Article

Adalimumab Tops List for Drug Spending, But Biosimilars Impact Impending

Author(s):

Adalimumab topped the list with AbbVie spending $13.6 billion on the drug in 2016, but the future remains in question as biosimilars' impact on the market looms in the distance.

This article is part of an MD Magazine series reporting the results of the "Medicines Use and Spending in the US" review by the QuintilesIMS Institute. A report on the stall of the HCV drug market —was published Friday.

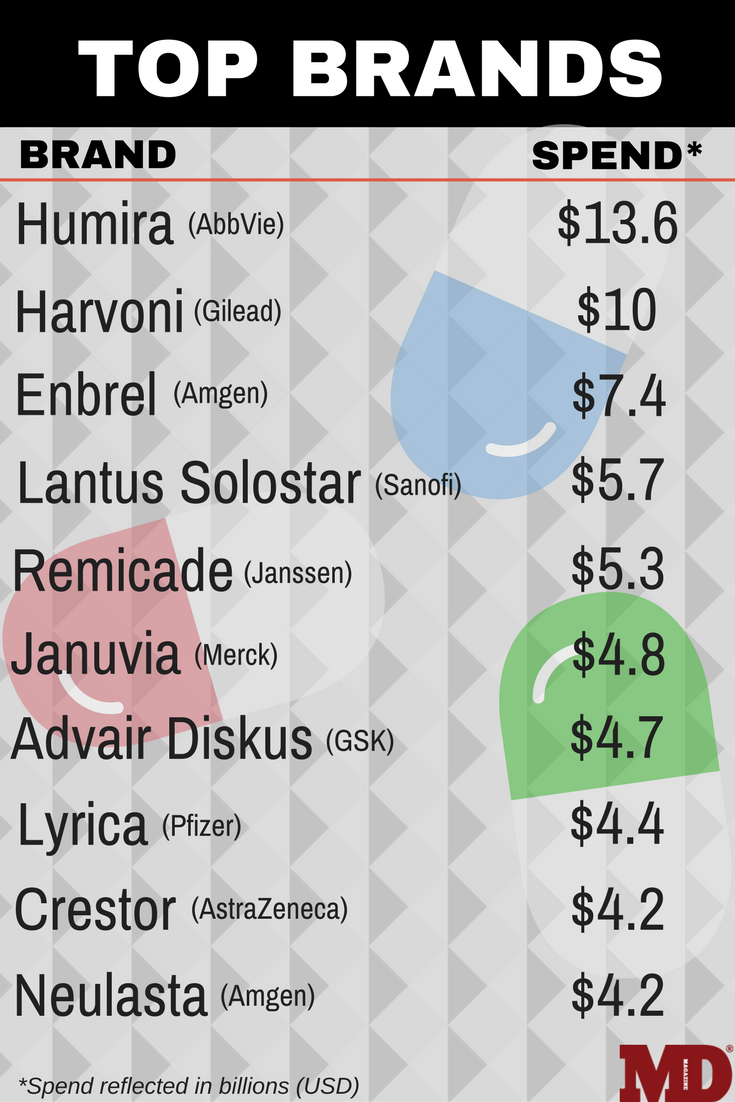

Adalimumab (Humira, AbbVie) a treatment for rheumatoid arthritis (RA), once again led the pack in drug invoice spending in 2016, with $13.6 billion spent, an excess of $3 billion more than the next highest spend, according to new data from the QuintilesIMS Institute released report on spending on medicines in the United States for 2016.

With this data, adalimumab extended its reign atop the list to 5 consecutive years. Spending for the drug has tripled from 2012, increased from $4.5 billion. Recently, testing results have come back from a trial that investigated the possible extension of dosing intervals for the drug among RA patients, in order to aid individualized treatment, in which it was found effective and safe.

"We think that rheumatologists should start the evaluation of adalimumab treatment by considering the pharmacokinetics in that individual patient," Merel l’Ami, MSc, from the Amsterdam Rheumatology Center and lead investigator of the study, told MD Magazine. “It will show the rheumatologist when drug concentrations are undetectable (occasionally, as a result of a large amount of anti-drug antibody formation), and it will show the rheumatologist when a patient is overexposed. Our study showed that patients can reduce the dose safely. Reducing this kind of overexposure will personalize treatment and save a lot of drug costs."

Looking forward to 2021, the report detailed that while the patient use of new treatments has slowed, it is expected to continue to recover to historical highs in spending growth of $15 to $17 billion from 2018 to 2021. The exclusivity loss impact is expected to grow to greater than 50% in the next 5 years, partly as a result of patent expiries, and partly a result of the introduction of biosimilars to the market.

