New State Laws Allow Residents to Shield Assets from Creditors

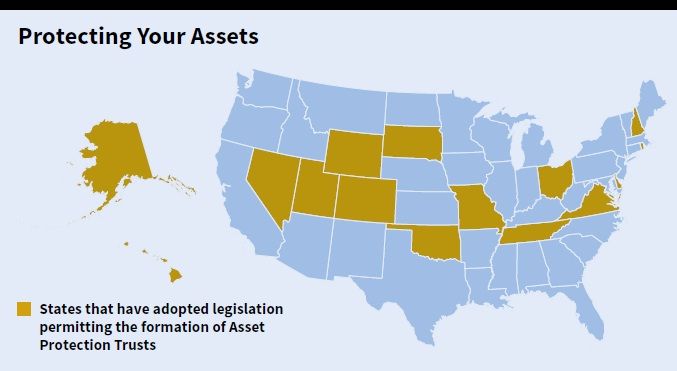

A growing number of states have enacted laws permitting residents to legally shield their homes, savings and other assets from potential claims of creditors. As of March 2013, Ohio became the fifteenth state (see map) to allow property and savings to be sheltered from lawsuits and creditor collection actions — a relief for many individuals, small businesses owners and professionals concerned about the threat of personal or business liability risks.

Pushing Back Against Lawsuit Abuse

The new laws, as adopted by Ohio and other states, represent a significant departure from long-standing state laws that strongly favor the interests of financial institutions and trial lawyers attempting to initiate or collect a debt or enforce a lawsuit judgment.

Typically, state laws have granted wide latitude to plaintiffs in the filing of lawsuits. Expanded theories of liability, broad and intrusive discovery rules and powerful judgment enforcement rules have skewed the litigation process heavily in favor of plaintiffs in the litigation, regardless of whether the underlying claim is with or without legal merit.

At the point that a judgment is entered, almost all assets owned by the defendant — exceeding a minimal threshold amount — can be seized by a creditor to satisfy a claim. Several states — notably Texas and Florida — provide unlimited homestead protection for a personal residence; but in most cases, the allowable state exemptions do not cover a significant amount of personal or business assets.

For example, most states permit all savings and investments other than retirement plan assets to be reached by a creditor. As a result, downturns in business, unexpected medical bills or lawsuit liability can quickly erase many years of accumulated savings. As Ohio Rep. Christina Hagan put it:

“…[the new law] will allow Ohio citizens, business owners and entrepreneurs to better protect their hard-earned assets, homes and businesses.”

How the New Laws Work

The creditor protection laws adopted by Ohio and the previous states specify in considerable detail how the law can be used for asset protection results. For example, if you live in Ohio you are now permitted to establish a trust with any individual or trust company located in the state acting as one of the trustees.

Your bank or brokerage accounts, other investments and any properties you own can be transferred into the trust. Under the rules, you are permitted to maintain management authority over the assets while in trust, but the trustee must carry out at least some minimal specified administrative or accounting functions.

Who Can Use the Assets in the Trust?

The law provides that income and principal can sit in the trust and earn income or be distributed to any designated beneficiary, including yourself. If you don’t need to touch your savings now because you have sufficient income from your job or business to meet all of your needs, then the assets would grow inside the trust or be distributed to children or other family members for whatever purpose. If at some later point you wish to draw on the savings for your retirement or other purposes, then you are permitted to do so.

Alternatively, if you rely on your savings to pay for your current living expenses, the trust can be designed to provide necessary distributions on a regular basis. You can also put your home into the trust and continue to use it — a valuable benefit for those with some equity to protect.

This ability to receive income and distributions from a trust you create and still have the assets protected from a judgment or lawsuit is the key feature of the Ohio law and the other states with similar legislation.

Trusts set up for the benefit of other family members have always been generally protected from most liability claims. But establishing a trust that allows you to personally benefit is the unique and distinguishing factor in these laws. Although the details of each of the laws of each state vary, sometimes significantly, the intent of each is to permit distributions for personal benefit while still providing basic asset protection.

Restrictions on the Available Protection

Some key restrictions of the Ohio law are that you can’t create the trust and use it, if it will make you unable to meet your obligations or to shield assets from those who already have a claim against you. Also, you are not protected from a liability arising within 18 months of establishing the trust.

If you are married, you cannot create a trust during marriage to protect assets against a claim by your spouse. However, if the trust was established prior to the marriage, a current or former spouse is not permitted to collect alimony, support or property from the trust in the event of a legal separation or divorce.

Uncertainties Remain

Many issues about the laws in Ohio and the other states still remain and are still too new to have been fully resolved. In particular, there are significant questions about whether the resident of one state can rely on the law of another state to achieve effective asset protection.

However, the growing number of states adopting asset protection legislation certainly broadens the scope of options available and makes it more likely that the application of the laws and their parameters will be more fully clarified within a reasonable period.

Robert J. Mintz, JD, LLM, is an attorney and the author of the book Asset Protection for Physicians and High-Risk Business Owners. To receive a complimentary copy of the book visit www.rjmintz.com.