- Revenue Cycle Management

- COVID-19

- Reimbursement

- Diabetes Awareness Month

- Risk Management

- Patient Retention

- Staffing

- Medical Economics® 100th Anniversary

- Coding and documentation

- Business of Endocrinology

- Telehealth

- Physicians Financial News

- Cybersecurity

- Cardiovascular Clinical Consult

- Locum Tenens, brought to you by LocumLife®

- Weight Management

- Business of Women's Health

- Practice Efficiency

- Finance and Wealth

- EHRs

- Remote Patient Monitoring

- Sponsored Webinars

- Medical Technology

- Billing and collections

- Acute Pain Management

- Exclusive Content

- Value-based Care

- Business of Pediatrics

- Concierge Medicine 2.0 by Castle Connolly Private Health Partners

- Practice Growth

- Concierge Medicine

- Business of Cardiology

- Implementing the Topcon Ocular Telehealth Platform

- Malpractice

- Influenza

- Sexual Health

- Chronic Conditions

- Technology

- Legal and Policy

- Money

- Opinion

- Vaccines

- Practice Management

- Patient Relations

- Careers

Cash Is King, Credit Is Queen

I’m a big proponent of maxing out available Roth space during one's low income/training years. However, most of us don’t have enough income to put $23,500 away on a resident/fellow's income.

There's an old saying, "Behind every great man, there's a great woman [and vice versa]." The genders in the saying don't matter; the point is that a person's success is frequently predicated on having the wholehearted support of his or her strong partner.

A strikingly similar relationship exists between cash (the successful partner) and credit/borrowing (the supportive partner). This article details how I use my credit/borrowing power to free my cash to accomplish greater financial success more efficiently. I learned from the best (and the worst): the big banks, who borrow cash at a 0% interest rate to purchase assets and generate more cash.

I’m a big proponent of maxing out available Roth space during one’s low-income/training years. However, most of us don’t have enough income as a resident/fellow to put away $23,500 worth of post-tax dollars each year. Below, I will share how I contributed $23,500 in post-tax dollars to my Roth IRA/Roth 403(b) last year on a PGY2 income of $53,000.

Step 1: Make a budget.

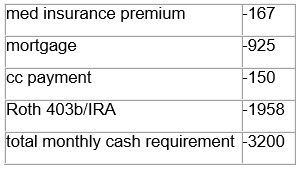

Notice how in order to contribute $1,958 per month, I must go in the red by $1,237 monthly.

Step 2: Separate the monthly expenses into chargeable expenses and cash-only expenses.

Anything I can charge on a credit card, I do; this includes utilities, gas, food, home insurance, car insurance, property tax, child care/pet expenses, home/car maintenance, medical/dental copays.

Why not? I get tax-free cash-back rewards* and up to 21 months at 0% interest on the necessities I charge on credit cards. (*check out this post on how I got $1,200 cash for my $4,000 grocery bills in 2015 using the Discover It credit card.)

After charging everything possible to my credit card, I am left with a monthly cash requirement of $3,200, well below the $3,478 I bring home each month.

As I put away $1,958 each month, I’m also accumulating $1,237 of zero-interest credit card debt each month. By the end of the year, I will have accumulated approximately $15,000 worth of 0% interest credit card debt, minus 12 months’ worth of minimum monthly payments.

The minimum monthly payment is usually 1-2% of the revolving balance, so the $278 in cash left over each month comfortably covers it.

Step 3: Develop a plan to pay off the 0% interest credit card debt. (Watch a short YouTube video on how to do this.)

During the first 15-21 months, the debt from charging my monthly expenses costs me nothing. In fact charging earns me money via cash rewards.

By transferring this debt to a new card before the 0% introductory interest rate expires, I am able to take advantage of low rates on other cards. For instance, my Chase Slate card offers 15 months at 0% interest with a 0% transaction fee; Chase Freedom offers 15 months of 0% APR with a 2% up-front transaction fee (which is equivalent to 1.7% effective interest rate).

In the 21 months since I graduated from med school, I have only paid negative interest by borrowing money from my credit cards.

So far, I’ve been able to pay off older cards with expiring 0% rates using a combination of the cash flow freed up from charging purchases on my newer cards and additional income from internal moonlighting (approximately $200 per month).

I’m also looking forward to a pay raise when July 1, 2016 hits.

Up-to-date result (January 2016): I have put away $38,250 in my Roth IRA/Roth 403(b) since 2014 and I currently have a $20,000 interest-free credit card balance. I anticipate I will never pay more than 1.7% interest on that balance. Again, the goal is to pay off the debt with cash or newer cards before the 0% interest expires.

Bottom Line

As long as you can keep your credit card debt interest rate below 2% annual interest, it is tax-efficient and sound debt leverage to direct your limited cash flow towards Roth contribution in index funds, bearing an 8% average annualized return in the long run.

Reader question: “Do you have an idea for how long you would carry on the debt snowball, or are you planning to do it as long as you possibly can?”

DWM’s answer: Great question. I plan to do this for as long as I can, into attending-hood, because there is a big incentive for me to do so. Rich people get richer because they leverage their credit to get better deals & buy more assets. While I make 1.1% cash back on purchases with Bank of America right now, when I get richer, I actually make 1.75% cash back on the same purchases because I will have more money deposited at Bank of America. This is just an example of how the combination of cash flow (king) and good credit (queen) can give you more money. Most of the cash-back cards I currently use offer 3-10% cash back (an awesome outlier, the Discover It card, gives me 20% cash back).

I will use credit cards to build net worth faster and more efficiently as long as the math makes sense. This method has served me well. For example,

1. It saved me nearly $60,000 in student loan interest during medical school, which ultimately allowed me to pay off my student loan much faster.

2. When DRB didn’t refinance my student loans because of my debt/income ratio (this was before they began refinancing PGYs), I used credit cards to accelerate paying off my student loans.

3. Mindful use of credit cards allowed me to take advantage of cheap and early Roth spaces as a PGY1/PGY2.

Lastly, I define a “debt snowball” as debt increasing due to a high interest rate, such the 7% charged on student loans (Hint: refinance the student loans pronto). Debt that consists only of the principal, or even better, less than what I borrowed (due to cash back/negative interest) is a truly “good” debt to me.

On the other hand, I understand why David Ramsey dislikes credit card debt, as credit card companies do intentionally bait and switch. As smart consumers, we simply take the bait and leave before the switch! I call it "bite and bounce!" (Watch a YouTube Video on how to bite and bounce.)

What do you think? Are you comfortable with 0% or negative interest credit card debt? What do you do to help you maximize tax efficiency and investment return?

This article is for informational purposes only and not intended as a substitute for professional advice. Please consult a professional accountant, financial adviser or lawyer, before making financial decisions.