Adalimumab is expected to face the impact of biosimilars by 2019, or perhaps sooner. Multiple biosimilars for the drug have been introduced since 2016, with several headed down the pipeline in the coming months.

The FDA approved adalimumatto (Amjevita, Amgen), a biosimilar to the successful RA therapy, in September 2016. In January of 2017, early top-line results of a phase 3 trial showed that Pfizer’s PF-06410293, another biosimilar to adalimumab, met its primary endpoints in safety and efficacy. And as recently as September of 2017, Sandoz announced positive data on a biosimilar to the drug that is currently under review by the European Medicines Agency (EMA).

The introduction of biosimilars has led to a fear of less competition in the drug market, something the FDA has sought to combat, laying out a plan to increase competition in June 2017. The plan included the facilitation of lower-cost alternatives.

“Encouraging more competition through options like biosimilars is one way we can help contain or maybe even reduce costs while spurring innovation for new therapies,” Sheila Frame, vice president and head of biopharmaceuticals at Sandoz North America, said in a statement at the time.

After adalimumab, Ledipasvir sofosbuvir (Harvoni, Gilead) for hepatitis C (HCV) took the second spot in the spending list with $10 billion, followed by the RA therapy etanercept (Enbrel, Amgen) with $7.4 billion. Sanofi’s insulin glargine injection (Lantus Solostar) for diabetes with $5.7 billion in spending, and infliximab (Remicade, Janssen Biotech) for Crohn’s disease with $5.3 billion rounded out the top 5.

Total invoice spending on the US market reportedly reached $450 billion in 2016, an increase of $24.7 billion from 2016, and up from $378.5 billion in 2014. The overall growth of the market slowed 5.8% though, less than half of the 2015 rate of 12.4%, and despite that high spend, QuintilesIMS reported that, on a net basis, the increase was 28% lower than the invoice level of $323 billion, for a total growth of only 4.8%.

Branded drugs accounted for 74.2% of the US market but only accounted for 10.5% of dispensed prescriptions, while unbranded generics totaled only 15% of the market but dominated in percent dispensed prescriptions, accounting for 84.6%. Branded generics rounded out the remaining 10.8% of the market and 4.9% of prescriptions.

Keeping that in mind, generics have reportedly saved the US health care system $1.67 trillion since 2007, according to the Association for Accessible Medicines (AAM). The FDA introduced a new policy to expedite the review of generic drug applications in June 2017, and in October, FDA Commissioner Scott Gottlieb, MD, announced initiatives to quicken their approval to aid the development of complex generics.

The impact that pharmaceutical spending - branded or generic - has on clinicians is less understood. According to Christian T Ruff, MD, MPH, of Brigham and Women's Hospital, many physicians are unaware of spending data and its impact on the health care system in the US. What physicians are aware of, however, is the costs of drugs.

"The one issue that I think resonates broadly is the outsized costs of branded drugs," Ruff told MD Magazine. "Certainly, many of the biologic therapies listed are the biggest culprits. They are certainly more expensive to make, but the excess profits far exceed the additional production costs. There is now beginning to be a discussion on how to reign in prices for these drugs."

Ruff noted that spend data does not have much of impact on clinician prescribing or practice patterns unless it affects the work-flow of the clinician. If expensive drugs require prior authorizations, physicians are much less likely to take the extra effort, except in cases where there are really no other good options for the patient.

Many patients with disabling RA or HCV may not have access to alternatives to branded therapies, leading the healthcare system to absorb the costs, at least for now. One of the hypothesized ways that costs could be driven down, according to Ruff, is through the actual approval process.

"Where you see lines drawn in the sand by pharmacy benefit managers, and others, are in areas where these expensive drugs are an add-on or alternative therapies," Ruff said. "A good example are the PCSK9 inhibitors, which are challenging to get approved unless you have proved that a patient is appropriately treated with high intensity statins, which are generic."

In terms of prescription numbers, levothyroxine topped the list with 123 million, followed by lisinopril 110 million, and atorvastatin with 106 million. The top 5 were rounded out by acetaminophen/hydrocodone with 90 million and metoprolol with 88 million prescriptions.

The report also highlighted a point of interest for the growth of new brands, noting that spending growth was driven by these introductions, but that they only contributed $13.9 billion to 2016’s growth, a decrease of $3.4 billion from the year before and $6.7 billion from 2014. This decrease in growth from new brands was noted by a shift toward specialty therapies, according to the authors.

The report, "Medicines Use and Spending in the US: A Review of 2016 and Outlook to 2021," is available to download online.