- Revenue Cycle Management

- COVID-19

- Reimbursement

- Diabetes Awareness Month

- Risk Management

- Patient Retention

- Staffing

- Medical Economics® 100th Anniversary

- Coding and documentation

- Business of Endocrinology

- Telehealth

- Physicians Financial News

- Cybersecurity

- Cardiovascular Clinical Consult

- Locum Tenens, brought to you by LocumLife®

- Weight Management

- Business of Women's Health

- Practice Efficiency

- Finance and Wealth

- EHRs

- Remote Patient Monitoring

- Sponsored Webinars

- Medical Technology

- Billing and collections

- Acute Pain Management

- Exclusive Content

- Value-based Care

- Business of Pediatrics

- Concierge Medicine 2.0 by Castle Connolly Private Health Partners

- Practice Growth

- Concierge Medicine

- Business of Cardiology

- Implementing the Topcon Ocular Telehealth Platform

- Malpractice

- Influenza

- Sexual Health

- Chronic Conditions

- Technology

- Legal and Policy

- Money

- Opinion

- Vaccines

- Practice Management

- Patient Relations

- Careers

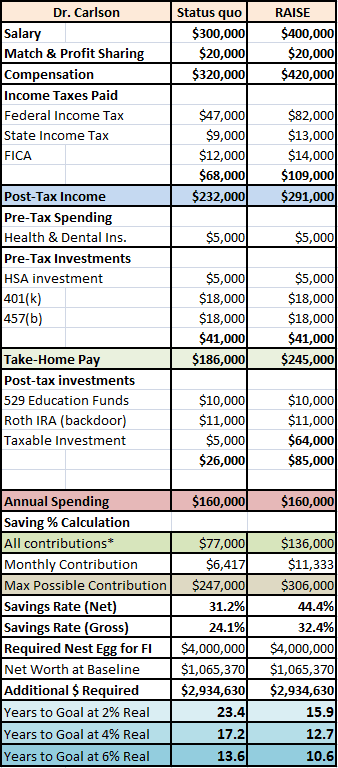

The Effect of a Big Bump in Income on Financial Independence

Interested in financial independence or an early retirement? An increase in income with no increase in spending can get you there years sooner.

It’s time to revisit another of our four physicians.We’ve seen what might happen if Dr. Anderson keeps working while FI, while FI, and the consequences when Dr. Benson increased his spending.It’s Dr. Carlson’s turn to undergo a life-altering event.Let’s make it a good one.

Dr. C now lives the life she used to daydream about when she was an overworked intern.At least, she spends the money she used to dream about spending.The life, well, it’s pretty good, but when she looked at the PoF's projections of a 25 to 30-year career to reach financial independence, she wasn’t so sure this was the dream life.

Sure, she enjoyed being a physician, but as she was stuck in the 40-minute commute home to her cushy suburban enclave of Joneses, she now daydreamed of being home for dinner on a regular basis, having her weekends free, and attending all her childrens’ piano recitals, parent-teacher conferences, and soccer and hockey games.

Dr. C was smart enough to know that her best bet would be to increase her annual savings and work towards FI.There are two sides to the savings equation: income and spending.While she would like to decrease spending, her family had become accustomed to the good life and they loved their 4500 square foot home, which happened to be in the best school district in the region according to all her neighbors.

Dr. C decided to work on the income side.She considered picking up some locum tenens work, but that would further reduce her time for herself and her family. Hopefully, there’s a better option for her.

Many hours into a recent happy hour, sometime around midnight, Dr. C’s good friend and former residency colleague confided in her about an impending retirement in her private group at the suburban hospital not far from Dr. C’s home. Dr. C had stayed in academics because she loved teaching and research, but the clinical demands were increasing every year, leaving little time for the good stuff.Her job looked and felt like private practice, but with academic pay.

Dr. Carlson decided to make a career change.She jumped ship from the University of Tertiarycare to join her buddy in private practice at Our Lady of Suburbia.With an improved payor mix on the outskirts of the metro, Dr. Carlson was able to work fewer hours, have a shorter commute, and earn an additional $100,000 a year.

How will the raise affect Dr. C’s financial future?To be consistent, we’ll assume Dr. C made this change 11 years after we first met our four physicians, the point at which Dr. A achieved financial independence.

Without the raise, Dr. C was looking at another 14 to 23 years before FI, a career spanning 25 to 34 years.With the $100k per year raise, she could shave off three to seven from her working career, assuming she continued her rather spendy ways with an annual $160,000 budget.In 10 to 15 years, she will have the $4 million she needs to be FI with this level of spending.Taxes ate up $39,000 of her raise, but she was able to increase her taxable investments by $61,000 a year, increasing her overall savings rate substantially.

Dr. C could also make a lifestyle change.

What if she also worked on the spending side of the equation?After a family get together with the Bensons, Dr. C and her family decided they could be comfortable and happy with a $120,000 a year budget like Dr. B and his family has.How do the numbers play out?

By lowering her annual spending, Dr. C needs “only” $3 million to call herself FI.This fact, along with increased contributions to her taxable investment account, will shave another four to seven yearsoff of her working career.By increasing her income and decreasing her spending, she is in shape to retire seven to 14 years earliercompared to maintaining the status quo. That’s about a 60% reduction in years left to FI, or about 10 years of more carefree living at an age where Dr. C is fully able to enjoy her newfound freedom.

Changing two of the three variables int he FI equation had a dramatic effect.

In this exercise, we saw a nearly identical effect when Dr. C got a $100,000 raise as we did when she cut her annual spending by $40,000.Why?With the big raise, nearly 40% of the raise was withheld for federal and state income taxes.In the case of decreased spending, not only was she saving more, but she also had an FI target that was $1 million lower.

Of course, neither of these changes come easy. A $100,000 raise won’t be out there for many, but remember we are looking at household income. Perhaps some of the increase could come from a spouse returning to work now that the kids are in school. And it doesn’t have to be a six-figure raise. Any increase in savings will alter the equation in your favor.

Similarly, a 25% reduction in spending isn’t likely to happen overnight. But it could. Dr. C had a $48,000 mortgage. When the last mortgage payment is made, she’s looking at a 30% reduction overnight. If we were to look at our budgets, we should all be able to find some low hanging fruit. Of course, trimming the budget isn’t required. It’s just one tool in the belt to help us achieve financial independence and the fringe benefits that go along with it.

What would you do if you were in Dr. Carlson’s shoes?Increase income?Decrease spending?Or perhaps both or nothing at all?