do some soul searching and decide if and when you’ll be truly ready to retire. For me, it’s all about minimizing the likelihood of regret.

Is it time to retire?

What is the Likelihood of Regret?

There are two distinct likelihoods of regret that must be considered.

1. The likelihood you’ll regret retiring too soon.

2. The likelihood you’ll regret working too long.

Let’s consider each of these independently.

Why might you regret retiring too soon?

You could have earned more money.

More money would allow you to have a lower withdrawal rate, allowing you to sleep better at night. Sure, a 4% withdrawal rate works looking backward, but our lives are looking to an uncertain future. A 3% withdrawal rate might make you more comfortable with an early retirement.

More money would allow you to undergo some lifestyle inflation. You may not enjoy the finer things in life right now, but people change. Even you. Even me. My desires are different than they were ten years ago, and I imagine they won’t be the same ten years from now. Or twenty. Or forty.

More money could be used to benefit others. Just imagine how much good could be done with the income from just one more year. How cool would it be to donate $200,000 to a favorite cause? You could use it to start your donor advised fund, if you haven’t already.

You may be wearing some golden handcuffs.

I’ll be fully vested in my employer’s profit sharing and match money in about two and a half years, which is one reason that is the minimum amount of time I intend to continue working. If I leave sooner, I’ll be leaving a high five-figure sum on the table. Those are my golden handcuffs.

Golden handcuffs can come in many forms. Pensions, or pension increases. Provided healthcare when retiring after a certain age. Bonus payments tied to length of service or project completion. Golden handcuffs as financial incentives can be psychologically powerful, even for the financially independent.

Life might not change that much anyway.

Circumstances may make retiring in the near term less enticing. Our boys are in a public gifted and talented “school within a school” and can be for several more years.

If I were to retire now, we would want them to continue the program, and we will be married to that school schedule. Early retirement for me is all about freedom. My awesome early retirement ideas are incompatible with the public school schedule.

Why might you regret working too long?

There is a time opportunity cost.

Unless you absolutely love your job, and would do it for free, you are working in lieu of occupying your days and perhaps nights with something you’d rather be doing. There is an obvious opportunity cost in terms of time when you’re working, unless there’s truly no place you’d rather be than at work.

You don’t want to experience full burnout.

I’ve probably exhibited some mild burnout symptoms, but for the most part, I’m reasonably content with my job. But burnout is real and increasing, and I wouldn’t want to experience it personally. That would be bad for me, bad for my family, and bad for my patients. If you’ve got the means and are beginning to burn out, it’s best to retire sooner than later.

Life is short.

On the front lines, we see too many patients with devastating health problems that present far too soon. Raise your hand if you’ve lost a colleague, close friend or family member well before full retirement age. We’ve got a room full of raised hands. I plan on living a long, healthy life, but I certainly can’t guarantee it.

Striking a Balance

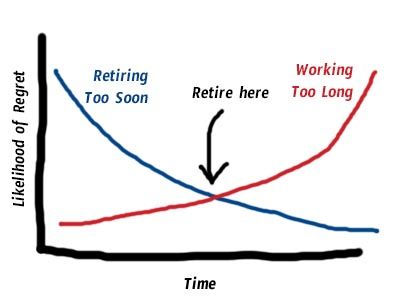

In my analytical mind, I picture the likelihoods of regret as lines on a graph with a timeline along the X-axis. The likelihood of regretting retiring too soon starts out high and decreases with time. The likelihood of regretting working too long starts low and increases with time.

At some point, those lines will intersect. That’s where the magic happens. That’s the best time to retire, at the nadir on the Likelihood of Regret scale.

Identifying the nadir is the tricky part. Clearly, many factors go into what those lines will look like for you, and those lines won’t be static. Family matters and career disturbances may cause sudden shifts in one or both lines.

My lines have certainly shifted over the course of the last year, and my nadir has moved to the left.

What changed?

- I’ve begun to form some more definitive post-retirement plans.

- My younger son is skipping kindergarten. Time warp!

- We sold our oversized former home last fall, eliminating our last debt.

- I’ve started to realize a small blog income, even after the charitable mission and expenses have been covered.

- I discovered a love of writing, which could become a part time encore career.

Will my ideal retirement point change again?

It could.

Things that could move it to the right (retire later):

- A prolonged market downturn

- Real or perceived need for higher future spending

- Significant Lifestyle Inflation

- A big salary cut, making it more difficult to reach my financial goals

Things that could move it to the left (retire sooner):

- A terrible diagnosis with a poor prognosis (for myself or a family member)

- Excellent market returns

- A sudden windfall (inheritance, lotto (which I don’t play))

- New or increased work-related stress

- A big salary cut, making work not worth the effort

· If anything changes in our timeline, I’ll be sure to let you know. As of now, I’m targeting the summer of 2018 to leave my current full time job. New Zealand and/ or Australia beckon, and I could see myself working there for a year or longer.

· I guess I now have 2020 vision for my early retirement.